Can Lumentum keep its balance?

The race to supply 1.6Tbit/s components for cloud providers and hyperscalers is a huge long-term bet for companies like Lumentum, who are tapping years of telecom optical switching know-how to build tomorrow's AI data centers.

Optical networking components vendors always walk a high wire as their customers want it all – lower prices, higher throughput, lower power and a plentiful supply, even when telecom buying cycles are topsy-turvy.

Lumentum is one of the companies trying to maintain its balance while its customers' bandwidth needs change daily. During a Light Reading interview last week, its CEO, Alan Lowe, was calm and upbeat when we discussed future market opportunities on a high wire stretching over a sea of roiling storylines.

The company is absorbing a strategic acquisition, aiming to benefit from the continuing wave of investments in computing and networking to support artificial intelligence, and waiting to see when service providers will pick up spending, as those firms are still using inventory stockpiled during the last few years.

Lumentum also faces the threat that some of its customers, systems vendors who have developed their own optical component manufacturing processes, could compete directly with it.

With all that going on, predicting the future is tough. Just a month ago, Lumentum's shares took a beating as the company reported a $1.47 per share loss for the quarter when Wall Street expected that loss to be $0.80. The mixed results included the company's Cloud & Networking revenue of $287 million, which improved 25% from the previous quarter and declined 25% from the year-ago period.

Integration and opportunities

At OFC last week, Lowe said the medium- to long-term opportunities are still big for Lumentum, and its $750 million acquisition of Cloud Light, which closed in November, is helping the company be a force in the market for high-speed transceivers.

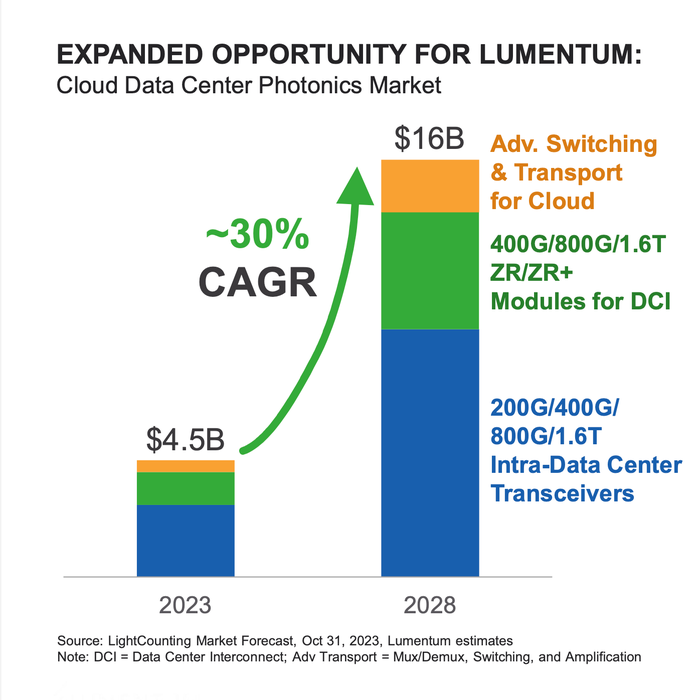

With Cloud Light onboard, Lumentum recently told analysts and investors it expects the market for photonics in cloud networking and data center applications to grow at a compound annual growth rate (CAGR) of about 30%, potentially reaching as high as $16 billion by 2028. As of this writing, Lumentum's market cap is just over $3 billion.

(Source: Lumentum)

Lowe said that growth, which doesn't directly depend on telecom service providers, "is really exciting, not just for the hyperscalers but also for the AI infrastructure providers in that whole ecosystem."

"I think the excitement about the leading edge transceivers inside the data center today at 800 gigs and what looks like very, very possible, you know, in the not too distant future at 200 gig per lane EMLs [electro-absorption modulated lasers] and silicon photonic transceivers, you know, really to do that next level of optical within the data center," Lowe said.

Lowe said the "next level" of data center optics is all due to a bandwidth explosion supporting AI networks. Market researchers have noted that while the market for 800G pluggable optics is still ramping up and growing fast over the next five years, the development of 1.6Tbit/s optics – where you'll see 200G per lane EMLs – is happening now as well. This is another ball for companies like Lumentum to juggle as the high wire swings to and fro.

Still ahead: Another telecom bandwidth boom

Projections for bandwidth needs outside and between data centers are all over the place at OFC. Lowe said he'd heard presentations where the bandwidth requirements outside the data center would grow 10x over the next three years.

While that's happening, Lowe said data centers must move further away from each other because of the power requirements. "And so that data center interconnects outside of the data center is really a big opportunity, one that hyperscalers are all talking to us about," he said.

That's a problem of a different scale and will require some leap in innovation, Lowe said, because you can't just spend 10x the capital to make it happen. "And so, you know, collaboration with customers and collaboration with supply partners is going to be necessary to be able to do things differently and increase speeds and lower the power and all those things... I'd say that's a real catalyst for growth."

As it chases those opportunities, the competitive metrics for component makers are changing, too. Lowe said the past was all about keeping costs low. "And now I think, you know, given the power challenges that our customers have, power is more important than cost," he said. "And so if you can save a few watts and a transceiver, they're willing to pay a little bit more."

Lowe said keeping the watts per bit as low as possible is a priority to Lumentum's hyperscaler and data center customers. That's led to more collaboration with customers, DSP suppliers and others to look at how to "change the game of power consumption in the next generation of products."

The next generation

While optical components makers wait for telcos to start spending more freely, the data communications business is still going strong and everything AI touches increases bandwidth demand. For Lumentum, the future of data centers could mean that the optics themselves become part of the computing process, in addition to being the mechanism for moving bits between servers or cities.

If one pictures today's data center and edge network nodes as part of a large distributed supercomputer, the connections inside and out will need high-powered lasers, high-speed optics and as few hops between optical and electrical connectivity as possible. As the development of 800G and 1.6T components shows, the product cycle times between technology generations are always shrinking.

The future will be here before you know it and, while the wind blows and the clouds roll in, Lumentum's high-wire walk may pick up to a full sprint.

About the Author(s)

You May Also Like