Consolidated points to fiber strategy as 'main driver of business' this year

Execs from Consolidated Communications said the company added more than 12,300 fiber broadband subscribers in Q1, representing 60% annual growth.

Consolidated Communications held a Q1 earnings call on Tuesday focused on the company's successes in the fiber broadband arena and positioning its Fidium Fiber business as its main growth driver going forward.

Speaking on the call, Consolidated CEO Bob Udell confirmed that the company saw a quarterly record of 12,337 fiber broadband net adds, achieving 2,404 broadband overall customer additions. "This means that just in the first quarter, we are well above our full year 2022 consumer broadband net adds, offsetting DSL losses," said Udell, according to an Atom Finance transcript. Total net adds for 2022 were 724.

As a result, consumer fiber broadband revenue grew 56%, contributing to overall consumer broadband revenue growth of over 6%.

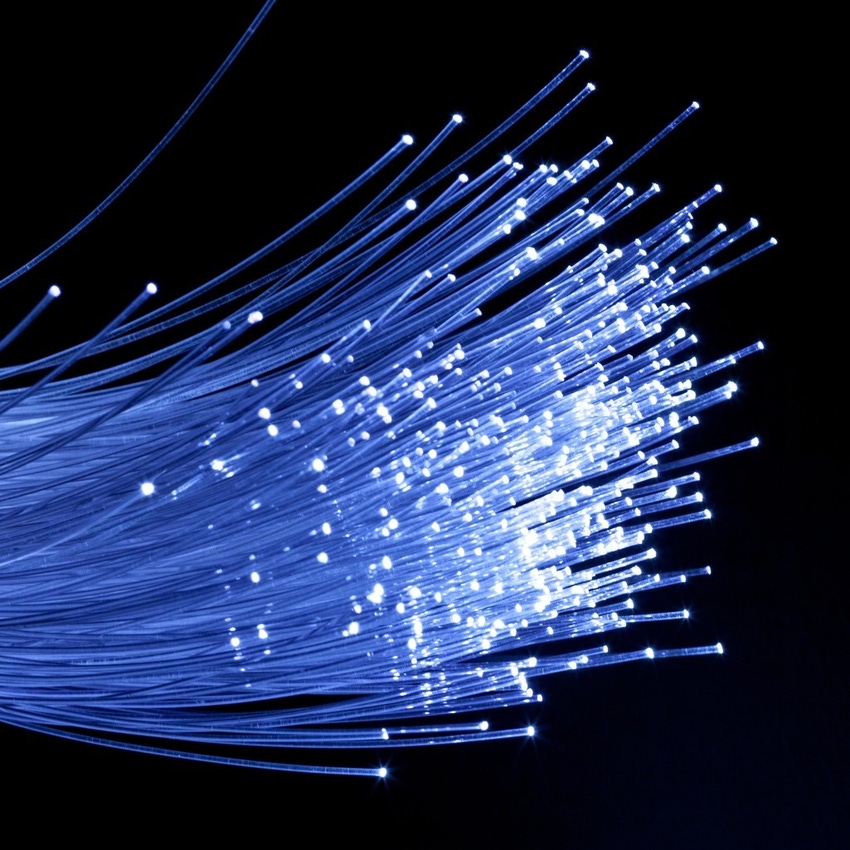

Figure 1:  (Source: gualtiero boffi/Alamy Stock Photo)

(Source: gualtiero boffi/Alamy Stock Photo)

Udell noted that average revenue per user (ARPU) for fiber broadband consumers was up 5.7% in Q1, with fiber ARPU exceeding copper by over $14 (or 27%).

"This is a meaningful difference and provides us with ample upside to continue driving significant revenue and EBITDA as our mix shifts increasingly to fiber," he said.

Udell also pointed to record net adds in recent months as an indicator of continued fiber growth in the second and third quarters of this year. He noted that the company experienced the "highest months of consumer fiber net adds in our history," with roughly 5,200 in March and nearly 6,000 in April (exceeding a prior monthly record of 4,300).

As Consolidated pursues a buildout strategy to upgrade its copper network to fiber, the company said fiber now comprises 37% of its consumer broadband connections – or over 1 million passings – up from 25% last year. Consolidated expects that over 70% of its passings will be upgraded to fiber by mid-2026 and is on track to upgrade at least 225,000 fiber locations this year. The company upgraded nearly 54,000 locations in Q1.

Federal funding potential

As he has on prior calls, Consolidated's Udell pointed to federal broadband funding as a "key component" driving Fidium Fiber's growth strategy. Analysts have recently pointed to Consolidated as one telco that will see its enterprise value boosted by the $42.5 billion Broadband, Equity, Access and Deployment (BEAD) program.

"When synchronized appropriately with our fiber builds, these governmental funding opportunities helped to offset rural high-cost passings, allowing us to maximize the economies of our builds for complete areas. This is a key component as we continue our expansion," said Udell.

Consolidated has received over $150 million in broadband partnership and grant funding opportunities since 2019 and was tracking "nearly $140 million of additional broadband government partnership opportunities" in Q1, representing a $40 million increase from Q4 2022 in grants and partnerships, Udell added.

'Return to growth' in 2024

Executives also signaled a "return to growth" in 2024. The company reported Q1 revenues of $276.1 million, down 8% (4% normalized). Consumer fiber revenue was $26.1 million, up 52% (56% normalized), and consumer broadband revenue was $68 million, up 3.1% (6.4% normalized). The company reaffirmed its 2023 guidance with an expected revenue range of $310 million to $330 million.

"Through our actions during 2023, we are solidifying the foundation for a return to growth in 2024," said Udell on Tuesday's earnings call.

Consolidated CFO Fred Graffam added that Fidium Fiber will be the company's main revenue driver for 2023.

"The most powerful thing we can do is continue to see the momentum in the fiber business," said Graffam. "As you could see, we had a substantial step-up in consumer fiber revenue in the first quarter. That is going to be the main driver of the business for the rest of the year."

Execs were also asked about recent news that Searchlight Capital Partners and British Columbia Investment (BCI) have proposed to acquire outstanding shares in Consolidated Communications and take the company private, a proposal that's being reviewed by a special committee.

"Related to the offer to buy the company, that's being handled by the independent committee," Udell said. "We're going to keep the management team focused on running the business and keeping the momentum we've established, and then let the independent committee manage the process around Searchlight's interest in acquiring the company."

Related posts:

— Nicole Ferraro, editor, Light Reading, and host of "The Divide" on the Light Reading Podcast.

About the Author(s)

You May Also Like