AT&T, Verizon continue efficiency drive with 3,200 more job cuts

The American telcos have been able to cut tens of thousands of jobs and still provide nationwide services to millions of people.

A certain type of American loves to sound off about lazy and inefficient Europeans, addicted to long vacations (ahem, holidays, thank you) and subsidized healthcare, just as a certain type of European enjoys the stereotype of Americans as cheeseburger-mad, banjo-strumming hicks. But comparisons between telcos from different regions do the Europeans no favors.

There are few American telecom employees who resemble extras on the set of Deliverance, for one thing. More importantly, Europe's big telcos, when measured against their US counterparts on some criteria, look about as efficient as a worker on a Friday afternoon following a long liquid lunch. After its ejection of another 1,000 employees since January, jobs-cutting Verizon currently has a workforce of just 104,400 people. That's roughly 9,500 more than the UK's BT had (excluding subcontractors) at the end of September 2023. But Verizon makes around 6.6 times as much in annual sales.

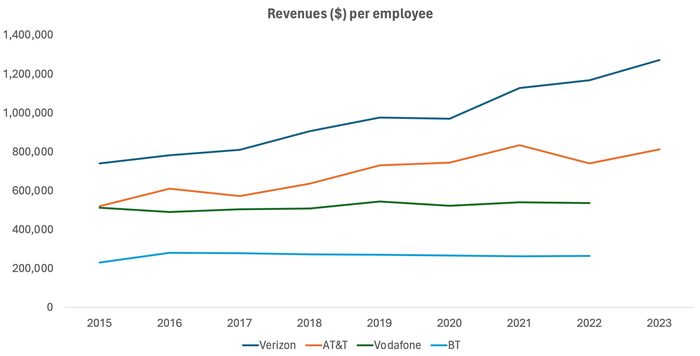

Americans, it is well known, pay much steeper rates for smartphone and other telecom services, to the envy of Europe's telcos. There are also lots of Americans and comparatively few Brits. Yet Verizon has also dispensed with around 73,300 employees since 2015 while growing annual sales by some $5 billion. In 2015, it made about $740,600 in sales for each employee. Last year's figure was more than $1.27 million.

On that metric, BT seems to have gone backward. Fattened by its takeover of mobile operator EE, it employed more than 106,400 people in 2016. While today's workforce is admittedly much smaller, the pace of shrinkage has not even been close to Verizon's. Meanwhile, BT's annual revenues have declined by around £3.4 billion (US$4.2 billion) over this period. Per-employee sales fell from £226,470 ($281,660) in 2016 to less than £213,000 ($264,907) last year.

Captain Kirkby takes the helm

This must all look quite ugly to BT shareholders familiar with international telecom, and it possibly explains why Philip Jansen promised such massive cuts as BT's top executive before he saw his own name erased from the payroll last year. In May 2023 Jansen said BT would slash 55,000 jobs from the total of about 130,000, with subcontractors included, by 2030.

Still unclear is whether Allison Kirkby, his successor since the start of February, has different ideas. For an incoming CEO, she has kept a low profile during her first three months in charge. The best the national press has been able to produce is a story this week about Kirkby's naming of some McKinsey partner to take charge of BT's strategy. She does, though, have a reputation for ruthless efficiency – by European standards, at least – having previously led cost-reduction efforts at Telia and Tele2, two other troubled European telcos.

(Source: Light Reading, companies)

Just as BT is not the only bloated European telco, neither is Verizon the only axe-twirling American. It is overshadowed by close rival AT&T, which has cut another 2,200 jobs since the start of the year – according to results published Wednesday – after losing 12,400 last year. In 2015, AT&T employed more than 280,000 people. Its headcount today is 148,300.

As at Verizon, though, annual per-employee revenues have soared, rising from less than $522,000 to about $813,500 over this nine-year period. It may have helped that Americans in some parts of the country seem wary of post-pandemic city centers – and their expansive zones of desolation and homelessness – and are eager to keep shopping online. So-called digitalization and its ugly sibling automation are recurrent themes at AT&T, which is in the middle of another efficiency program, this one aimed at saving $2 billion. Those commercials with A-list casts need to be paid for somehow.

More European bloat

As for European bloat, Vodafone managed to gain nearly 3,000 employees between 2019 and 2022 despite an efficiency push. With about 98,000 employees in 2022, it was down from a peak of 111,684 in 2015. But annual per-employee revenues have grown just 4% over this period and recently dipped. Figures for 2023 will not be revealed until the publication of Vodafone's annual report in June. But the company has recently quit the Italian and Spanish markets, and it is trying to execute a merger with Three in the UK. Last May, Margherita Della Valle, Vodafone's CEO, announced plans to cut 11,000 jobs.

Della Valle probably has less freedom to keep snipping than she would like. The regulations that govern the firing of staff are clearly more stringent in Europe than they are in the US, where the image of workers being immediately frogmarched out of offices, arms in the forklift posture beneath tatty boxes of belongings, illustrates the heartlessness of the system to Europeans.

Many bosses (although evidently not BT's Jansen) still downplay talk of automation and artificial intelligence (AI) as killers of jobs. Generative AI, they insist, is a tool that needs an operator, just like the spinning jenny of the eighteenth century. But the story told by US metrics is that a telco can offload tens of thousands of employees and sell just as much as it previously did, if not even more. Explain that one, Verizon.

About the Author(s)

You May Also Like