ZTE cuts 2,000 jobs and faces risk of China 5G slowdown

ZTE managed small growth in sales thanks to spending on network equipment by Chinese telcos, but analysts warn it might not last.

It's easy to forget about ZTE. The state-backed Chinese equipment vendor never enjoyed the successes in Europe and the Americas of Huawei, its bigger domestic rival. When US government attention switched to that company, ZTE became a subplot in the China-versus-US story. Given sanctions relief by Donald Trump, the former (and possible future) US president, ZTE nursed itself back to health away from the main action.

First-half results come at a difficult time for the sector as major service providers cut spending and make use of equipment stockpiles they built up in the lean COVID-19 years. Yet ZTE's limited exposure to belt-tightening markets outside China, where it generated more than 70% of first-half sales, meant it probably avoided some of the worst conditions. Overall revenues were up 1.5%, to about 60.7 billion Chinese yuan ($8.3 billion), compared with the year-earlier period. Net profit rose almost a fifth, to nearly RMB5.5 billion ($760 million).

Cost cutting and lower financing costs evidently helped to lift the bottom line. Figures show that ZTE cut 2,075 jobs between the start of the year and June 30, leaving it with 72,736 employees on that date. Despite this, its investment in research and development grew 26%, to nearly RMB13 billion ($1.8 billion), putting the ratio of R&D spending to sales at 21%. Only Huawei in the vendor community beats it on that measure. Staff outside the R&D function seem likely to have felt the full impact of cost-saving efforts.

Unlike Huawei, whose breakdown of results seems increasingly designed to hide what's really happening at its networks unit, ZTE continues to report sales for three distinct lines of business activity – carrier (serving telcos); government and corporate; and consumer (meaning gadgets). And despite the push into enterprise and handset markets, ZTE is still very much a vendor of telco network equipment. More than two-thirds of its revenues were generated in that market.

In other words, ZTE is mainly a supplier of network products that mainly serves government-backed Chinese telcos. With Ericsson and Nokia squeezed to the fringes of China's network equipment market, ZTE and Huawei have profited as state-controled telcos plow billions into the rollout of 5G networks. Unsurprisingly, then, ZTE's carrier sales rose 5.4%, to RMB40.8 billion ($5.6 billion), with overall sales to China (including corporate and consumer activities) up 6.2%, to RMB43.1 billion ($5.9 billion).

Tougher days ahead

The uncertainty is how long this can last. China already appears to have a much denser 5G network than any other country on the planet, making it a thick forest of antennas (although critics say operators measure site numbers differently from US and European telcos to exaggerate the gulf). There are already signs that China Mobile, the country's biggest mobile operator, is reducing capital expenditure now that 5G is widely available. For ZTE, finding something to replace it won't be easy.

Other parts of the business are struggling, too. Revenues from government and corporate customers dropped 12.4% for the first half, to less than RMB5.9 billion ($810 million), as authorities turned more cautious. Given the concern within Europe and the US about using Chinese technology products, ZTE is unlikely to figure prominently in this sector outside China. On the gadgets side, sales dropped 2.6%, to about RMB14 billion ($1.9 billion).

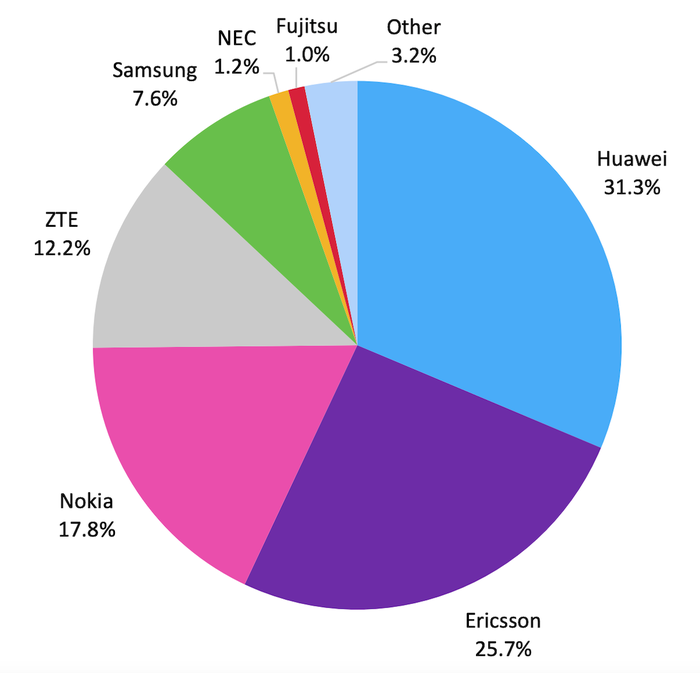

Market shares for combined 2G, 3G, 4G, and 5G RAN in 2022 (Source: Omdia)

(Source: Omdia)

Still, ZTE is clearly in much healthier shape than it was back in 2018, when US sanctions tore into its performance and full-year sales fell more than a fifth, to just RMB85.6 billion ($11.8 billion). New research from Omdia, a Light Reading sister company, ranks it fourth in radio access networks (perhaps the biggest equipment sector) on business performance and market share, with 12.2% of global RAN sales last year (undoubtedly concentrated in China). In a qualitative assessment of the radio portfolio, Omdia scored ZTE fourth, behind Ericsson, Huawei and Nokia (in that order) and ahead of various US and Asian challengers.

A worry for anyone interested in ZTE's fate is the company's apparent dependency on US and US-origin technologies. Despite being more self-reliant, Huawei has been hobbled in the smartphone sector by US sanctions cutting it off from vital components. Transistors measuring just 5 nanometers, which Huawei can no longer procure from Taiwan's TSMC, are now being included in basestation equipment, too.

Its competitiveness will eventually suffer, said Tommi Uitto, the head of Nokia's mobile networks business group, at MWC, without naming Huawei directly. "When we are moving from 7 to 5 and then to 3, they are going backward," he told Light Reading. A mere stroke of the US legislator's pen could be enough to put ZTE in the same predicament.

The other concern is a slowdown in the Chinese economy and the possibility of a big reduction in 5G spending. As Omdia points out in its latest research, "Huawei continues to face challenges and China's share of the global RAN market is expected to diminish after two years of massive 5G rollout." There could be some painful contractions ahead.

Related posts:

— Iain Morris, International Editor, Light Reading

About the Author(s)

You May Also Like

_International_Software_Products.jpeg?width=300&auto=webp&quality=80&disable=upscale)