NBCU's Peacock to Stream Free Tier, 2 Premium Tiers

Service set to launch on April 15 to Comcast X1 and Flex customers, roll out nationally on July 15. Peacock expects to have 30-35 million domestic accounts and $2.5 billion in annual revenues by end of 2024.

Peacock, the new streaming service from Comcast-owned NBCUniversal, will launch with Comcast X1 and Flex customers on April 15 and then nationally on July 15. Peacock will feature two paid subscription tiers along with a free, ad-based version of the service.

With more than 15,000 hours of content, the ad-supported premium subscription Peacock tier will sell for $4.99 per month. For $9.99 per month, you can get an ad-free version. Those tiers will include access to live sports, content in 4K and High Dynamic Range (HDR), and early access to NBC's evening franchise shows. For example, Peacock premium subs will get to see The Tonight Show Starring Jimmy Fallon at 8:00 p.m. ET each weeknight vs. its regular TV airing time of 11:35 p.m. ET.

Figure 3:  NBCU's Steve Burke said Peacock will enable the programmer to better monetize TV series and other shows that are streamed and fall outside traditional TV distribution.

NBCU's Steve Burke said Peacock will enable the programmer to better monetize TV series and other shows that are streamed and fall outside traditional TV distribution.

The completely ad-fueled version of the service, called Peacock Free, will offer 7,500 hours of content, including next-day streams from current seasons of NBC shows and a mix of curated libraries such as "Family Movie Night" and "SNL Vault."

Pay-TV connections

While Peacock will be available as a standalone streaming service, the new offering will also take advantage of NBCU's pay-TV distribution partnerships. Early on, Comcast's pay-TV customers and broadband-only Flex customers will get the premium, ad-supported version of Peacock Premium for no added cost, and $5 per month for the ad-free tier. That same deal will be offered to Cox Communications' pay-TV subs on Cox's new Contour platform (based on an X1 syndication deal with Comcast).

Comcast also has plans to offer Peacock to pay-TV subs at UK-based Sky, which Comcast acquired in the fall of 2018. Sky's Now TV technology will power the Peacock platform.

Speaking at an investor event held at NBCU's 30 Rock headquarters in New York, NBCU chairman Steve Burke, who is retiring later this year, said the multi-faceted approach with Peacock would help the programmer better monetize its content across not just linear TV, but also streaming.

"The challenge is this massive audience is not well monetized," Burke said. "We're leaving money on the table."

Peacock, Burke added, is being built to be the "equivalent of a 21st-century broadcast business delivered on the Internet."

Matt Strauss, chairman of Peacock and NBCUniversal Digital Enterprises, said the new streaming service aims to eliminate three pain points -- programming fragmentation, endless scrolling and subscription fatigue.

On the programming end, Peacock will deliver both live and on-demand content in categories such as movies, kids, drama and comedy, which represents about half of TV viewing, but also reality shows, sports, news, and late-night shows. Peacock will also take a page from Spotify by creating dozens of dedicated, personalized digital "channels," Strauss said.

Peacock aims to help subscription fatigue with its free, ad-based offering, he said, noting that the service's ad-supported tiers will carry an ad-load of about five minutes per hour, versus up to 20 minutes for a traditional TV show.

Noting that 600 engineers are working on Peacock, Strauss said Peacock would be offered on mobile, web, smart TV platforms and "major" connected TV devices, alongside the "deep integration" on Comcast X1 and Flex boxes with voice navigation capabilities.

Figure 4:  Matt Strauss demonstrated the Peacock app for Comcast's Xfinity Flex streaming service for broadband-only customers.

Matt Strauss demonstrated the Peacock app for Comcast's Xfinity Flex streaming service for broadband-only customers.

The app itself will spool up a live TV feed when it's opened, "just like TV," and present a home page with three primary selections -- channels, trending and browse -- Strauss said.

In between the corporate messaging, Jimmy Fallon injected some humor into NBCU's investor presentation:

#crushedit 🔥🔥🔥

— Rich Greenfield (@RichLightShed) January 16, 2020

WATCH: @jimmyfallon explain @peacockTV at the #PeacockInvestorDay pic.twitter.com/SfD0RZwGs5

Joining the streaming crowd

Peacock is entering the streaming fray alongside a recent wave of other OTT-delivered subscription services launched or on the way from other major studios, programmers, and media companies. That set of competitors includes Disney (Disney+), Apple (Apple TV+), WarnerMedia (HBO Max) and Quibi, a service that will focus on premium-level short-form entertainment and news content.

They are all joining a crowded market of general entertainment subscription services that also includes Netflix, Hulu and Amazon Prime will be fighting over wallet share. Though so-called "subscription fatigue" is a challenge faced by all, the good news is that consumers have been tacking on more and more SVoD services.

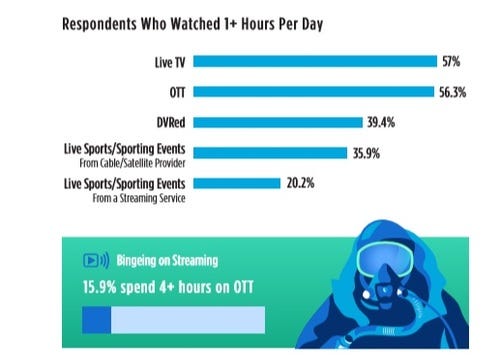

According to TiVo's latest "Video Trends Report," the average number of SVoD services taken per respondent in 2019 was 6.9, well up from the four that the survey found three years prior. TiVo, which based its Q4 2019 study on responses from 6,145 adults in the US and Canada, also found that OTT viewing has almost closed the gap on live TV.

Figure 1:  (Source: TiVo, "Video Trends Report 2019")

(Source: TiVo, "Video Trends Report 2019")

FreeWheel, the Comcast-owned online ad-tech company, also got into the action today with a new study of its own focused on how advertising and ad addressability (targeting) is altering the TV landscape. It found that the "optimism scores" (the percentage increase in spending minus percentage decrease) for ad spending via OTT and connected TV platforms rose to 59 in 2019, versus 37 in 2018. Linear TV, meanwhile, saw its optimism score drop to (-8) in 2019, compared to an already low score of 5 in 2018.

Though Peacock intends to use advertising to achieve profitability faster than via a subscription-only model, it won't be cheap to get off the ground. Comcast CTO and EVP Mike Cavanagh noted late last year that the company would spend about $2 billion in the first two years for Peacock to be profitable by year five.

Update: To expand on that business plan, Strauss said Peacock forecasts having 30 million to 35 million domestic accounts by the end of 2024 and break even. At that time, Peacock also expects to drive $6 to $7 of monthly ARPU and bring in annual revenues of $2.5 billion.

Strauss noted that the Peacock will be driven by a set of revenue inputs -- active accounts (customers that stream Peacock each month), engagement (hours of content watched per account) and the revenue per user.

Related posts:

— Jeff Baumgartner, Senior Editor, Light Reading

Read more about:

EuropeAbout the Author(s)

You May Also Like

_International_Software_Products.jpeg?width=300&auto=webp&quality=80&disable=upscale)