Has streaming reached a new plateau?

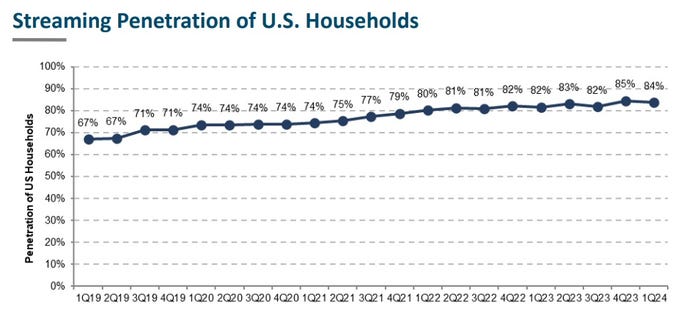

HarrisX data shows that streaming penetration of US households dropped in Q1 2024 while the average number of services per household has flattened. 'Streaming has become a zero-sum game,' MoffettNathanson said in its analysis.

Streaming has taken firm hold of the video market, but earlier, rocketing growth has flattened out in recent quarters, a new study shows.

Streaming penetration of US households held steady, at about 82%, for most of 2022 and 2023, then hit a new high of 85% in Q4 2023. MoffettNathanson said it's "plausible" that Netflix's crackdown on password sharing contributed to that bump.

However, streaming penetration dropped slightly to 84% in Q1 2024, MoffettNathanson points out in its latest quarterly streaming tracker (registration required), which is based on an analysis of fresh data from HarrisX.

(Source: MoffettNathanson Q1 2024 SVOD Tracker based on HarrisX data)

"Whether this marks a new plateau or whether there is additional room for streaming to increase its penetration will be a key question for investors going forward," MoffettNathanson said in the study, based on HarrisX's survey of 23,769 adults between January and March 2024. "Is this (still elevated Y/Y) penetration rate the new plateau? Or are additional growth spurts yet to come?"

The average number of streaming services has flattened to about 3.8 per household. The streaming market will be hard-pressed to boost that number.

"[T]he lack of growth here shows that we have entered a phase of the streaming wars where the competitors are no longer vying for fresh, virgin territory but rather against each other for land (and share of wallet/view time) already claimed. Streaming has become a zero-sum game," MoffettNathanson explained.

Netflix's password-sharing crackdown appears to be having an impact. In HarrisX's Q2 2023 study, some 15% of users reported using passwords from someone outside the household; that dropped to 10% in Q1 2024.

Daily usage drops

HarrisX also found that daily usage is down across the top streaming services linked to the study. Hulu saw the biggest hit, as usage dropped 350 basis points (bps), followed by Discovery+ (-330 bps). Disney+ (-65 bps) and Peacock (-90 bps) saw the shallowest drops.

But streaming usage continues to reflect the pay-TV cord-cutting trend.

HarrisX found that, in Q1 2024, 51% of streamers don't take a pay-TV service, up from 45% in the year-ago period. Additionally, the percentage of streamers who dropped pay-TV declined to 33% in Q1, versus 37% in the year-ago period.

About the Author(s)

You May Also Like