The nights are closing in and the chill winds of inventory corrections and budget cuts have blown into the radio access network (RAN). Nervy bosses at Ericsson and Nokia, the Nordic giants, have both complained about a spending slowdown this year. For the recent second quarter, the pace of RAN decline was the fastest Dell'Oro has witnessed in seven years, said the market-research company. If that's bad for the big equipment vendors, it's even more troubling for the upstarts.

Several have backed a concept called open RAN. In a traditional network, a single big vendor integrates all the parts and software, guaranteeing they work together. That's been a problem for specialists trying to squeeze in and directly serve telcos. Open RAN seeks to fix it. Using technical interfaces cooked up by the O-RAN Alliance, a newish specifications group, an operator would ideally be able to assemble a mobile site with parts from different suppliers.

Yet while telcos profess interest in the technology, various open RAN new entrants are performing more poorly in the current frosty conditions than their established rivals, according to insights provided by Dell'Oro and Omdia, another market-research firm (and a sister company to Light Reading). This is despite a small increase in open RAN's share of the total market. Omdia now estimates it will account for approximately 7% of a market generating about $42 billion in sales this year, up from 6% in 2022.

The chief losers appear to be Mavenir and Rakuten Symphony. The latter, a vendor subsidiary of Japan's Rakuten, saw its revenues for the first half drop 5% year-over-year, to $148 million, and they contracted 18% for the second quarter alone. Former boss Tareq Amin, who recently left the group, previously admitted that gaps in its 4G portfolio, which Rakuten expects finally to bridge in coming weeks, had hindered progress with "brownfield" telcos.

When Amin spoke to Light Reading in May, he dangled the prospect of an upcoming deal with a brownfield operator, hoping details could be shared by July. "Either brownfield use cases get validated or we become always a small niche business on greenfield," he said back then. But no big contract has been announced. The best Symphony could do was reveal details of a memorandum of understanding with VEON, which operates networks in various emerging markets. Kaan Terzioglu, its CEO, has made clear that any open RAN deployment will be restricted to Ukraine, and that it will not start until Russia's invasion ends.

Mavenir is bleeding

As for Mavenir, any revenues it generates in the virtual RAN market are also understood to have fallen substantially so far this year, after it previously boasted open RAN sales of $100 million for the whole of 2022. A pause in investment by Dish Network, its biggest customer, appears largely responsible. As a result, Mavenir's market share for the first six months of the year has more than halved compared with the same period of 2022, according to one reliable source.

A resumption of spending by Dish could swiftly boost the small vendor's fortunes, as would the delivery of products to India's Bharti Airtel, which has reportedly hired Mavenir to equip 2,500 sites. But there are rumors in industry circles that Mavenir has issued no forecast commitments to suppliers for next year. Unlike Rakuten, the unlisted Mavenir does not disclose full details of its financial performance. But it was unprofitable as recently as 2020, when a prospectus for an initial public offering (subsequently aborted) showed a net loss of $81 million.

Since then, Mavenir has raised about $750 million in private equity financing from Siris Capital, its biggest shareholder, and Koch Industries, along with another $100 million in debt financing. Funds have been aimed partly at plugging the sort of "brownfield" gaps highlighted by Amin. But a huge tranche has apparently gone into establishing Mavenir as a hardware maker and systems integrator – roles it never initially played as a software specialist.

This portfolio expansion by Mavenir and others, including Japan's NEC and Fujitsu, somewhat undermines the original case for open RAN. As companies expand and give up specializing, their research and development budgets can no longer be concentrated in one area. And Mavenir spent just $89 million in 2020, compared with the $4.3 billion that Ericsson plowed into R&D last year. The ability of Mavenir and Rakuten to continue funding product improvements and development is bound to concern any big telco.

DT's Timotheus Höttges (far left) calls Nokia "our partner" in open RAN.

(Source: Deutsche Telekom)

Circumstances could now favor the established order. Timotheus Höttges, the CEO of Germany's Deutsche Telekom, recently cited Nokia as "our partner" on open RAN, neglecting to mention any smaller vendors that have figured in trials. Samsung, the world's fifth-biggest RAN vendor, appears to have thrived as a supplier of open RAN products in North America. Some industry watchers now think big operators will buy O-RAN-compatible products from the same giant vendors they have used in the past.

"They would probably go to an Ericsson and say provide us with an end-to-end solution, ideally up to the central unit," said Kim Larsen, a former chief technology officer within the Deutsche Telekom group, during a recent interview. "We'll go forward with the open RAN architecture, but we would prefer to do that for at least several years with an Ericsson or a Nokia or a Samsung."

Dell'Oro's latest research about the broader RAN market highlights Nokia as recording the largest market share gains, based on industry revenues, between 2022 and the first half of 2023. Samsung appears to have lost market share, perhaps because India's Reliance Jio, which previously used the South Korean company as its sole 4G vendor, has awarded 5G contracts to Ericsson and Nokia as well. But Ericsson's market share also dipped over this period, said Dell'Oro. And China's Huawei was up despite growing resistance in Europe.

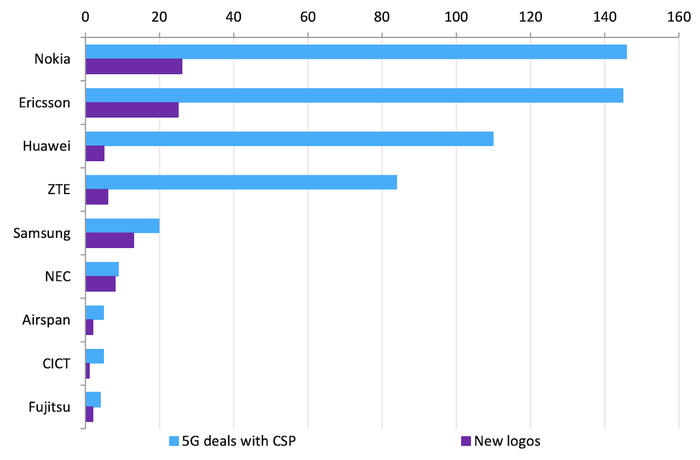

There are some positive messages about smaller vendors in a recent presentation from Omdia on the RAN market last year. It puts the combined market share of the top five vendors – Huawei, Ericsson, Nokia, ZTE and Samsung, in that order – at 94.6%, exactly half a percentage point less than they had in 2021. This shows "that upcoming vendors have collectively gained market share," said Omdia. Yet the increase is not what they would have hoped for. Amin's long-term goal at Rakuten Symphony was to capture 25% of the market.

Figure 3: Number of 5G commercial deals with CSPs and new logos (as of March 2023) (Source: Omdia)

(Source: Omdia)

Open by name, closed by nature

In the meantime, various technical concerns about open RAN have not receded. Most O-RAN Alliance stakeholders agreed the "category B" part of the important 7.2x specification, dealing with the interface between radios and baseband equipment, led to performance problems in massive MIMO, an antenna-rich 5G technology. A "compromise" was reached in June, producing two non-mandatory "operation mode" fixes. But one means putting interference-addressing equalizers into both the radio and the distributed unit (DU) that does baseband processing, instead of in the DU only, as 7.2x first intended. Besides complicating the radio, it risks driving up cost.

The alternative is to keep the radio as simple as possible. To address the category B performance problems, it proposes support for an important feature called channel estimation in both the radio and the DU, and not just the DU, as originally specified by 7.2x. But critics say this would lead to interoperability problems if the DU vendor were different from the radio vendor and their algorithms did not match up.

Qualcomm, which backs this option, disagrees. "[When] both algorithms are of good quality the overall result will also be of good quality," it said by email, before knocking the alternative. "Placing equalization in the O-RU [open radio unit] increases its complexity and power consumption, which should be a concern for everyone." If nothing else, that is a sign of the industry split on this topic.

Another prevailing concern is about the unsuitability of general-purpose processors (GPPs) for RAN computing. One fix is to move the entire physical layer of the software stack onto customized silicon. But if the software vendor switched to another silicon supplier, it would have to rewrite its code, which hardly tallies with ideas about openness.

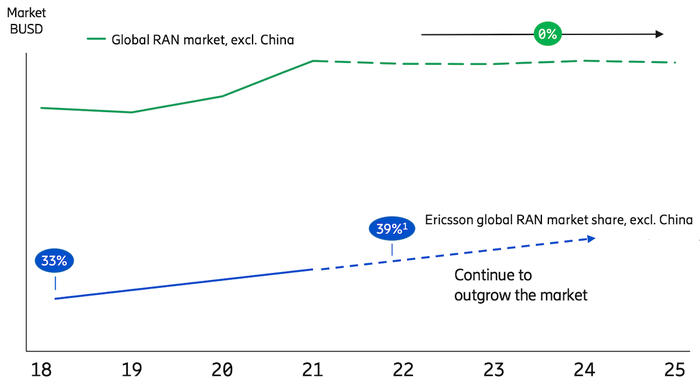

Figure 4: Historical RAN sales and forecast (Source: Ericsson, Dell'Oro)

(Source: Ericsson, Dell'Oro)

(Market source: Dell'Oro July and November 2022; market share based on rolling four quarters, Dell'Oro)

Intel, which has attacked this approach for being incompatible with virtualization, argues that its latest GPPs are good enough for all bar two RAN functions (forward error correction and discrete Fourier transforms). A hardware accelerator, closely integrated with the GPP, can be used for those, allowing all layers of the RAN software stack to run on the same platform, it says. Whether or not this measures up performance-wise, the current lack of GPP alternatives to Intel would leave the industry more heavily reliant on one chip supplier if this approach took off. Again, that does not sound very open.

Such concerns partly explain why no brownfield operator is prepared to invest in open RAN today. But the combination of technical niggles and a RAN slowdown could be a perfect storm for open RAN new entrants. Ericsson, which Omdia currently ranks ahead of Huawei on the quality of its radio portfolio, has a relatively bleak RAN outlook based on Dell'Oro numbers, forecasting zero market growth between 2021 and 2025. With more players in the mix, each one might have to settle for a smaller cut. Either that, or a few of them go hungry.

Related posts:

— Iain Morris, International Editor, Light Reading

About the Author(s)

You May Also Like