YouTube TV set to become top US pay-TV provider by 2026 – analyst

YouTube TV is expected to add 1.5 million subs per year and reach 12.4 million by the end of 2026, MoffettNathanson predicts. That will push YouTube TV's base past both Comcast and Charter.

YouTube TV might soon be the king of pay-TV.

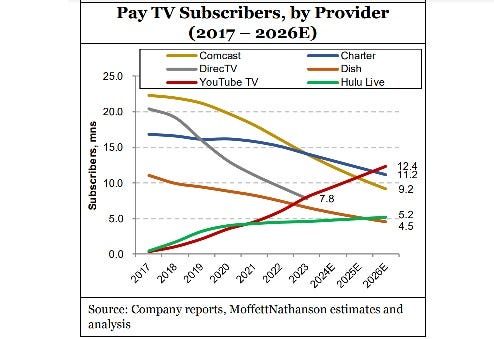

YouTube TV, a virtual multichannel video programming distributor (vMVPD) that launched in February 2017, is on pace to become the number one pay-TV service (in terms of subscribers) by sometime in 2026, according to a forecast from MoffettNathanson.

YouTube TV currently has about 8 million paid and free subscribers (streaming media analyst Dan Rayburn noted on LinkedIn that, according to his sources, up to 20% of all YouTube TV subs are on seven-day free or "extended free trials" at times).

But YouTube TV's ongoing growth amid the ongoing decline of traditional US pay-TV providers will put it ahead of the pack in the coming years. YouTube TV only trails Comcast and Charter Communications, which each have about 14.1 million pay-TV subs.

MoffettNathanson expects YouTube TV to grow at about 1.5 million subs per year, reaching about 12.4 million subs by the end of 2026.

"At the current levels of decline, YouTube TV is on a clear path to becoming the largest Pay TV provider in the United States," MoffettNathanson analyst Michael Nathanson proclaimed in a report (registration required) that analyzed YouTube TV's entire business. "In fact, we see YouTube TV becoming the number one player in Pay TV subscribers in the US, surpassing Comcast in 2026."

Google/Alphabet doesn't break out YouTube TV's financials, but Nathanson estimates the service generated about $6 billion in revenues in 2023 (up from $900 million in 2019), and will hit nearly $11 billion in 2026. Some of that recent growth has come by way of subscriber growth, but a chunk is also due to ongoing price increases: After starting out at $34.99 per month, the price has gradually risen to today's level of $72.99 per month.

"Nevertheless, with traditional MVPD packages now fetching prices in excess of $100, we would argue the ease of YouTube TV (mobile viewing, no cable boxes or satellites, etc.) still presents a great value to those still watching linear television and a great entry point for younger consumers not conditioned for the traditional distribution models," Nathanson noted.

The road to profitability

And YouTube TV is about to turn an important financial corner.

The analyst believes that YouTube TV was "slightly unprofitable" in 2023, as overall profits were dragged down by losses from the addition of the NFL Sunday Ticket package. But Nathanson sees YouTube reaching profitability in 2026 and reaching margins of about 6%.

"Longer term, we view the vMVPD business as a roughly 10-15% margin business," he predicted.

Though growing, YouTube TV was a small piece of YouTube's estimated overall 2023 revenues of $45.1 billion. MoffettNathanson estimates that YouTube TV's $6 million in revenues represented 13% of total YouTube revenues. Advertising revenues led the way, representing $31.5 billion, or 70% of total revenues, in 2023.

About the Author(s)

You May Also Like

.jpg?width=300&auto=webp&quality=80&disable=upscale)