US streaming got a jolt in Q2 – study

In a bit of a surprise, streaming penetration of US households rose to 84% in the second quarter of 2023, suggesting 'another leg of growth,' MoffettNathanson noted in its review of a new, wide-ranging study.

US streaming services have clearly turned their attention toward profitability and away from driving subscriber growth at any cost. Despite that backdrop, the penetration rate of streaming services appears to have accelerated a bit in the second quarter of 2023, according to a new survey focused on the usage of streaming services.

Streaming penetration of US households rose to 84% in Q2, the highest sequential change versus a Q1 since that data's been tracked by a HarrisX survey that is regularly analyzed by MoffettNathanson (a unit of SVB Securities). That Q2 84% penetration rate in Q1 2023 compared to 82% in the prior quarter and 81% in the year-ago quarter.

Drilling down a bit deeper, the survey also found that older streamers were a key driver, as every service grew share of nearly every demographic 30 years or older compared to a flat or a slight decline in the 18- to 24-year-old group.

"Despite our prior belief that streaming was reaching the flatter part of the penetration curve in the U.S., 2Q data suggests another leg of growth (at least in the short term) across the newer launched services as well as the more mature streaming services," MoffettNathanson analyst Michael Nathanson noted in his analysis (registration required) based on a HarrisX study of survey of 20,674 respondents taken between April and June.

Top streaming services rebound in Q2

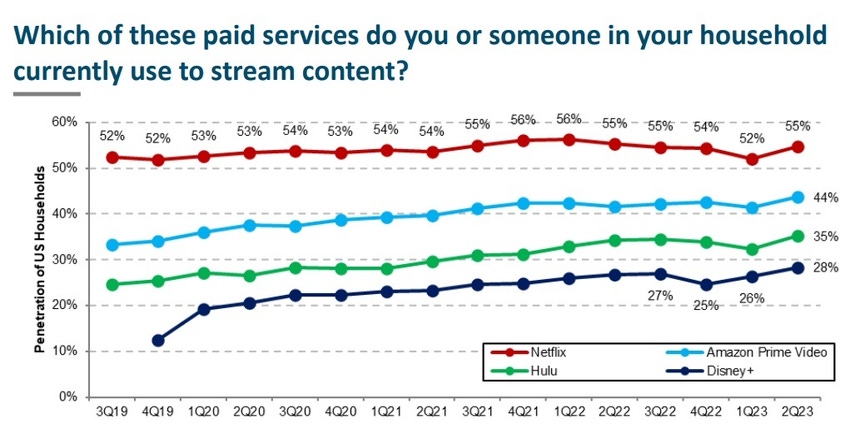

Notably, each of the top three services (Netflix, Amazon Prime and Hulu) showed a strong rebound with respect to usage in Q2 after declines in Q1, the report found. Peacock and Paramount+ also saw some momentum in the period. Nathanson noted that some of the growth among those services might be attributed to new promotions such as the Verizon My Plan initiative introduced in May.

The HarrisX data also offered an updated picture on the pay-TV cord-cutting trend. It found that streaming households without pay-TV rose to 48% of US households, versus 36% for streamers with pay-TV.

"The spread between streamers without a Pay TV subscription and streamers with Pay TV should keep widening even as the non-streamers dropped to 17% of households," Nathanson explained.

Nathanson noted he was also surprised to see an uptick in streaming services per household. According to the survey, the average number of services watched surpassed four for the first time, while the number of streaming services subscribed hit a new average of 3.8.

"We are surprised by the increase in both metrics after such an extended period of stability. Given the underlying concern around the macro backdrop, we had been concerned there would be growing pressure to drop services," Nathanson wrote. "However, if households are leaning into more streaming subscriptions, we have greater concern of the risk of higher cord-cutting with streaming being used as an equivalent replacement."

Minutes viewed across both subscription and hybrid, advertising-supported services saw a 16% increase in Q2 versus the year-ago period. Aided by the strength of the Ted Lasso series, Apple TV+ was the biggest gainer, up 130%. Discovery+ was the outlier, with a decline of 19%, driven by cannibalization from the launch of Max, a new super-sized service from Warner Bros. Discovery that combines content from Discovery+ and the former HBO Max service.

The advertising-supported VoD and free, ad-supported TV (FAST) category also got a jolt, with viewing minutes up 49%, led by gains from The Roku Channel, Tubi, YouTube and, to a lesser extent, Pluto TV.

Eye on Netflix earnings

Nathanson also attached his forecasts for Netflix, which is set to release Q2 2023 results later today. The analyst expects Netflix to add about 500,000 subscribers in the US/Canada region in the period, nearly doubling consensus expectations. With results for other regions expected to be in line or lower than forecasted, Nathanson expects Netflix to pull in total net adds of 2.2 million, down slightly from the 2.3 million consensus figure.

Looking further ahead, MoffettNathanson expects Netflix to reach 246 million global paid subs by the end of 2023 (1 million below consensus), and nearly 271 million by then end of 2025, versus 280 million for consensus.

Related posts:

— Jeff Baumgartner, Senior Editor, Light Reading

About the Author(s)

You May Also Like