US pay-TV subscriber base eroding at record pace

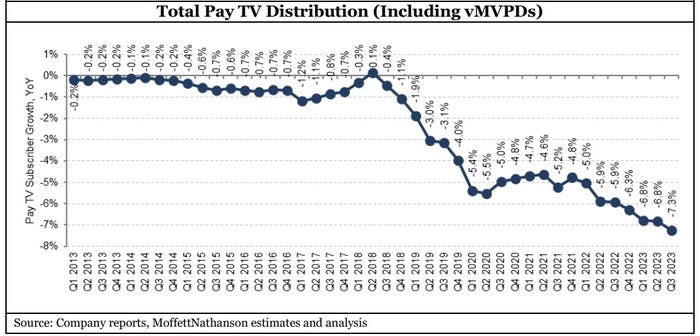

MoffettNathanson estimates that US pay-TV lost a total of about 900,000 subs in Q3 2023 – a worst-ever third quarter for the industry. That poor result left US pay-TV shrinking at a record pace of 7.3%.

The hits keep coming in the US pay-TV industry.

With virtual multichannel video programming distributors (vMVPDs) such as YouTube TV unable to pick up the slack, the US pay-TV industry lost about 900,000 subscribers in Q3 2023, a worst-ever result for a third quarter, MoffettNathanson estimated in its latest Cord-Cutting Monitor (registration required).

That poor result, the research firm added, left the total pay-TV industry shrinking at a record pace of -7.3%, widened from a year-ago decline of -5.9%.

It also left pay-TV penetration of occupied households (including vMVPDs) at just 54.8% – a level last seen in 1989, five years before the debut of DirecTV, MoffettNathanson analyst Craig Moffett pointed out.

Drilling down on Q3 results, traditional pay-TV providers (cable, telco and satellite) shed 1.97 million subscribers, widened from a loss of 1.94 million in the year-ago quarter.

Within that category, US cable lost 1.10 million video subs in Q3, versus a loss of -1.09 million in the year-ago period. Satellite operators (Dish Network and DirecTV) lost 667,000 subs in Q3, versus -567,000 in the year-ago quarter. Telco TV providers lost 198,000 video subs in the period, an improvement when compared to a year-ago loss of -250,000 subs.

YouTube TV surpasses Dish

vMVPDs, meanwhile, added 1.08 million in Q3, down from a year-ago gain of about 1.34 million. Despite those gains, vMVPDs recaptured only 21.7% of traditional pay-TV's subscriber losses in the period, according to MoffettNathanson.

Meanwhile, YouTube TV continues to dominate the vMVPD category. MoffettNathanson estimates that YouTube TV added about 350,000 subs in Q3, extending its total to 7 million – representing 40% of the vMVPD sector's 18 million subscriber total.

"Based on our Q3 estimate, YouTube TV has now surpassed Dish Network [6.72 million satellite TV subs at the end of Q3] to become the country's fourth largest MVPD of any kind," Moffett noted. "At the current trajectory, YouTube TV should pass DirecTV for third place in less than a year."

'Re-bundling' unlikely to resolve pay-TV's woes

Moffett is bearish that ongoing "re-bundling" initiatives – through the combination of streaming services, discounts, aggregated search and discovery platforms and potential mergers between major content suppliers – will solve pay-TV's problems.

He allows that the new Charter-Disney deal is a helpful step, but he's likewise doubtful that it will turn into a watershed moment for the industry unless a fuller complement of content players and distributors buy in.

"Giving customers more value for their dollars by combining linear and streaming for a single price (at least notionally) is clearly a step in the right direction if the industry is to make any serious effort to preserve the linear model," Moffett noted. "But a truly serious effort would require more than just one or two participants defending the model. It would require all participants defending the model."

He also reckons that recent reports about a possible merger between Warner Bros. Discovery and Paramount might seem like a big move toward re-bundling, but believes that in reality it would represent a relatively modest one.

"[T]wo sub-scale services merging into one still sub-scale service would help, but only a little," Moffett concluded.

About the Author(s)

You May Also Like

_International_Software_Products.jpeg?width=300&auto=webp&quality=80&disable=upscale)