Vodafone's new energy deal won't make it much greener

Purchase power agreements signed with Iberdrola cover a small fraction of Vodafone's energy use, while both consumption and emissions are rising.

The solar farms that sprawl across parts of the European countryside are an ugly sight to anyone who is not a lover of photovoltaics. But they are probably an improvement on power plants belching fumes and may be needed if companies are to reach some of their ambitious net-zero targets. Hence a new deal under which all the energy generated by a new plant in Germany will supply just one company – Vodafone.

Still under construction by Spanish energy giant Iberdrola, it's the Boldekow plant in Mecklenburg-Western Pomerania, expected to have a total capacity of 56 MWp (a measure of the maximum potential power output) when finished. But Vodafone is not stopping there. Its Portuguese subsidiary has signed a power purchase agreement (PPA) with Iberdrola for energy generated by the Velilla solar plant in Spain. Another PPA, signed by Vodafone Spain, covers energy that comes from Iberdrola's Cedillo plant near Cáceres.

Add this all up and Iberdrola will be covering 410 gigawatt hours (GWh) of Vodafone's annual energy needs over the next three years. This will help "to accelerate Vodafone's net-zero journey," said the operator in its statement, besides boosting its energy security. But the impact will probably be small.

For a start, Vodafone already claims to source all its European energy from renewables, which implies these PPAs are either replacing or succeeding earlier deals. Worldwide, Vodafone bought 81% of its energy from renewable sources in its most recent fiscal year (ending in March 2023), up from 77% the year before and 55% the year before that.

What's more, 410 GWh is only 6.5% of Vodafone Group's energy consumption in its last fiscal year. Companies essentially have two ways to be greener. One is to buy renewables and give up the fossil fuels habit. The other is to cut energy use. From a shareholder perspective, the latter may seem preferable because it also promises cost savings. Yet Vodafone's electricity bill went up by a third last year, to about €1.2 billion (US$1.3 billion).

War and other things

This was largely because energy prices spiked after Vladimir Putin invaded Ukraine and countries decided they should probably buy their gas and oil from slightly more savory dictators instead. But it's not the sole reason for Vodafone's increase. For the fiscal year ending in March 2022, it guzzled precisely 6,142 GWh of energy across its global operations, according to financial statements, 17 GWh less than it consumed the year before. But its energy use rose by 149 GWh in the last fiscal year, to 6,274 GWh – an increase equal to 36% of what Iberdrola will provide through the just-signed PPAs.

It marks Vodafone out as one of the few big European telcos whose annual energy consumption has materially risen. The UK's BT, for instance, consumed 2,641 GWh in the year to March 2023, a 4% reduction, while Spain's Telefónica used 6,106 GWh in 2022, roughly the same amount as the year before.

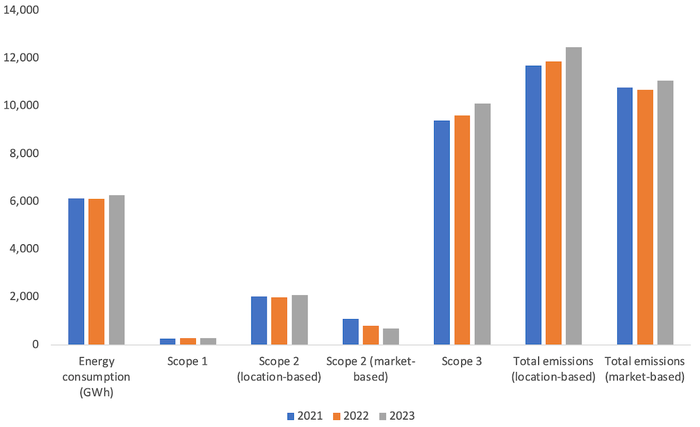

Worse, from an environmental perspective, are the emissions increases Vodafone has acknowledged in the last few years. Even with its flight from fossil fuels and claims about using only renewables in Europe, Vodafone's annual emissions – including the upstream and downstream stuff categorized as Scope 3 – have gone up in the last couple of years, however they are measured.

Energy use and emissions at Vodafone Group (Source: Vodafone)

(Source: Vodafone)

(Notes: All emissions data is in kilotons of carbon dioxide equivalent)

Two options are available for calculating Scope 2, the category that broadly covers the electricity Vodafone buys to power networks and other facilities. So-called "market-based" metrics take into account the sorts of PPAs Vodafone has been signing with Iberdrola, while "location-based" numbers use national-grid data. Vodafone does well on the market-based figure, cutting annual emissions by 37% in the last two years, to 690,000 metric tons of carbon dioxide equivalent. But the location-based figure is up 2.5%, to nearly 2.1 million.

On Scope 1, which covers items such as fuel bought for company vehicles, Vodafone's annual emissions have increased slightly, from 270,000 to about 280,000 in the last couple of years. But the bulk of Vodafone's emissions fall into Scope 3, and the annual amount has grown by more than 7% over this same period, to an icecap-thawing 10.1 million.

The Scope 3 problem

There is only so much Vodafone and other telcos can do about emissions for which they are not directly responsible. Building guarantees into contracts with suppliers and asking vendors to lean more heavily on their own suppliers are steps Vodafone is taking. "What we're also doing beyond our direct area of influence is that every procurement needs to ensure that every single member in the chain has their share of commitment," said Andrea Dona, Vodafone UK's chief network officer, during a recent briefing with press and analysts.

Government authorities could do more to help, he thinks. "You need evidence you have communicated to all customers and ensured vulnerable customers are safeguarded, but there comes a point where we also need help," he said. "Certain old technologies just need to be switched off. If we hang onto everything, it becomes quite burdensome."

Many people reading the details of the Iberdrola and Vodafone arrangement will ponder the long-term feasibility of renewables. Boldekow will reportedly feature as many as 80,000 bifacial solar panels and yet generate only a tiny fraction of the energy that Vodafone Group needs every year. And those panels are loaded with the sort of rare earth materials that are getting harder to obtain amid today's geopolitical strife. Net zero is going to be far more difficult than some of its proselytizers would have you believe.

Related posts:

— Iain Morris, International Editor, Light Reading

Read more about:

EuropeAbout the Author(s)

You May Also Like