Ericsson and Nokia staff are paying the price of a telecom slump

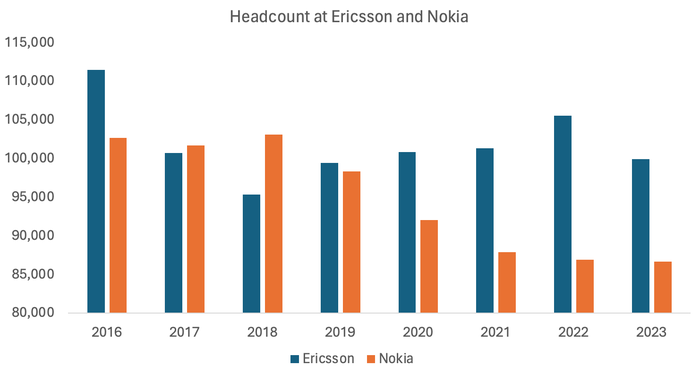

The Nordic kit vendors have slashed 27,500 jobs since 2016, about 13% of their combined workforce, and the cuts keep coming.

A company's headcount should ideally flex like a bodybuilder's muscle, expanding in times of activity and shrinking when the workload is light. But the latter has worryingly become the norm for Ericsson and Nokia, Nordic makers of mobile network equipment hurt by a collapse in US spending. After recently notifying analysts of 9,000 group-wide job cuts last year, Ericsson today said it would reduce headcount in Sweden by 1,200 roles amid "challenging" conditions.

The latest cuts are substantial, representing about 9% of Ericsson's Swedish workforce at the end of last year. They will follow the 500 job cuts that happened in Sweden between 2022 and 2023 and were announced days after news of research-and-development layoffs in China, where Ericsson has ceded market share to local producers such as Huawei.

A spokesperson for the company described today's update as "part of ongoing global initiatives," implying there will be cuts in other markets, too. While Ericsson referred to the figure of 9,000 cuts on its last earnings call in January, group headcount is shown in the last annual report to have dropped by exactly 5,577 last year, giving Ericsson 99,952 employees worldwide in December.

(Source: Ericsson, Nokia)

The year before, however, its ranks were fattened by the $6.2 billion takeover of Vonage, a US software company that finished 2021 with more than 2,000 employees. Other significant takeovers under current CEO Börje Ekholm have included Kathrein, a German antenna company, in 2019, and Cradlepoint, a maker of wireless equipment for the enterprise sector, in 2020. Despite these acquisitions, Ericsson today employs 11,500 fewer people than it did in late 2016, just before Ekholm took charge.

It is suffering after sharp cuts to capital expenditure by operators in North America, where Ericsson generates a big share of its profits. A breakdown of results shows the US was by far the company's biggest market by sales in 2023, generating 85.3 billion Swedish kronor (US$8.1 billion), about a third of the global total. But the US amount fell by 22% that year. Headline profits have tumbled. The operating margin at Ericsson's mobile networks business shrank from about 20% in 2022 to 11% last year. According to one estimate, US telcos pay about twice as much for equipment on a like-for-like basis as operators in Europe.

The axe now seems likely to fall harder in Europe and Asia than it does in the US, where Ericsson has just landed its biggest deal ever – a $14 billion contract to replace Nokia across one third of AT&T's footprint (Ericsson already had the other two thirds). But there are doubts this AT&T contract will do much to lift profits. While AT&T plans to invest between $21 billion and $22 billion in capital expenditure this year – up from $19.7 billion in 2023 – multiple sources believe Ericsson offered generous discounts to secure its contract and will also absorb the cost of replacing Nokia equipment that has not yet fully depreciated.

Finnish deep freeze

Nokia has also been hacking into its workforce. In 2016 – the year it bought Alcatel-Lucent in a €15.6 billion ($16.9 billion, at today's exchange rate) deal – it employed nearly 103,000 people worldwide. But the number had fallen to less than 86,700 last year, and the Finnish vendor expects to be much smaller in future.

In October, before AT&T and Ericsson announced their deal, Nokia warned it would be cutting between 9,000 and 14,000 jobs by the end of 2026 in response to the market slowdown. This will leave it with between 72,000 and 77,000 employees when the process is finished. In the most extreme case, then, Nokia will employ about 30,700 fewer people than it did in 2016, meaning 30% of jobs at the company will have vanished over this period.

Just like Ericsson, Nokia suffered last year as US telcos stopped spending. Revenues generated in North America tumbled one third, to about €5.7 billion ($6.2 billion) of the headline €22.3 billion ($24.2 billion) in sales. And Nokia's operating margin shrank from 9.3% in 2022 to 7.6% last year.

AT&T's decision to go all-in with Ericsson has stoked concern about the outlook for Nokia. When the news surfaced, the Finnish company revealed that AT&T had been responsible for between 5% and 8% of its mobile revenues last year, a range that would translate to between €490 million ($531 million) and €784 million ($850 million) for the whole of 2023. Achieving a double-digit operating margin at its mobile networks business group will take an extra two years because of AT&T's move, it said.

The slowdown in the US is blamed partly on earlier stockpiling by American telcos, which amassed inventory they have still not fully depleted. But operators have also had little appetite for investing in network improvements while their own sales remain under pressure. Global sales of radio access network equipment fell 11% between 2022 and 2023, according to Omdia, a Light Reading sister company. And this year it is guiding for a drop of between 4% and 6%. More workforce shrinkage lies ahead.

About the Author(s)

You May Also Like

_International_Software_Products.jpeg?width=300&auto=webp&quality=80&disable=upscale)