Who will buy UScellular?

T-Mobile appears to be the most likely bidder for UScellular, which is now up for sale. But it's not clear how any buyer would handle UScellular's various spectrum and tower assets.

Late last week the parent company of UScellular, Telephone and Data Systems (TDS), announced it would "initiate a process to explore strategic alternatives for UScellular." Meaning, it would put UScellular's assets up for sale.

Investors cheered the news. Shares in TDS and UScellular spiked roughly 60% after the announcement.

The move was largely unexpected. TDS is mostly controlled by the Carlson family – Walter Carlson is the company's non-executive chair of the board and LeRoy Carlson Jr. is its CEO – and the family has steadfastly refused to sell UScellular even as other small carriers headed for the exit. It's not clear what sparked the change.

"The TDS board believes that now is the right time for a comprehensive review of strategic alternatives for UScellular. We will pursue the pathway that is in the best interest of shareholders," Walter Carlson said in a company release announcing the move.

For its part, UScellular reported quarterly earnings of $5 million last week, down from the $21 million it posted in the year-ago quarter and well below Wall Street analyst expectations, noted The Wall Street Journal. UScellular also lost another 28,000 postpaid phone customers during the period, despite efforts by the company's CEO to reinvigorate growth.

"There is no deadline or definitive timetable set for completion of the strategic review, and there can be no assurance regarding the results or outcome of this review. TDS and UScellular do not intend to comment further on the strategic review process, and we'll make further announcements as appropriate," TDS CFO Vicki Villacrez said during the company's quarterly conference call last week, according to Seeking Alpha. "We do not plan to answer any questions regarding the review."

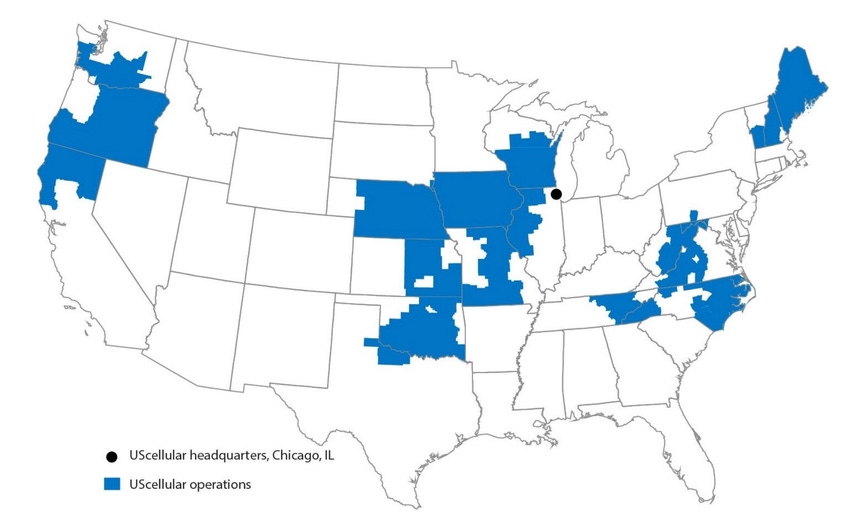

UScellular operates a wireless network across around 21 states; counts around 5 million mobile customers; owns spectrum licenses ranging from 600MHz to AWS, CBRS, 3.45GHz, C-band and 28GHz; and manages around 4,300 cellular towers across its coverage area.

The Chicago-based company also employs around 4,600 full- and part-time workers.

A complicated sales process

Importantly, most analysts agreed that UScellular's assets will ultimately be broken up across several different buyers. Even if one company agrees to purchase UScellular outright, that buyer will probably seek to offload unwanted assets afterward.

For example, network operators in the US like T-Mobile and AT&T generally do not own cell towers. Instead, over the years they have sold those holdings to cell tower operators like American Tower and Crown Castle, who then rent them back to network operators. UScellular is relatively unique in the US market because it still owns most of the cell towers that underpin its network.

Further, network operators like Verizon and AT&T are increasingly scooping up the spectrum licenses of smaller carriers and are not purchasing their customers or their network equipment. Instead, that unwanted network equipment is decommissioned, and customers are encouraged to sign up for service elsewhere.

But it's not clear whether UScellular's assets would be treated in the same way. For example, T-Mobile in 2020 acquired Sprint's customers, spectrum and network. But it then immediately worked to shutter Sprint's network and shift its customers onto the T-Mobile network. Today, much of that work is finished.

Possible buyers

Regardless, a number of analysts speculated on some of the possible suitors for UScellular's assets:

T-Mobile

"The best fit may be with T-Mobile," wrote the financial analysts at New Street Research in a recent note to investors. They argued that T-Mobile would likely want access to USCellular's 600MHz, PCS and AWS spectrum licenses – those that T-Mobile is already using in its own network. They speculated that T-Mobile might sell other UScellular spectrum holdings – like the 700MHz that it's not using in its network – to the likes of AT&T and Verizon.

Verizon or AT&T

Roger Entner, the founder and lead analyst of Recon Analytics, said on his weekly podcast that any of the three big operators in the US – T-Mobile, AT&T or Verizon – could purchase UScellular.

Others agreed. "We think the most likely transaction partner would be one of the three national carriers," wrote the New Street analysts.

But Entner told FierceWireless that any potential buyer will likely shutter UScellular's network and migrate its subscribers to their own network. Entner also said that the real value in UScellular is not its wireless subscribers but in its spectrum holdings.

Dish Network

"There is the prospect of a deal with Dish, if UScellular's network materially accelerated Dish's progress towards their next FCC deadline," wrote the New Street analysts.

Indeed, Dish is under a federal mandate to cover 70% of each of its spectrum licenses with 5G by 2025.

But the New Street analysts acknowledged that a Dish acquisition of UScellular is unlikely, largely because Dish is facing some substantial financial challenges and will need to raise additional cash to maintain its wireless business in the next year or so.

"We think the odds of this [Dish-UScellular deal] are very small; there is only one overlapping band (600MHz); and the network architectures are incompatible," wrote the New Street analysts. "UScellular would presumably have to be willing to take stock in a Dish deal."

Charter and other cable companies

"One thought that should not be ruled out is a possible bid from Charter," analyst Jim Patterson of Patterson Advisory Group in his weekly newsletter. "Of the cable companies who are most highly interested in wireless ownership, they would be the one we could see leading a consortium bid. Charter has significant operations in North Carolina, Wisconsin, and Maine and might have enough CBRS and other spectrum to fill in part / most of the Kansas City Metropolitan Trading Area (MTA). And they have little interest in the TDS wireline asset. Mediacom (Iowa), Suddenlink (West Virginia), and Cox (Nebraska and Oklahoma) might also be interested in joining some sort of consortia."

But others disagreed.

"We would rule out cable as a buyer entirely," wrote the New Street analysts.

And Entner, of Recon Analytics, argued that UScellular's coverage area does not match up with any cable company footprint.

Tower companies

UScellular's cell tower business would undoubtedly be interesting to companies like American Tower or SBA Communications. After all, such companies have built their entire businesses around buying or building cell towers and then renting space on those towers to wireless network operators.

However, UScellular's cell tower business is complicated by the fact that its network is the main user of its towers. Meaning, if UScellular's network is dismantled, its towers may no longer carry much value.

In its most recent earnings report, UScelluar said it continues to work to rent its towers out to other wireless network operators. The company said that it currently counts around 1.55 tenants per tower, up from 1.44 two years ago.

Dark horse bidders

Of course, there's always the possibility that a surprise buyer will emerge, whether Google or another deep-pocketed technology company.

That possibility came up during Entner's podcast. However, he said the prospect of an up-and-coming tech company buying an aging, regional wireless network operator is about as likely as the Catholic Church buying UScellular.

What will it cost?

Price, of course, will be the deciding factor in any purchase of UScellular's assets. And the value of spectrum licenses or cell towers is notoriously difficult to pin down.

"We can't put numbers on what UScellular's tower portfolio is worth or what bidders might pay. We don't know how the assessment of strategic alternatives will play out," wrote the financial analysts at MoffettNathanson in a recent note to investors regarding UScelluar's cell tower portfolio. "We don't know what rent, escalator, capacity rights, contract duration, and other terms UScellular (or a successor) might negotiate as part of a deal, which involves trade-offs between the value of UScellular's towers and the value of UScellular's carrier business and its appeal as an M&A target. We don't know what share of its towers are on owned land vs. leased land. We don't know how many sites an acquirer would decommission."

But the financial analysts at Raymond James estimated the value of UScellular's 4,300 cell towers at around $2.9 billion. They pegged the value of UScellular's mostly unused spectrum holdings – including its millimeter wave, 3.5GHz CBRS, C-band and 3.45GHz licenses – at around $2.5 billion. And they gave UScellular's mobile business, including its roughly 5 million customers, a value of $2.6 billion.

Will regulators approve the transaction?

Regulatory approval is often a big unknown in any merger or acquisition. For example, T-Mobile worked for more than two years to obtain approval for its purchase of Sprint.

Further, the topic has gained heat during recent years, particularly considering the Biden administration's Department of Justice has been actively moving against mergers such as Microsoft's bid for Activision.

But most analysts argued UScellular's small stature will smooth its sales process. Indeed, the New Street analysts estimated the company commands a 1% share of the US mobile market.

"If past antitrust analysis prevails, we think it will be approved," the New Street analysts wrote in a recent note to investors. But they argued that approvals could be more difficult to obtain if a major carrier like T-Mobile, AT&T or Verizon makes a bid for UScellular.

Related posts:

— Mike Dano, Editorial Director, 5G & Mobile Strategies, Light Reading | @mikeddano

About the Author(s)

You May Also Like

_International_Software_Products.jpeg?width=300&auto=webp&quality=80&disable=upscale)