Orange backs out of banking after losing €1B

The French telco is in exclusive talks with BNP Paribas about a sale and says its intention is to withdraw from the retail banking market.

It's a bleak end to a sad chapter about telco diversification. In 2016, Orange bought a small bank, donned a pinstripe suit and dreamed of disrupting Europe's financial services market much as Internet companies had upended the telecom sector. Seven years on, it's retreating ignominiously like a teller who messed up his sums, announcing it will quit the European bank business once and for all.

Orange is now in exclusive negotiations with BNP Paribas, an old-fashioned bank, about the transferral of customers and assets while it pulls out. The aim is partly to ensure Orange Bank customers can still use the full range of products and services while it closes the tills, locks up the vault and prepares to hand over keys. Talks with BNP Paribas will focus on defining a "referral partnership" for customers in France, along with "financing solutions for mobile devices." A BNP Paribas takeover of the Orange Bank business in Spain is also up for discussion. It all implies Orange might not get much, if anything, for the rest of the business it tried to build.

This is somewhat embarrassing for Christel Heydemann, Orange's CEO since last year, whose name went on the official comments even though she had nothing to do with the whole sorry affair. As is typically the case in these instances, there was no admission of failure in her prepared remarks, which instead sought to put a positive spin on the withdrawal. Orange today serves more than 2 million customers and has one of the best applications on the market, said Heydemann. "The evolution of the banking market now leads us to guide the market into a new phase."

The writing had probably been on the wall since October 2021, when Orange confirmed it had not been able to find a new partner to replace Groupama. The French insurance group facilitated Orange's entry into the sector by selling it a controlling 65% stake in Groupama Banque in April 2016. Years later, Groupama's bosses decided they did not want to participate in a capital increase, further diluting Groupama's stake to 22%. Unable to lure other investors, Orange subsequently took full ownership, pumping another €230 million (US$251 million) into the business.

A run on the bank

Orange had little to say about its bank venture in its earnings statement for the first quarter of this year, merely noting it served 2 million customers across Europe at the end of March without sharing any details of profitability. But that sole revelation means it has gained only about 400,000 customers in the last two years, given the 1.6 million it served in mid-2021.

It has evidently fallen well short of its targets. In early 2016, when Orange was still eyeing a takeover of Groupama, Laurent Paillassot, then head of its mobile financial services business, said about a third of Orange's customers had expressed interest in an Orange Bank service. In France alone, that would have implied about 9 million people were prospective customers at the time.

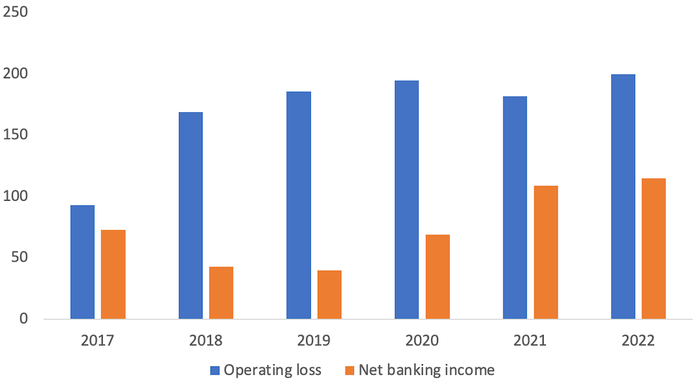

Orange Bank headline figures ( euro M) (Source: Orange)

(Source: Orange)

About five years later, in its universal registration document for 2020, Orange was very specific about its goals. "Orange Bank aims to break even in Europe towards the end of 2023, with nearly 5 million customers and around 400 million euros in net banking income," it said. With only 2 million customers at the end of March, it was obviously going to miss that target. The income one looked equally unrealistic. Orange Bank reported net banking income of just €115 million ($126 million) for 2022, and that figure was only €6 million ($6.6 million) more than it reported for 2021.

Far worse, though, are the hefty operating losses that Orange Bank has racked up. An examination of Orange's universal registration documents since 2017 shows these total €1.025 billion ($1.12 billion) since 2017, the year Orange Bank was launched. Over this period, it has generated net banking income of just €449 million ($490 million) altogether.

Stephane Richard, Heydemann's predecessor in the top job, clearly underestimated just how hard it would be to challenge the banking establishment. Orange believed its network of stores, customer relationships and Internet savviness would compensate for a lack of bank-sector experience and knowhow. But older retail banks also have branches and customers, and they can just as easily hire software engineers to build new mobile bank apps. Indeed, some of the apps that banks provide in the UK market compare favorably with the customer-service ones developed by telcos.

The industry concern must be twofold. First, if Orange could not diversify into a sector where customer relationships and physical branches are similarly important, what chance do telcos have in more challenging areas? Second, does the reluctance of customers to use Orange for banking as well as telecom show that convergence has limits? Telcos worry these days about relying on too few suppliers for too many things. Perhaps consumers share the feeling.

Related posts:

— Iain Morris, International Editor, Light Reading

Read more about:

EuropeAbout the Author(s)

You May Also Like

_International_Software_Products.jpeg?width=300&auto=webp&quality=80&disable=upscale)