Consumers spending less on video services and apps – study

Average consumer spending on video services dipped about 13%, to $176.84, in Q4 2023, according to TiVo's latest 'Video Trends Report.' Meanwhile, ad-supported streaming usage is on the rise.

Consumers are spending less on video services, subscribing to fewer video services and showing increased tolerance for ad-supported content, TiVo found in its Q4 2023 "Video Trends Report."

Average total spending on video services reached $176.84 in Q4 2023, down about $13 from $189.38 in the year-ago period. While the drop was more dramatic among pay-TV subscribers, spending on video services among broadband-only subscribers actually rose, found the study, which was based on a survey of 4,436 adults in the US and Canada.

(Source: TiVo Video Trends Report, Q4 2023)

The average number of paid video services also dropped – to 7.1 in Q4 2023 from 7.6 in the year-ago period. Meanwhile, the average number of non-paid services – many of them in the free, ad-supported streaming television (FAST) category – rose slightly to 4.0 versus 3.9 a year earlier.

Meanwhile, the number of video sources consumers use also dropped – from 11.5 in Q4 2022 to 11.1 in Q4 2023.

However, FAST and other ad-based video-on-demand services are now being used by nearly 70% of respondents, up almost 20% since 2020.

The scaling back on video spending and a gravitation toward more FAST services indicate that "consumers appear to be waving the caution flag," TiVo noted in the report. "The number of sources has seemingly topped out and consumers, especially those from high-income households, have become increasingly cost conscious."

More than a quarter of cord-cutters end up resubscribing

The report also highlighted an ongoing cord-cutting trend that is wreaking havoc on traditional cable, satellite and telco pay-TV service providers. But the cord-cutting pace appears to be slowing.

Some 27.6% of those surveyed said they plan to cut the cord in the next six months, down 30% from a year earlier.

Notably, 27.7% of those who cut the pay-TV cord said they later resubscribed, with 33.8% saying they couldn't get access to the shows they wanted without pay-TV. About 29.1% of those resubscribers said pay-TV was the best way to watch major sports events. However, that picture is changing as rights for top leagues continue to transition to subscription streaming services such as Amazon Prime Video, Apple TV+ and NBCU's Peacock.

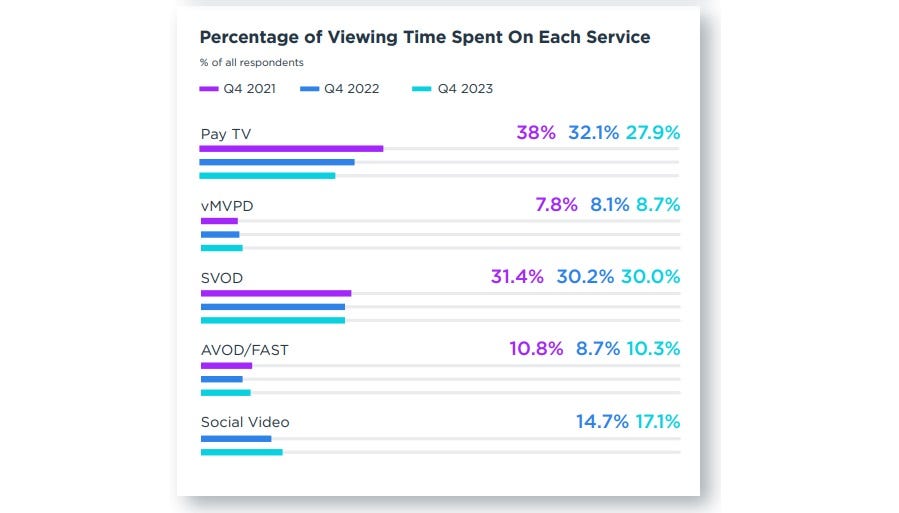

The time consumers spend on pay-TV services is also declining while usage on virtual multichannel video programming distributors (vMVPDs) such as YouTube TV, SVoD, FAST and "social" video platforms have all risen over the past two to three years.

(Source: TiVo Video Trends Report, Q4 2023)

But consumers are reporting a drop in perceived quality across all categories. For example, quality perception for vMVPD services dropped from 81.2% in Q4 2022 to 75.9% in Q4 2023. Drops were also seen in the pay-TV category (67.4% versus 70.2%), FAST (59.5% versus 61.5%) and ad-free SVoD (74.9% versus 80.2%). However, the quality perception gap between paid and non-paid services continues to tighten, TiVo noted.

Loyalty low for smart TV operating systems

The study also focused on the streaming device market, finding that 25% of those surveyed planned to buy a smart TV in the next six months. Some 47.2% said they intend to replace an existing TV while 52.8% said they plan to add a smart TV for another room or location in the home.

The top driver for smart TV purchases (49.4%) is based on low prices/sales, followed by image quality/resolution (44.3%) and the reputation of the TV brand/manufacturer (36.4%). Only 17.7% said they buy smart TVs based on a platform they already have.

And overall loyalty to operating systems is somewhat low – just 28% of those surveyed who own a smart TV said they would choose their current platform again and would refuse to consider other operating systems when making future smart TV purchases.

Still, Samsung fared well among smart TV brands. Samsung was tops among survey groupings with one, two or three or more smart TVs, followed by LG Electronics.

(Source: TiVo Video Trends Report, Q4 2023)

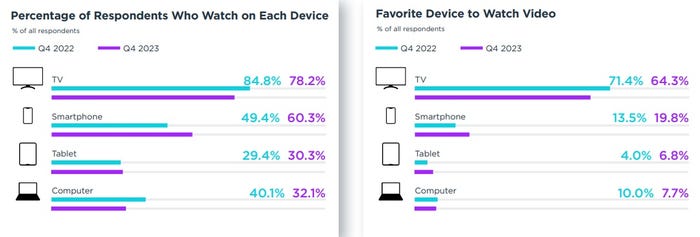

The study also found that consumers still prefer to watch video on the TV screen by a wide margin. But the gap is narrowing, as 19.8% said they prefer to watch video on a smartphone.

About the Author(s)

You May Also Like