New Heavy Reading Report highlights the changing roles of the carriers, hyperscalers and ISVs in edge computing deployments

Heavy Reading's Telcos and Hyperscalers report indicates that the smaller CSPs are more likely to turn to the hyperscalers for help with edge solutions, while the larger providers are more likely to build expertise in-house.

Heavy Reading collaborated with Ericsson, Google Cloud, Intel and Viavi to conduct a survey of 101 global CSPs that have launched edge computing solutions or are planning to do so within 24 months. The aim was to understand how communications service providers (CSPs) and hyperscale cloud providers (HCPs) work together to enable edge computing. One of the drills-downs of the survey examined where CSPs were sourcing the vertical industry expertise needed to address enterprise edge computing workloads. The survey also explored the related subject area of who owned the training data, the AI algorithms and the models training for the network AI applications used in edge computing implementations.

Building or borrowing vertical industry expertise?

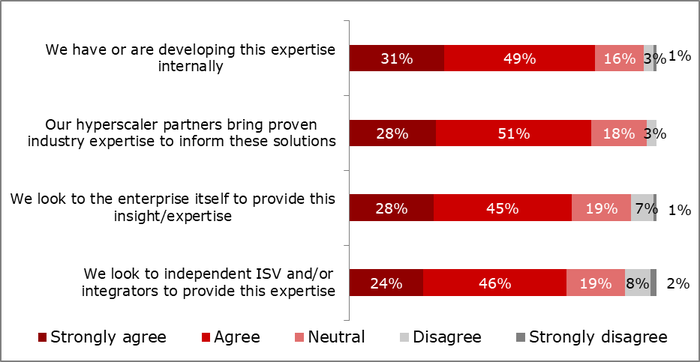

Until now, the market for edge services has been characterized by solutions that address specific use cases for specific enterprises. Those solutions have been highly customized and hard to replicate, even within the same vertical. Are CSPs willing to tackle the challenge of amassing enterprise expertise, or are they looking to their edge ecosystem to offload this resource-intensive task (see figure below)? At first glance, it appears that the CSPs are neutral about where this expertise originates, whether from within their own organizations or from independent software vendor (ISV) partners, cloud partners or the enterprise itself. Between 70% and 80% of respondents "agree" or "strongly agree" with each choice. A 10-percentage-point difference is very tight. However, developing expertise internally does edge out the other choices as the most popular response.

However, if we examine only the largest CSPs (over $5bn in annual revenue), the responses are more highly differentiated. Large CSPs look to their own internal organizations or the hyperscalers for expertise; fewer look to the enterprise itself. For the hyperscaler response, the combined number of "strongly agree" and "agree" changes by only 1 percentage point, but there is an estimated 10-percentage-point shift from "agree" to "strongly agree." This is not the case with building expertise internally, where the "strongly agree" percentage increases by 9 percentage points for the largest carriers while the "agree" percentage remains virtually unchanged.

The takeaways are clear:

All methods are viable for all CSPs.

But smaller carriers are more likely to look to their ecosystem partners for expertise.

And Tier 1 carriers are focused on building expertise internally.

Vertical industry expertise is leveraged from multiple sources

(Source: Heavy Reading 2023)

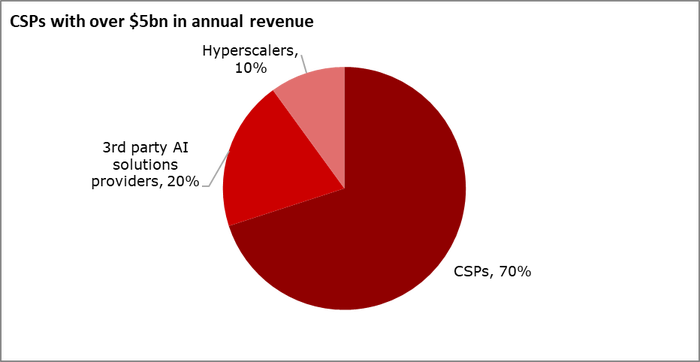

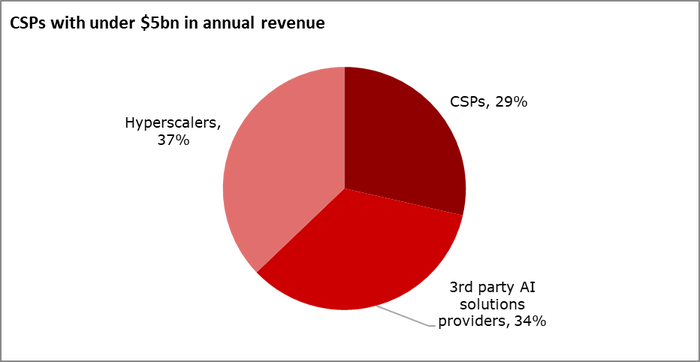

The survey contained a follow-up question regarding the use of AI, querying respondents regarding primary owners of training data, AI algorithms and model training for network AI applications (see figure below). All three vendor segments received at least a quarter of the responses, but the hyperscalers were the lowest, with 29%. In addition, the numbers shift dramatically if we look only at responses from CSPs with over $5bn in annual revenue. A full 70% of Tier 1 companies favored themselves — the "CSPs." Only 10% of these largest carriers favored hyperscalers. Conversely, for lower revenue telcos, the "CSP" response plummeted to 29%, and the hyperscaler response was 37%. This reinforces Heavy Reading's observation that the smaller the CSP, the more likely it is to turn to the hyperscalers for help with issues foreign to their core expertise. In contrast, Tier 1 providers are working to build expertise in-house.

Who is the primary owner of the training data, AI algorithms and models training for network AI applications?

(Source: Heavy Reading 2023)

Heavy Reading's survey results, overall, point to an increased willingness among the CSPs to partner with HCPs — regardless of the size of the CSP. There is, however, one aspect of working with the HCPs that causes concern among the CSPs: HCP vendor lock-in. For more insights here, we urge you to read the rest of the report.

Read the full report for more edge computing insights

Heavy Reading's survey results show that carriers have committed to edge computing and are progressing rapidly with implementations. At the same time, they are expanding their partnerships with the hyperscalers, particularly in the areas of automation and AI. To gain more in-depth details of service providers' perspectives on edge computing deployment and their hyperscaler brethren, download and read the full report now.

This blog is sponsored by Intel.

About the Author(s)

You May Also Like

_International_Software_Products.jpeg?width=300&auto=webp&quality=80&disable=upscale)