Cable broadband faces a pricing problem – study

An analysis of Net Promoter Score data shows that pricing and support issues, rather than the core product, are stymying cable broadband. That's a fixable problem, reckons New Street Research.

Cable operators are struggling to gain broadband subscribers, but the core issues they are facing track to pricing strategies and customer support – rather than the core product itself – New Street Research surmises in its latest analysis of the US broadband industry.

New Street Research's conclusion was tied into a 124-page Q3 "Broadband Trends" report that includes an analysis of key Net Promoter Score (NPS) data from Recon Analytics, which runs weekly surveys with about 10,000 respondents.

While cable's net promoter scores for product do lag those from fixed wireless access (FWA) and fiber competitors, cable broadband subscribers are still generally happy with the product, New Street points out. However, cable's NPS gap with rivals in areas such as pricing/value and customer support is much wider.

"Price value and customer care are both issues, and we believe that Cable's pricing strategy contributes to both," New Street explained in the report. "The good news for Cable is that pricing and customer support are far easier to fix than product."

Update: New Street noted that cable's pricing problem is not centered on average revenue per user (ARPU), which is on the rise (see below for more on cable's ARPU trends), but instead stems from acquiring customers at low promotional prices, then increasing the prices sharply over a year or two.

Though cable operators such as Comcast and Charter Communications have been investing in improving customer service, New Street acknowledged that it will take time for that perception to shift.

FWA holds a big NPS advantage

At a high level, NPS, a metric that can measure the effectiveness of company management and serve as a solid predictor of future market share, is improving across US broadband, New Street points out.

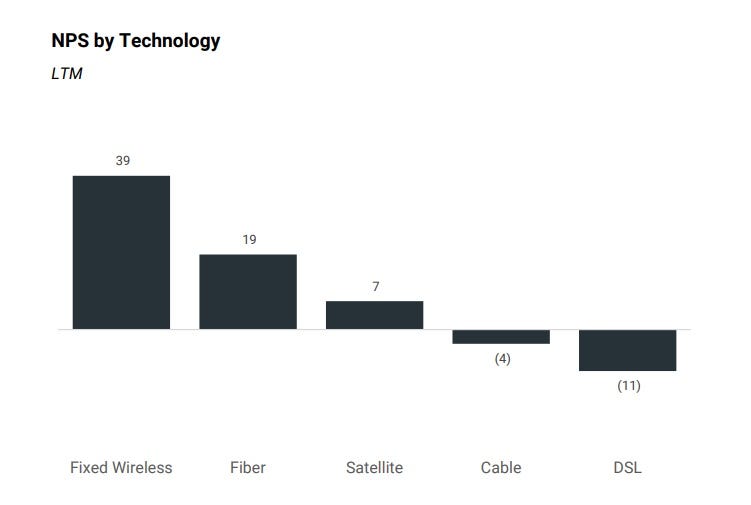

And FWA has a clear advantage when viewed through the NPS lens. Not only are FWA's net promoter scores rising, but FWA's score doubled that of fiber-to-the-premises (FTTP) services over the past 12 months.

(Source: New Street Research analysis; Recon Analytics)

Cable's NPS is negative but is improving steadily. New Street suggests that cable must close that net promoter score gap, but views it as a fixable problem.

Notably, US cable's product-related NPS has risen in the past 12 months and has been largely positive in other categories such as installation and setup, billing and overall experience. But those numbers have been matched by declines in areas such as customer support and value for price.

Cable losing share to FWA, but FWA disconnects are heading to cable

Bigger picture, total broadband subscriber adds of 4.1 million in Q3 remained above pre-pandemic norms, with FWA over-indexing to customers that are new to broadband, the report found.

US cable operators are seeing flat growth and are barely taking share among fixed broadband providers. New Street believes cable operators are gaining share in the 55% of their footprint where they compete against DSL but are losing share in the 45% of the market where they compete against fiber.

Cable is clearly losing share to FWA, accounting for about two-thirds of industry switchers and representing the largest source of subs for FWA. New Street views the gap in price and value between FWA and cable as a key driver. Led by T-Mobile and Verizon, the US FWA sector added about 966,000 subs in Q3, extending its total of 6.9 million subs. New Street expected to see FWA subscriber growth stabilize in the range of 900,000 to 1 million subscribers for at least the next couple of quarters.

The thread of good news for cable is that nearly 60% of FWA disconnects are going to cable broadband, according to New Street. That fits with cable's narrative that FWA is an "inferior product" and that FWA won't stand up to future demands for speed and capacity.

New Street expects US broadband to add 3.15 million subs in 2023, +3.12 million in 2024 and +2.88 million in 2025. The firm forecasts fixed broadband penetration to approach 91% by 2027, up from 85% at the end of 2022. Overall broadband penetration will reach 97% by 2027, New Street predicts.

Rising ARPU

Meanwhile, cable average revenue per unit (ARPU), currently touted by cable operators as the key metric of their broadband business, continues to rise. Comcast saw ARPU rise 4.5% in Q3 while Charter posted ARPU growth of 2.6%.

In aggregate, US cable saw broadband ARPU growth of 3.1% in Q3, versus +2.8% in the year-ago period. The full US broadband industry saw ARPU rise 6.6% in Q3, compared to a gain of 5.2% in the year-ago period.

New Street expects cable broadband ARPU to "improve modestly" – in the 3% to 4% range – over the next couple of quarters.

About the Author(s)

You May Also Like