Charter's Alderfer pushes for more spectrum sharing

One of Charter Communications' top executives, Rob Alderfer, promoted the concept of spectrum sharing at the Cable Next Gen show, echoing a broader lobbying effort by the cable industry.

CABLE NEXT GEN – DENVER – Rob Alderfer, the VP of technology policy for cable giant Charter Communications, came to the Cable Next Gen show with a clear message: Sharing ought to be a cornerstone of spectrum policy in the US.

"Shared spectrum will be increasingly important," Alderfer said during a morning keynote presentation. "We need to enable new use cases and new players."

"Sharing should be a part of the nation's spectrum strategy going forward," he added. But he also acknowledged that both unlicensed spectrum and licensed spectrum – including exclusive-use licenses – will remain critical to mobile networks in the future. He noted that Charter is making use of a variety of wired and wireless technologies in its Spectrum Mobile business.

"We need a holistic approach" to spectrum usage and policy, he argued.

Alderfer's comments come at an important time. The Biden administration is working to flesh out a long-term national spectrum strategy that's intended to release more spectrum for commercial uses. Biden's broad plan is to offer spectrum in both licensed and unlicensed scenarios, and to take a deep and thorough look at the concept of spectrum sharing.

However, as a top executive with one of the nation's largest cable companies, Alderfer also pushed forward a spectrum position that is somewhat at odds with that of the 5G industry. CTIA – which represents 5G operators like T-Mobile, Verizon and AT&T – continues to urge federal policymakers to release more licensed spectrum and to eschew spectrum sharing.

Further, CTIA has loudly called out the cable industry for attempting to block "real competition" in the telecom industry. That's because 5G-powered fixed wireless access (FWA) services have dramatically cut into cable's core Internet business. Those FWA offerings are powered by large chunks of exclusively licensed – and not shared – spectrum.

The Charter position

"Unlicensed spectrum has really been a success story for our country," Alderfer said during his keynote, noting that Charter's Spectrum Mobile MVNO is the fastest growing wireless provider in the US. Spectrum Mobile piggybacks on Verizon's 5G network thanks to an MVNO agreement between Charter and Verizon – but Charter has designed the service to connect to Wi-Fi whenever possible. Indeed, Alderfer said 87% of Spectrum Mobile's customer data is transmitted over Wi-Fi, which uses unlicensed spectrum.

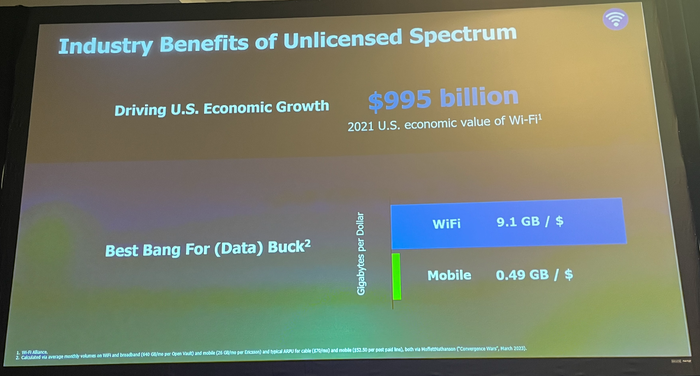

Alderfer also argued that unlicensed spectrum has significantly benefited the US economy. During his presentation, he offered a slide showing the economic benefit of Wi-Fi, as well as a gigabyte-per-dollar calculation between Wi-Fi (on unlicensed spectrum) and mobile (such as 5G, on licensed spectrum). The calculation showed Wi-Fi transmitting 9.1GB per dollar vs mobile transmitting 0.49GB per dollar. Alderfer's calculations cited data from OpenVault, Ericsson and the financial analysts at MoffettNathanson.

"Unlicensed spectrum is really the workhorse for mobile broadband," Alderfer said, noting that licensed spectrum represents a "legacy" approach to spectrum policy.

Alderfer specifically argued that policymakers should release spectrum for commercial uses in the lower 3GHz, 7GHz and 37GHz bands. He said regulators should employ sharing techniques to protect existing users in those bands, including the US Department of Defense (DoD).

The context

Hovering above Alderfer's presentation is a widening battle between the wireless and cable industries. The cable industry is hoping to make inroads into the mobile industry using MVNOs – meanwhile, the wireless industry is hoping to use FWA to make inroads into the cable industry's core Internet business.

And both have enjoyed significant successes. Charter counts almost 8 million mobile lines of service. On the other side, FWA offerings from Verizon and T-Mobile have managed to capture much of the growth in the US broadband industry. According to Leichtman Research Group, fixed wireless services accounted for 104% of total net customer broadband additions in the US in 2023, compared to 90% of the net adds in 2022, and 20% of the net adds in 2021.

For its part, the cable industry is slowly working to build their own small-scale 5G networks using spectrum in the 3.5GHz CBRS spectrum band. Such spectrum is shared with the US Navy.

But the wireless industry has generally shunned that spectrum band in favor of exclusively licensed spectrum, such as spectrum in the C-band, the 3.45GHz band and the 2.5GHz band. Those bands form the basis of the FWA offerings from the likes of T-Mobile and Verizon.

About the Author(s)

You May Also Like

_International_Software_Products.jpeg?width=300&auto=webp&quality=80&disable=upscale)