Will 5G operators restart network spending in 2024?

'We expect that 2024 may be the 'trough' in carrier capex,' according to Wells Fargo analysts. That's likely welcome news to cell tower and equipment vendors suffering through this year's spending slowdown.

After years of frenetic spending, 5G network operators started cinching up their purse strings earlier this year. Now, some financial analysts are debating when they'll start spending again.

"We expect that 2024 may be the 'trough' in carrier capex [capital expenses] at ~$27 billion across the industry, with Verizon, AT&T, and Dish Network all contributing to a dip in industry capex from the early 5G peaks," wrote the financial analysts at Wells Fargo in a recent note to investors.

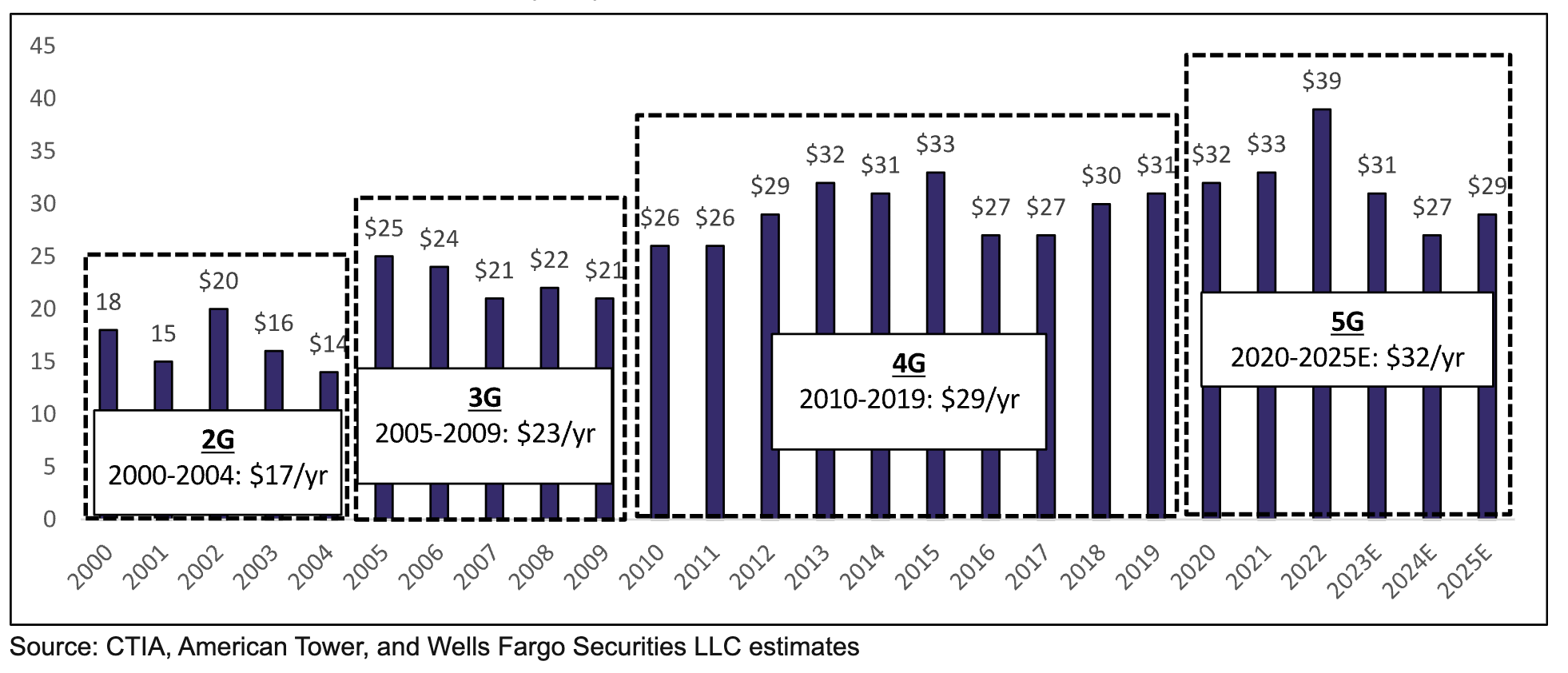

They continued: "While our 5G capex forecast through 2025 implies an average of $32 billion/year in wireless network investment over the first 6 years (vs. $29 billion/year throughout the decade-long 4G deployment cycle), the ~10% capex step-up is far below the ~30-35% increase in wireless capex we saw across the industry as we transitioned from 3G to 4G.

"Of course, this is partly the natural maturation of the industry as carriers consolidate and subscriber growth starts to slow. But it's also a sign that other macroeconomic factors, including a historically fast increase in interest rates and the highest inflation since the inception of the tower industry, are likely impeding or slowing investment beyond what might be normal in a typical cycle."

The analysts argued that US wireless network operators spent heavily in recent years on the cell tower and radio upgrades necessary for their move from 4G to 5G. However, they have started to slow that spending amid a shortfall in revenue growth.

"Despite significant hype for new 5G use cases, the returns on the recent 5G capex cycle have remained disappointing, to say the least," they wrote, noting that AT&T, Verizon, T-Mobile and Dish Network collectively invested over $230 billion in wireless capex and spectrum licenses from 2020 to 2023. "Yet [the operators] have only grown wireless EBITDA [earnings before interest, taxes, depreciation and amortization] by ~$10 billion, the majority of which has come through cost-cutting synergies from the Sprint/T-Mobile merger."

The Wells Fargo analysts argued that spending may increase starting in 2024. "There is still a continual need for the carriers to invest in higher-capacity networks based on mobile data consumption and a proliferation of additional 5G devices," they wrote, citing continued growth in wireless network usage.

Other analysts share that outlook.

"Our checks indicate there is a sense that spending will pick back up in ~spring 2024," wrote the financial analysts at TD Cowen in a recent note to investors. However, they argued that 2024 spending activity "will still be modestly below 2023."

Wells Fargo offers the past and anticipated future of wireless operator capital expenses. (Source: Wells Fargo)

A bigger-than-expected slowdown

Warnings of a slowdown in spending among 5G network operators first arose near the end of 2022. "Capex in particular is expected to drop significantly at Verizon and T-Mobile next year," wrote the financial analysts at Morgan Stanley in a note to investors at the end of 2022.

Those warnings gathered steam during the spring of 2023.

But the slowdown became painfully clear this summer amid dour second quarter reports from Nokia, Ericsson, Juniper Networks, Corning and others.

"While we had always anticipated domestic [cell tower] leasing growth to moderate as we move through 2023 ... organic leasing activity levels were lower than we anticipated in Q2 from some of our customers," Jeffrey Stoops, the CEO of cell tower giant SBA Communications, said last month.

At the heart of the issue are the midband 5G buildouts by T-Mobile, Verizon and AT&T. After doling out more than $100 billion on midband spectrum, the operators spent heavily to put that spectrum to work inside their 5G networks. Now, that work is nearing its end.

Dish Network, meanwhile, managed to reach its FCC-mandated 5G coverage targets for 2023, but then it promptly put a pause on its own spending after that.

Looking to the future

Financial analysts point to several reasons operators should increase their network spending starting next year.

"T-Mobile's [cell tower] leasing could start to move off of this bottom sometime in 2024 as it moves to deploy C-band and 3.45GHz spectrum, and Dish will presumably reengage by 2024 to avoid missing its 2025 [network] deployment milestones," wrote the financial analysts at MoffettNathanson in a recent report to investors on the cell tower market.

For its part, T-Mobile spent around $13.6 billion on its C-band and 3.45GHz spectrum licenses, and at some point, the operator will buy the tower space and radios necessary to put that spectrum into action. Dish, meanwhile, faces a government mandate to cover 75% of each of its spectrum license geographies with 5G by June 2025 – a requirement that will also require additional spending.

However, some analysts warn that the negative headlines may continue through the fall of 2023.

"Crown Castle continues to be the only tower company that provides its next-year outlook with its Q3 results. Thus, we'll get our first look at 2024 expectations in October," warned the Wells Fargo analysts. "We believe Crown Castle will 'rip the band-aid off' with their 2024 guide that will be a net negative headline across the tower stocks."

About the Author(s)

You May Also Like