Documenting broadband service provider data and analytics strategies

Key findings from a recent Heavy Reading survey show that BSPs are in the early stage of data collection and analysis, but they plan to improve their capabilities and use cases in the next 12–18 months.

Heavy Reading recently completed a survey-driven research project documenting how broadband service providers (BSPs) utilize data and analytics capabilities to optimize network performance and customer experience.

The survey, created in collaboration with Calix, attracted 91 C-level executives of leading BSPs serving 250,000 or fewer subscribers in the US, Canada and the UK. This blog presents a few of the insightful key findings.

Collect, analyze and optimize

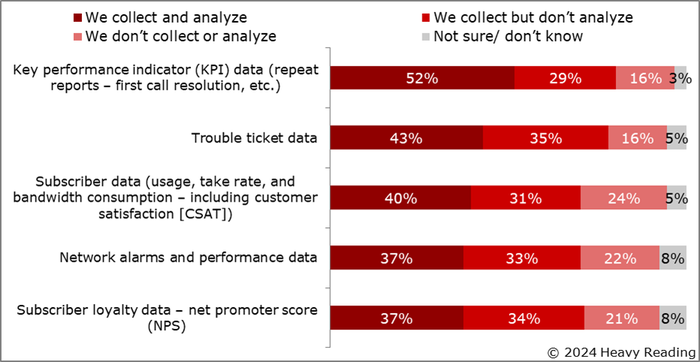

To gauge where BSPs are in their data evolution journey, Heavy Reading first asked them which types of data they collected and which percentage they analyzed. As the figure below illustrates, BSPs currently collect and analyze only 37% to 52% of the data. The priorities are KPI (52%) and trouble ticket data (43%), with subscriber data (40%), network alarms/performance data and subscriber loyalty data (both 37%) not far behind.

Which data sources do you currently collect and analyze?

(n=91)

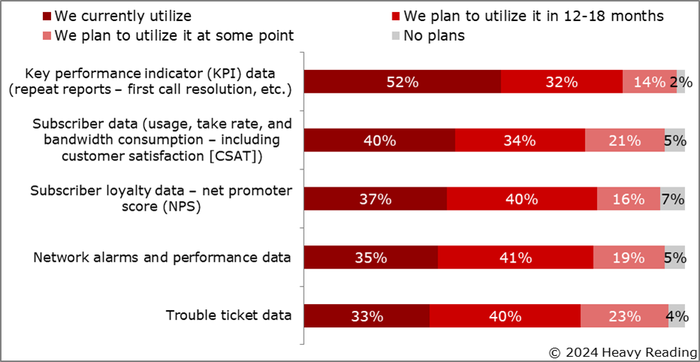

Although BSPs are early in the data/analytics cycle, many are focused on closing the gap and utilizing this data to guide business and marketing decisions, as illustrated in the figure below.

Based on "we plan to utilize it in 12–18 months," the leading priorities target network alarms and performance data (41%), as well as subscriber loyalty data and trouble ticket data (both 40%). These types of data are followed by CSAT and KPIs (34% and 32%, respectively).

The impact of execution over the next 12–18 months will be significant. Ultimately, the result will be a minimum of 73% of BSPs (based on the lowest ranked trouble ticket data) leveraging this data to enhance both business and network outcomes.

Do you currently utilize the following data for making business and marketing decisions?

(n=91)

Use cases and future capabilities

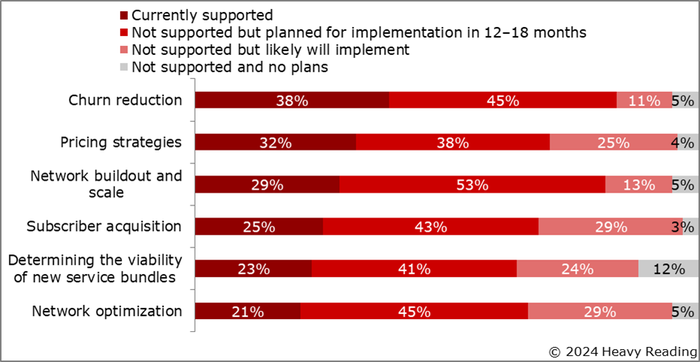

One factor driving BSPs to turn up their data analysis focus in the next 12–18 months is their focus on how this analysis can enhance specific use cases. As the figure below illustrates, there are several distinct priorities. Leading the way here are network buildout and scale (53%), churn reduction and network optimization (both 45%). Close behind are subscriber acquisition (43%), determining the viability of new service bundles (41%) and pricing strategies (38%).

This means that BSPs view data and analytics as essential for improving both customer retention and acquisition, as well as other basics — spanning from how they price services to network buildout and optimization strategies.

Do you use data/analytics for the following use cases?

(n=91)

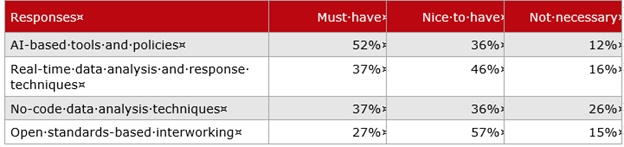

Another area the survey investigated was the additional analytics capabilities necessary to meet changing business and network requirements. As the table below captures, BSPs believe several "must have" capabilities exist. Of these, AI-based tools and policies lead the way (52%), followed by real-time data analysis and response techniques and no-code data analysis techniques (both 37%). Heavy Reading views this input as reinforcing the general industry view that AI tools are vital to meeting evolving business and network requirements.

What additional analytics capabilities do you require in the near future to meet changing business and network requirements?

(n=91)

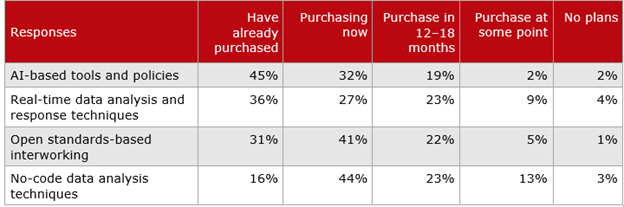

The C-level input in the table below confirmed that BSPs have already started purchasing these "must have" capabilities. Leading the way are the most progressive 45% that "have already purchased" some type of AI-based tools and policies, followed by another 32% "purchasing now." Real-time data analysis attained a second-place ranking based on "have already purchased" (36%) metrics.

Do you plan to purchase these capabilities?

(n=91)

While BSPs are still early in the data collection and analysis phase, they will close the gap in the next 12–18 months in terms of the amount of data they will analyze and the use cases on which they will focus. Moreover, BSPs are committed to enhancing their data and analytics strategies by integrating new capabilities such as AI-based tools and policies and real-time data analysis and response techniques to boost network and service experience performance.

Looking for more information?

Check out the following:

An archived Light Reading webinar, May the Data Be With You: New Analytic Strategies Top Service Providers Use Now.

A white paper, Data, Analytics, and the Broadband Service Provider.

About the Author(s)

You May Also Like