Dish and DirecTV's pay-TV biz will 'just melt away' without a merger, Ergen says

Dish chairman again calls a merger 'inevitable' as his company loses another 273,000 pay-TV customers in Q4 2021.

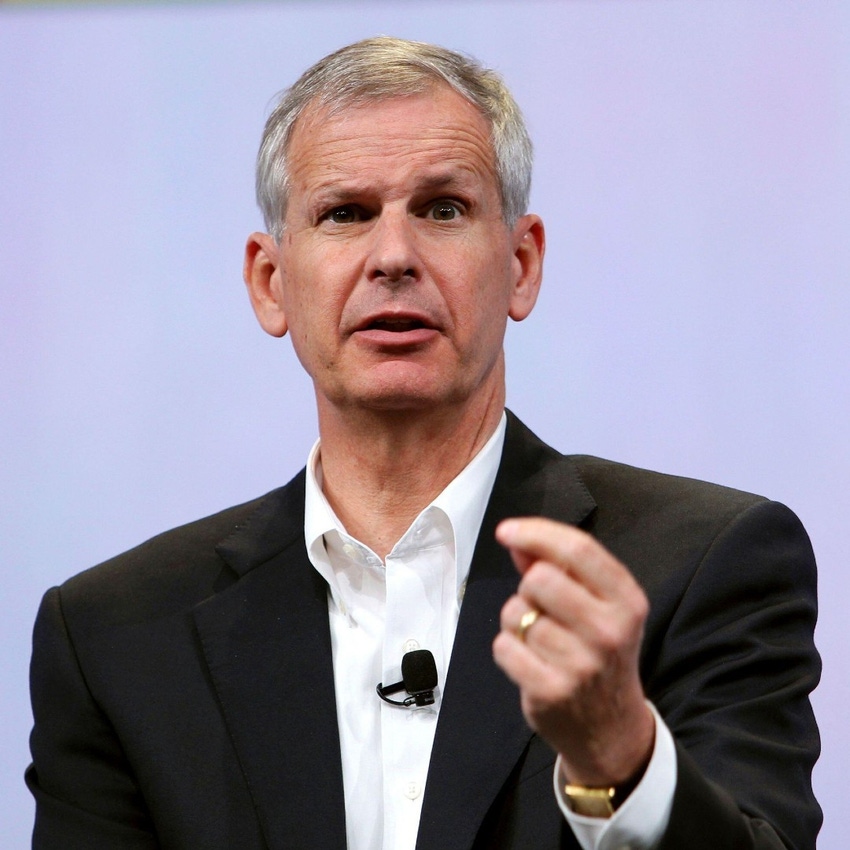

Dish Network Chairman Charlie Ergen continues to view a merger of Dish and DirecTV as an inevitability and believes a pairing is necessary if the pay-TV businesses of the two companies are to survive.

"I think it's inevitable that Dish and DirecTV go together. Otherwise, both companies will just melt away and there will be no service for customers," Ergen said Thursday on Dish's Q4 2021 earnings call.

Figure 1:  Dish Chairman Charlie Ergen believes that a Dish-DirecTV merger would pass regulatory muster.

Dish Chairman Charlie Ergen believes that a Dish-DirecTV merger would pass regulatory muster.

(Source: Reuters/Alamy Stock Photo)

"The regulatory reasons to not allow it don't exist anymore," he added. Dish/EchoStar and DirecTV attempted to merge 20 years ago, but US regulators blocked the deal because it would remove a pay-TV player from a market that was comprised of a limited field of providers at the time.

Ergen has argued that the picture is different today because the market is flush with streaming competition. Although Dish has its hands full with a 5G buildout, the company could have an easier path to a merger now that DirecTV has been spun out of AT&T.

The New York Post reported last month that Dish and DirecTV had engaged in "fresh talks" about merging.

Pay-TV sub losses widen in Q4

Meanwhile, to Ergen's earlier point, Dish's pay-TV subscriber base is eroding. The company lost 203,000 satellite TV subs in the quarter, ending the quarter with 8.22 million. Those losses were worse than the -139,000 analysts were expecting.

Dish's traditional sub base is now shrinking at a 6.7% annual rate, accelerating from a rate of 6% last quarter, according to MoffettNathanson analyst Craig Moffett.

Sling TV also had a rough quarter as it lost 70,000 streaming video subs, ending 2021 with 2.49 million. Analysts expected Sling TV to gain 16,000 subs.

"We don't think the vMVPD [virtual multichannel video programing distributor] segment is ever going to be the growth business it was originally hoped to be; it has been treading water for the past three years," Moffett explained in a research note. "Cord-cutters, particularly those focused on scripted entertainment rather than sports and news, are fleeing for SVOD, not vMVPDs."

Dish execs lamented that the company needs to do a better job hitting subscriber targets. Erik Carlson, Dish's president and CEO, said losses in the quarter were affected by Dish's carriage dispute with Tegna (since resolved), along with a November price increase.

But he was hopeful that Sling TV will rebound after its platform and user interface were re-engineered in the second half of 2021.

"Sling is a profitable business that will grow," Carlson said. "It's going to require a little bit of patience, but … we're now positioned to be able to innovate and enhance the customer experience with new features and differentiated offerings."

Related posts:

— Jeff Baumgartner, Senior Editor, Light Reading

About the Author(s)

You May Also Like

_International_Software_Products.jpeg?width=300&auto=webp&quality=80&disable=upscale)