Can Netflix keep the good times rolling?

Netflix subscriber growth blew out estimates again, as the streaming giant added 9.33 million subs in Q1 2024, ending the period with 269.60 million paid subs worldwide. But some analysts wonder if such growth is sustainable.

Netflix added 9.3 million subscribers in the first quarter of 2024, ending the period with nearly 270 million total. Netflix's growth in the period beat expectations, but some industry watchers wonder if the company's subscriber success is sustainable for the longer term.

The company paired the quarter's sub growth with Q1 revenues of $9.37 billion, up 14.8% versus the year-ago quarter.

The quarter was solid, but some analysts aren't yet ready to take a plunge on the stock, which was down 6.5% in Friday morning trading.

MoffettNathanson, for example, kept its "neutral" rating and a $500 price target on the stock. MoffettNathanson analyst Michael Nathanson wondered in a research note (registration required) if Netflix's current subscriber growth can keep the pace. Questions about that are "heightened" in the wake of Netflix's announcement that the company will stop providing subscriber and average revenue per member metrics at the end of this year.

"Embedded within that is both the question of how much the company's recent reacceleration has been a password-sharing crackdown-driven pull forward, as well as the question of how many monetizable password sharers are left," Nathanson wrote. "While one might be able to come to different answers to these questions, we do believe the lowest hanging fruit has already been captured."

Netflix outlined two priorities in its Q1 investor letter (PDF): to scale its subscriber base further and to build out its advertising business.

Netflix said its ads membership jumped 65% in the quarter, with over 40% of all new signups taking the company's less expensive ad-supported plan. Netflix launched its ads tier in November 2022. Netflix is also expanding further into live-streamed events, including this summer's matchup between Mike Tyson and Jake Paul. Its exclusive coverage of WWE's "Raw" will start in January 2025.

The company believes it has lots of runway left, estimating that its share of TV viewing is still less than 10% across the countries in which it operates.

Subscriber estimates rise

Netflix's results arrive a day after MoffettNathanson upped its subscriber estimates for the streaming service. MoffettNathanson now expects Netflix to add 23 million subs worldwide for full-year 2024 and end the year with 283.3 million – up from the consensus estimate of 281.8 million.

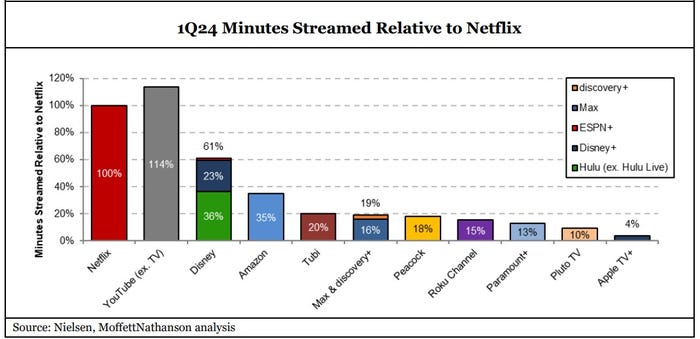

MoffettNathanson also pointed to Netflix's dominance in the streaming market – from a usage perspective – following new data from Nielsen. YouTube is still the clear leader in that category, but Netflix outperforms other premium streaming services, such as Disney+ and Amazon Prime Video, by a wide margin.

One potential area of concern is Netflix's penetration of pay-TV subscribers, which is now at 61%, down from a high-water mark of 67% in 2022.

"Does this mean that Netflix has run out of room to grow among the 48 million households still subscribing to the 8 largest MVPDs tracked by Nielsen? Likely yes, though that means far less today than it did a few years ago given the diminished share of total American households this group today represents," Nathanson explained in a research note (registration required).

Speaking on yesterday's earnings call, Netflix co-CEO Greg Peters said internal data shows that the company's crackdown on password-sharing has not negatively impacted viewership on the service, which remains "steady."

"That’s a pretty good sign that our engagement is holding up, and it sort of cuts through the noise around paid sharing," he said.

About the Author(s)

You May Also Like

.jpg?width=300&auto=webp&quality=80&disable=upscale)