SASE/SD-WAN roundup: AT&T tops SD-WAN leaderboard

In this SASE and SD-WAN roundup: AT&T gains first place on a global managed SD-WAN leaderboard, and enterprise professionals weigh in on demand for managed SD-WAN and SASE services to reduce network complexity.

In this SASE and SD-WAN roundup: AT&T gains first place on a global managed SD-WAN leaderboard, and enterprise professionals weigh in on demand for managed SD-WAN and SASE services to reduce network complexity.

AT&T tops SD-WAN leaderboard

AT&T scored first place on Vertical Systems Group's (VSG)2022 Global Provider Carrier Managed SD-WAN Leaderboard, followed by Orange Business, Verizon, BT Global Services, NTT, Telefonica Global Solutions, Hughes and Vodafone. The leaderboard includes service providers with 4% or more billable retail site share outside their home countries, which are shown in the graphic below.

(Source: Vertical Systems Group)

AT&T bumped Orange out of first place on the 2022 leaderboard, while BT overtook NTT. Hughes moved out of the Challenge Tier and onto the leaderboard. The top three service providers – AT&T, Orange Business and Verizon – also have MEF 3.0 SD-WAN certification.

"There was some shuffling of provider rankings since our last Leaderboard release, as competition for global customers is intense and share differentials in this segment are extremely tight," said Rosemary Cochran, principal of Vertical Systems Group, in a statement.

The analyst group also called out the Challenge Tier, which includes service providers with between 1% and 4% site share. Challenge Tier service providers are, in alphabetical order, Aryaka (US), Colt (UK), Comcast Business (US), Deutsche Telekom (Germany), Global Cloud Xchange (India), GTT (US), Liberty Networks [formerly Cable & Wireless] (Barbados), PCCW Global (Hong Kong), Singtel (Singapore), Tata (India), Telia (Sweden) and Telstra (Australia).

Colt, Comcast Business, PCCW Global, Tata and Telia also have MEF 3.0 SD-WAN certification.

Companies in the Market Player tier have site share below 1% and include China Telecom, Cogent, HGC Global, Zayo and others.

Cisco, Fortinet, HPE Aruba, Nuage Networks from Nokia, Palo Alto, Versa and VMware (in alphabetical order) are the top SD-WAN technology providers that the Leaderboard and Challenge Tier service providers use.

Hybrid workforce drives demand for SASE

The rise of the distributed workforce is driving demand for secure access service edge (SASE) and zero-trust network access (ZTNA) services, according to a survey by analyst group Futuriom of 194 enterprise networking and security executives.

In the survey, 98% of respondents attributed hybrid work to the increased demand for SASE and ZTNA. In addition, 92% of those surveyed agreed that ZTNA is a crucial component of SASE.

Increased use of the Internet, software-as-a-service (SaaS) and remote work has broken down enterprise perimeters and requires a new security architecture that ensures secure access to enterprise applications from any location, said Futuriom.

"The general description of this approach is the term zero trust, which means that networks and applications can't trust access by anyone or anything and must use a more sophisticated set of identifiers and authentication methods to ascertain that access is non-hostile," according to Futuriom's report about the SASE/SD-WAN survey.

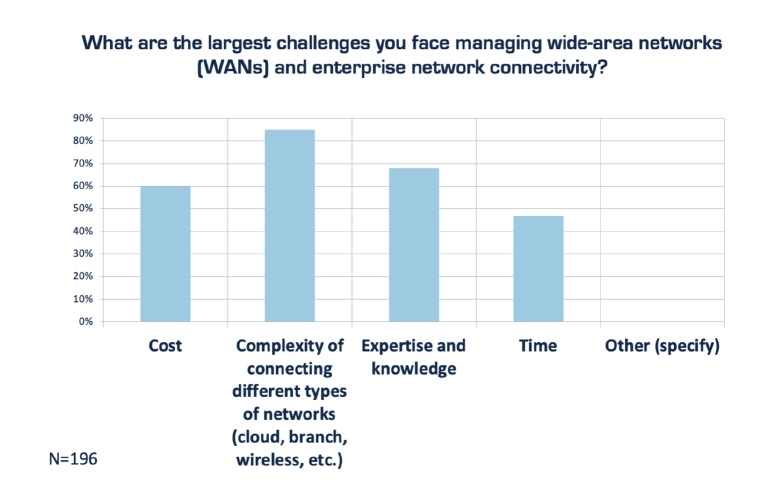

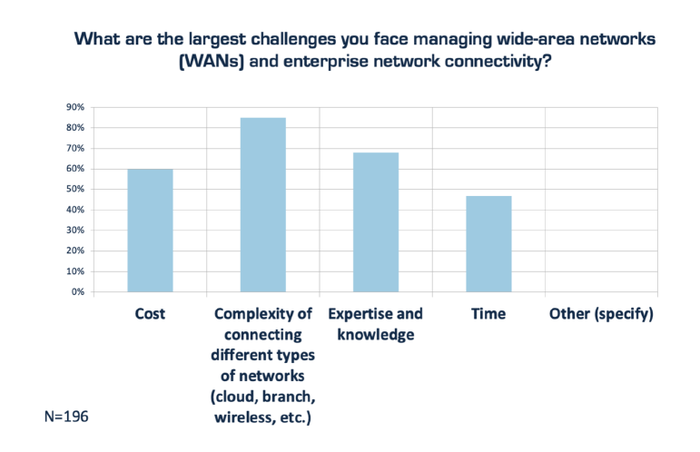

Survey respondents also revealed that they're seeking managed services in large part to address network complexity.

"When asked about the largest challenges in managing WANs, 85% of respondents identified complexity, followed by expertise and knowledge (68%). Rounding out the responses were cost (60%) and time (47%)," said Futuriom. (Multiple responses were allowed.)

Click here for a larger version of this image.

(Source: Futuriom)

Respondents also commented on how they would like to consume SD-WAN/SASE services. The most popular deployment models were best-of-breed combination (34%) and single-vendor (23%).

Related posts:

— Kelsey Kusterer Ziser, Senior Editor, Light Reading

About the Author(s)

You May Also Like