The US Federal Trade Commission sued to block Nvidia's proposed $40 billion purchase of Arm, arguing the deal would stifle competition in the chipset space.

The development creates another major obstacle for Nvidia, which sells chips into data centers and other high-tech sectors. Nvidia had hoped to quickly snap up a company whose chipset designs help to underpin the silicon sold by a wide variety of other chip makers, including smartphone silicon supplier Qualcomm. Arm is owned by Japan's SoftBank.

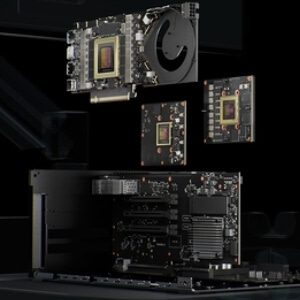

Figure 1:  Nvidia sells chips for a variety of high-tech markets.

Nvidia sells chips for a variety of high-tech markets.

(Source: Nvidia)

Indeed, Qualcomm's $1.4 billion purchase of Nuvia earlier this year was seen as a hedge against the possibility of Arm falling into the hands of rival Nvidia.

The FTC's action is also noteworthy considering President Biden's pick to lead the FTC, Lina Khan, focused on antitrust and competition law during her career.

Nvidia announced its plans to purchase SoftBank's Arm last year. The move immediately sparked concerns among UK regulators. That's not necessarily a surprise considering Arm is based in the UK and is one of the country's few chipset champions.

Moreover, the opposition from the FTC isn't necessarily a surprise. Nvidia last month reported quarterly revenues of $7.1 billion, up 50% from a year ago. But the company also warned that the FTC had "expressed concerns" about its Arm acquisition. Nvidia said it was in discussion about "remedies to address those concerns."

The developments are also occurring amid heightened global interest in chipsets due to their geopolitical importance and ongoing shortages of supplies.

Related posts:

— Mike Dano, Editorial Director, 5G & Mobile Strategies, Light Reading | @mikeddano

About the Author(s)

You May Also Like