T-Mobile signs on for DigitalBridge's MGM gamble

ExteNet, a DigitalBridge company, is building a massive network across more than two dozen properties for casino giant MGM. And now T-Mobile plans to use that network.

Some of Marc Ganzi's puzzle pieces are starting to fall into place.

The latest: T-Mobile announced a new networking agreement with ExteNet Systems – one of the many networking companies owned by Ganzi's DigitalBridge – that involves updating and expanding its 5G network across select sports, entertainment, hospitality and transportation venues.

The agreement covers the massive new network that ExteNet is building in roughly two dozen properties owned by MGM Resorts International across the US. A massive casino resort operator, MGM said in September that its agreement with ExteNet will help expand 5G services for nearly 200,000 visitors daily "while eliminating dead zones and increasing reliable access to apps, maps, and other high-tech capabilities that complement MGM's exemplary service standards."

And now, T-Mobile plans to use that network to extend its own signal into MGM locations. "T-Mobile will be the first carrier to join the new wireless network ExteNet is deploying in each MGM Resorts property nationwide," according to the new agreement between the two companies.

A long game for DigitalBridge

The company that is now DigitalBridge acquired ExteNet for $1 billion in 2015. At the time, the purchase was in part designed to position DigitalBridge to build indoor and outdoor small cells and distributed antenna systems (DAS) for many of the nation's biggest network operators.

However, the US wireless industry has cooled on small cells in recent years as big 5G providers work on upgrading their macro cell towers with their new midband spectrum holdings.

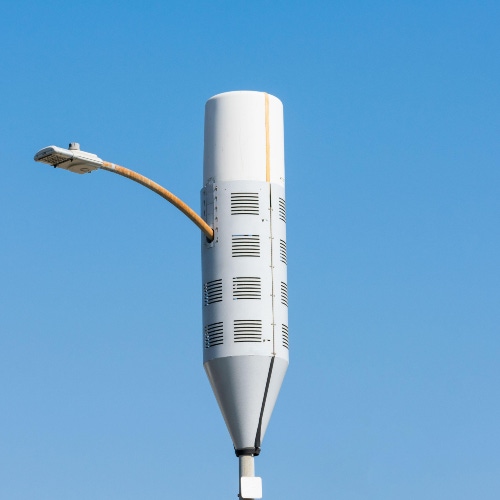

Figure 1:  Small cells are roughly the size of a pizza box and often sit atop light poles or inside buildings.

Small cells are roughly the size of a pizza box and often sit atop light poles or inside buildings.

(Source: Michael Vi/Alamy Stock Photo)

But that doesn't mean small cells are dead. For example, Verizon CTO Ed Chan said earlier this year that the operator plans to speed up its small cell buildout starting in 2023.

Ganzi, the chief executive of DigitalBridge, remains positive on small cells. "The [small cell] market continues to sort of defy gravity," he said in November during his company's most recent quarterly earnings call.

He pointed to the recent acquisition of small cell operator ZenFi Networks by BAI Communications as an example of the continued interest in the small cell space. BAI did not release the financial terms of its ZenFi deal, but Ganzi suggested it involved a significant amount of money.

The reason behind such transactions, he said, is a belief that small cells will grow faster than the macro cell tower industry over the next decade.

T-Mobile's small cell strategy

T-Mobile's network chief, Neville Ray, has been cool toward small cells in the past. In 2020, he said that adding network capacity through the installation of additional small cells is time consuming and expensive due to the need to obtain construction permits and equipment for the devices.

Indeed, T-Mobile in 2021 canceled an order for small cells that Sprint made prior to T-Mobile's acquisition of the company. T-Mobile said it will no longer use the 5,700 small cells (which mostly had not yet been built), and would pay Crown Castle around $362 million to break the contract.

But earlier this year T-Mobile inked a new deal with Crown Castle that includes the addition of small cells to its network.

Broadly, T-Mobile has said it expects to double the number of DAS installations and small cells in its network to around 50,000 through 2025.

And now it's clear that DigitalBridge's ExteNet will be part of that work. "ExteNet will rationalize T-Mobile's small cell framework and upgrade existing infrastructure, implementing a high-quality and cost-effective solution to deliver streamlined, faster and more efficient 5G wireless networks," the companies announced.

Related posts:

— Mike Dano, Editorial Director, 5G & Mobile Strategies, Light Reading | @mikeddano

About the Author(s)

You May Also Like