Will regulators put more caps on 5G spectrum ownership?

The FCC recently opened a new proceeding into its spectrum screen, a first step in potentially limiting the amount of spectrum 5G network operators can deploy. AT&T is likely cheering the move, while T-Mobile may fight against it.

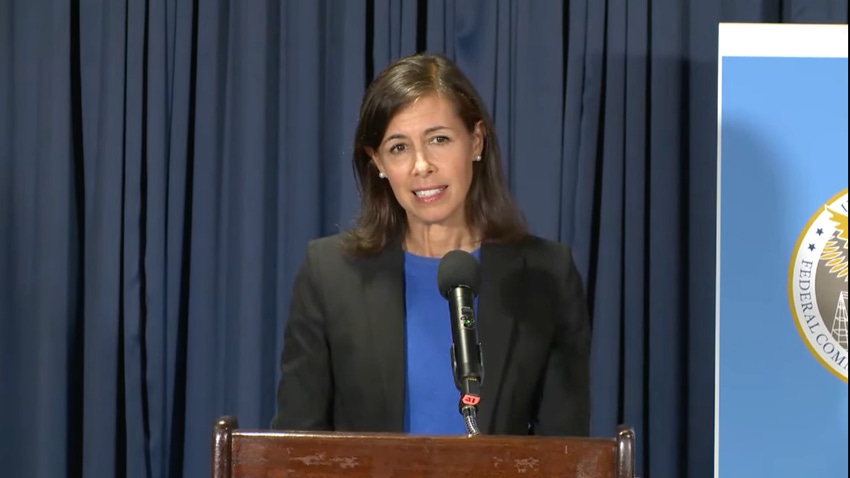

Just days before the agency's chairwoman announced plans to reinstate some net neutrality guidelines, the FCC also opened a proceeding into the spectrum screen.

The move could reflect the fact that Democratic FCC Chairwoman Jessica Rosenworcel now believes she has enough political clout to impose limits on 5G spectrum ownership via the agency's spectrum screen.

After all, Democratic commissioners now outnumber Republicans after the Senate finally approved Democrat Anna Gomez as the fifth commissioner on the FCC. That development paved the way for Rosenworcel to reopen the net neutrality debate.

A renewed look at the FCC's spectrum screen could potentially affect 5G network operators like T-Mobile by limiting the amount of spectrum they can put into their networks.

More broadly, it could also affect the cell tower operators and the equipment vendors that would be charged with putting that spectrum into action.

Updating the rules

The FCC first introduced its spectrum screen in 2004 in order to prevent wireless network operators from gobbling up all the market's available spectrum, thereby blocking rivals from acquiring it. The screen is generally triggered when any one company acquires more than one-third of the total suitable and available spectrum for commercial services in a given market.

The agency subsequently tweaked the screen, first in 2014 to specifically target spectrum below 1GHz and then again in 2016 to carve out rules designed for millimeter wave (mmWave) spectrum bands, generally those above 20GHz.

Now, the FCC has agreed to have another look at the screen to see whether it should have specific rules regarding midband spectrum, which generally sits between 2.5GHz and 6GHz. Such spectrum is often considered ideal for 5G.

However, some analysts don't believe the agency will move quickly on the matter.

"The Rosenworcel FCC doesn't care that much about that," analyst Roger Entner, with Recon Analytics, told Light Reading.

Entner argued that the FCC will likely get bogged down in debates over Title II and net neutrality, and won't make any moves on the spectrum screen anytime soon. Moreover, he pointed out that the FCC lost its auction authority earlier this year amid congressional deadlock. That renders a discussion over the screen irrelevant until Congress revives the agency's auction authority.

Reading the tea leaves

The FCC's new proceeding, launched at the end of September, stems from a complaint AT&T filed in 2020. "In the wake of its acquisition of Sprint (in which the FCC declined to require any divestitures), T-Mobile itself now exceeds the commission's screen by an unprecedented margin throughout much of the country," argued an AT&T executive at the time.

The company revived its complaints late last year after T-Mobile added to its midband spectrum war chest by winning most of the 2.5GHz spectrum licenses the FCC offered up at an auction. "T-Mobile controls a grossly outsized portion of the midband spectrum needed to fuel the 5G revolution," AT&T told the commission at the time.

According to the financial analysts at Raymond James, T-Mobile today maintains a commanding lead over AT&T and Verizon in overall spectrum ownership below 6GHz. The firm found that T-Mobile owns an average of just over 350MHz in the nation's top markets, compared with around 300MHz for AT&T and Verizon.

In its new proceeding, the FCC is looking into the issue. "We seek comment on AT&T's request that the commission apply 'enhanced factor review,' as it currently does for below-1-GHz spectrum, to any acquisition of unpaired midband spectrum ... that would cause a service provider to hold more than one third of the total amount of midband spectrum available," according to the agency's notice.

"My read of that FCC document is that AT&T wants a very specific midband spectrum screen, which to me sounds like AT&T thinks it's paying too much for spectrum and wants less competition from T-Mobile and Verizon," wrote Anshel Sag, an analyst with Moor Insights & Strategy, in response to questions from Light Reading. "Additionally, I think AT&T might not believe it has enough spectrum today to compete with T-Mobile and Verizon."

"With all of the new spectrum, the screen should be updated," wrote J. Armand Musey, an analyst with Summit Ridge Group, in response to questions from Light Reading. "However, they may want to wait until we know if there is really a fourth competitor (Dish) or not. A 30 percent limit, for example, does not work well with three players."

Dish, for its part, is using its own spectrum holdings to build a fourth nationwide 5G network in the US.

Political realities

"We believe that AT&T would only have filed the petition if it believed that such a screen would provide AT&T an advantage in the market," wrote the financial analysts at New Street Research in a recent note to investors.

"Therefore, the FCC putting out a notice on a petition that was filed more than two years ago suggests that the Chair believes that FCC should act and that there is a majority that agrees with her position, which presumably is that some screen is necessary," they added. "We are far from knowing what the details will be – and the details matter – but in the ongoing spectrum battles the FCC notice creates a possibility of a gain for AT&T and a loss for T-Mobile."

According to Entner, with Recon Analytics, the current debate around the spectrum screen stems from T-Mobile's acquisition of Sprint, and the fact that the FCC declined to require the company to divest any 2.5GHz spectrum.

"You have to give it to T-Mobile, they played the FCC extremely well," Entner said. T-Mobile, for its part, argued in part that its merger with Sprint would help catapult the US ahead of China in the 5G marketplace.

And that kind of political maneuvering will likely guide any new debate over the spectrum screen, according to Sag, the analyst with Moor Insights & Strategy. "I think that with these kinds of issues, it might really come down to who has the right lobbyists in place and on what issues," he wrote.

About the Author(s)

You May Also Like

.jpg?width=300&auto=webp&quality=80&disable=upscale)

_International_Software_Products.jpeg?width=300&auto=webp&quality=80&disable=upscale)