Consumer streaming satisfaction on the decline – study

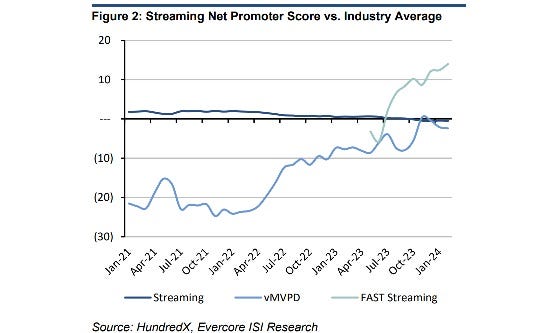

Streaming customer satisfaction has dropped from pandemic levels in 2021, according to ISI Evercore's analysis of a recent HundredX survey. However, satisfaction among virtual MVPDs and FAST streaming services are on the rise.

Consumer satisfaction for streaming services is a mixed bag. While overall consumer satisfaction for video streaming has dropped in recent years, a pair of subcategories – virtual multichannel video programming distributors (vMVPDs) and free, ad-supported streaming television (FAST) services – have seen satisfaction rise.

Drilled down further, streaming satisfaction has steadily declined from pandemic levels in 2021, when the total streaming monthly net promotor score (NPS) was 38, versus 28 in 2023, according to ISI Evercore's analysis of HundredX's recent monthly survey of between 3,000 and 4,000 streaming and sports customers.

vMVPDs have seen a gradual rise in NPS, while FAST has enjoyed a steep rise in recent months.

"Given customer demand for new original content, variety and low prices, streaming is an increasingly challenging business to generate customer satisfaction," ISI Evercore analysts noted in the study (registration required).

And thanks to dropping net loyalty scores across the broad streaming industry, "most customers expect to change services in the next twelve months," the analysts added.

Drivers differ for general streaming, vMVPDs and FAST services

For general/traditional streaming, ease-of-use and price are what most consumers (about two-thirds of survey respondents) care most about. Among 11 individual services covered in the study, Netflix, Discovery+ and Disney+ led in terms of ease-of-use, with Paramount+, Apple TV+ and ESPN+ hovering at the bottom of the category. NBCU's Peacock, Discovery+ and Paramount+ were the perceived leaders on price, with Disney+, Max and Netflix on the bottom.

Original content was the third most important category for general streaming. Apple TV+, Netflix and Discovery+ led the way on perceived original content, with ESPN+, Hulu and Peacock representing the bottom three.

Ease-of-use was also the most important category for vMVPDs, with two-thirds of respondents saying that's what they cared about most. That category included Philo, YouTube TV, DirecTV Now, Sling TV and Fubo. Philo and YouTube TV led the way with respect to ease-of-use, followed by DirecTV Now, Sling TV and Fubo. Philo and Sling TV led the way on perceived price, followed by YouTube TV, Fubo and DirecTV Now.

In a FAST category covering Tubi, The Roku Channel and Pluto TV, ease-of-use and variety were the top consumer drivers – three-fourths cared about ease-of-use the most, with two-thirds caring most about variety.

Tubi was tops for ease-of-use in the FAST category, followed by Pluto TV and The Roku Channel. Tubi also led the variety category, trailed by Pluto TV and The Roku Channel.

About the Author(s)

You May Also Like

.jpg?width=300&auto=webp&quality=80&disable=upscale)