Redzone, NextWave also complain of interference from T-Mobile's 5G

Following a complaint from Bloosurf, NextWave and Redzone said their operations are also suffering interference from T-Mobile's 5G network in 2.5GHz spectrum. Meanwhile, T-Mobile is buying more of it.

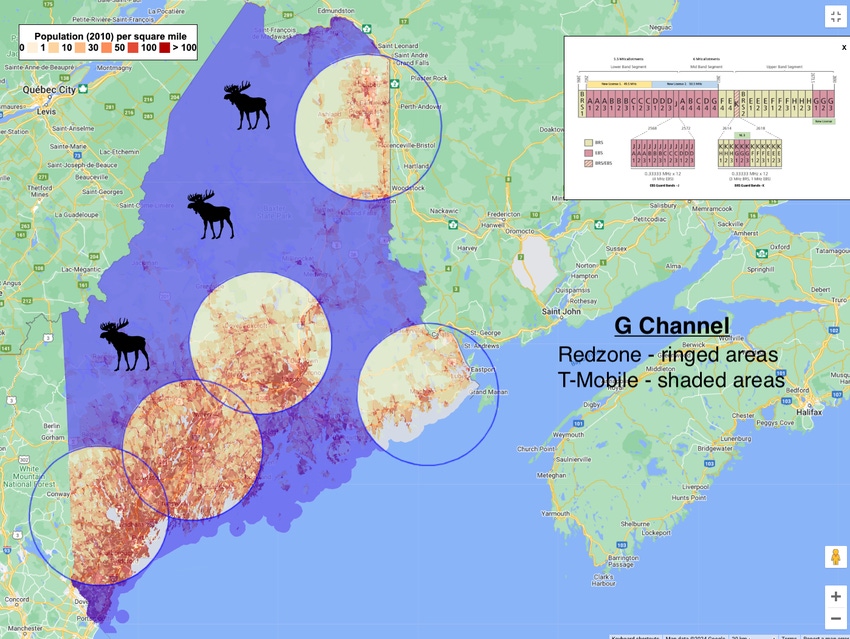

Two additional companies – Redzone Wireless in Maine and NextWave in New York – claim that T-Mobile's 5G network in its 2.5GHz spectrum is interfering with their operations. They join Bloosurf, which operates in Maryland, in raising interference complaints against T-Mobile.

"We have customers that are suffering great harm," Redzone Founder and CEO Jim McKenna told Light Reading. "We have customers that have left us because of this."

McKenna said he has been in discussions with T-Mobile's management about the issue for more than a year. "Please know that I am open to discuss any manner of solutions with you and your senior team that would turn this matter into the most positive, and successful outcome for all parties," McKenna wrote to T-Mobile CEO Mike Sievert more than a year ago, according to a letter McKenna provided to Light Reading.

But McKenna said T-Mobile has ignored his complaints.

"It's all part of a pattern of very disturbing behavior by T-Mobile," McKenna said.

T-Mobile officials declined to discuss the matter with Light Reading.

NextWave hopes for relief

Redzone isn't alone. As Light Reading recently reported, fixed wireless operator Bloosurf renewed its claims that T-Mobile's 5G service is interfering with its network. Bloosurf is now calling on the FCC to step in and do something.

Separately, NextWave has been suffering "severe" interference from T-Mobile that has "crippled" large parts of its New York network, according to an official familiar with NextWave's operations who asked not to be named. The official said NextWave is seeing the same type of interference in some of the other cities where it is building its 2.5GHz private wireless network.

After a slight delay, NextWave announced in February that it would expand its private wireless network into markets including Los Angeles, San Francisco, Las Vegas, Philadelphia and Dallas.

According to the NextWave official, the company is hoping for an FCC enforcement action against T-Mobile soon.

Stonewalled

McKenna said Redzone knew it would need to work with T-Mobile shortly after T-Mobile purchased 2.5GHz spectrum in Maine in the FCC's Auction 108 in 2022. "I even sent them a note of congratulations," McKenna said. Redzone has been operating fixed wireless access (FWA) services in its 2.5GHz spectrum holdings across Maine for more than a decade.

In early 2023, McKenna reiterated Redzone's hopes that T-Mobile would cooperate with the company on the technical details of T-Mobile's planned 5G network in order to prevent any potential interference.

However, shortly after T-Mobile received FCC authorization to turn on its 2.5GHz holdings in Maine earlier this year, it launched its 5G network in the state without any warning, according to McKenna. He said Redzone immediately noticed an uptick in customers' tech support calls as they suffered dropped connections due to interference. "It was a Friday in March," McKenna recalled.

Since then, McKenna said he has contacted T-Mobile on four separate occasions to try to get the company to work with Redzone on a possible solution. "I think there's a pathway to coordination," he said.

"I'll fly to Seattle tomorrow and sit down with them anywhere they want to meet," McKenna said.

He added that he will also consider other avenues to resolve the interference – such as an FCC complaint or a lawsuit. But McKenna said he would prefer to simply work with T-Mobile directly. "I welcome a conversation with them," he said.

Post-auction transactions

T-Mobile's appetite for additional 2.5GHz spectrum shows no signs of slowing. The company recently filed for FCC permission to acquire additional 2.5GHz licenses in California, Louisiana, Kentucky, New York and North Carolina.

T-Mobile acquired the bulk of its 2.5GHz spectrum licenses when it purchased Sprint in 2020. It acquired more, mostly in rural areas, in the FCC's Auction 108 in 2022. 2.5GHz forms the midband core of T-Mobile's high-speed 5G network.

T-Mobile is hoping to purchase its latest batch of 2.5GHz licenses from Central Louisiana License (CLL). CLL is tied to Jonathan Foxman and Cellular One. Foxman is the CEO of MTPCS, a small wireless provider that operates under various brands including Cellular One. As Light Reading previously reported, Foxman's IV Cellular in Illinois recently transitioned from a wireless network operator to an AT&T reseller.

CLL purchased its 2.5GHz licenses during the FCC's Auction 108.

T-Mobile's FCC filing on the topic stated that the purchase of CLL's licenses would increase T-Mobile's overall spectrum holdings to up to 400MHz in some locations.

That might be too much spectrum. Earlier this year, the FCC required T-Mobile to divest some of its Auction 108 winnings in Hawaii in order to meet the agency's spectrum screen, which is designed to protect competition.

The FCC first introduced the spectrum screen in 2004 to prevent wireless network operators from gobbling up all of a market's available spectrum, thereby blocking rivals from acquiring it. The screen is generally triggered when a single company acquires more than one-third of the total suitable and available spectrum for commercial services in a given market.

Following its 20MHz divestiture in Hawaii, T-Mobile will hold a maximum of 350MHz of total spectrum in Hawaii.

About the Author(s)

You May Also Like

.jpg?width=300&auto=webp&quality=80&disable=upscale)