Bharti Airtel: Out of Africa?

Having announced a major spending plan at home, India's biggest operator may be forced to consider its future in Africa.

Bharti Airtel's African safari may be drawing to a close -- across parts of the continent, at least. Having this week unveiled plans to spend almost $9 billion over the next three years on improving its networks in India, the indebted service provider may be under renewed pressure to raise cash and narrow its focus. A sale of some or all of its 17 operations in sub-Saharan Africa could be just the ticket. (See Bharti's $9B Network Splurge in India.)

Bharti Airtel Ltd. (Mumbai: BHARTIARTL) has, of course, made no secret of its desire to quit the four markets of Burkina Faso, Chad, Congo Brazzaville and Sierra Leone. Earlier this year, it revealed it was in exclusive talks with France's Orange (NYSE: FTE) about a sale of those assets. The question is whether the "Project Leap" spending plan forces Bharti Airtel to flog other African operations, with Orange a potential buyer.

Bharti Airtel markets in Africa | Orange markets in Africa and Middle East |

Burkina Faso | Botswana |

Chad | Cameroon |

Congo Brazzaville | Central African Republic |

Democratic Republic of Congo | Cote d'Ivoire |

Gabon | Democratic Republic of Congo |

Ghana | Egypt |

Kenya | Guinea-Bissau |

Madagascar | Guinea Conakry |

Malawi | Iraq (non-controlling equity interest) |

Nigeria | Jordan |

Niger | Kenya |

Rwanda | Madagascar |

Seychelles | Mali |

Sierra Leone | Morocco |

Tanzania | Mauritius (non-controlling equity interest) |

Uganda | Niger |

Zambia | Senegal |

Tunisia (non-controlling equity interest) | |

Source: operators. |

Bharti Airtel and Orange have not offered an update on their discussions since they were originally announced in July. Orange refused to provide a comment for this story when approached by Light Reading, while Bharti Airtel did not respond to queries. But Guy Zibi, chief analyst at Xalam Analytics, Heavy Reading 's Africa and Middle East research unit, agrees that Project Leap has major implications for the African operations. "I think they'll operate the African operations to at least not lose money, sell whatever assets they can and refocus on a few markets," he says.

The problem the Indian operator faces is getting a "good price" for its African networks, according to Zibi. In the July-to-September quarter, Airtel Africa's net loss widened to $170 million from $124 million a year earlier, with revenues shrinking from $1.14 billion to $967 million over the same period. Local currency weakness was blamed for the setbacks, but profitability is clearly suffering in markets that are no longer enjoying a telecom boom. Airtel Africa's EBITDA margin shrank from 23.6% in the July-to-September quarter of 2014 to 20.1% a year later.

While Airtel may be faring worse than some other African service providers, conditions are getting tougher for all, according to recent research carried out by Xalam Analytics. The median EBITDA margin for a sample of African operators examined in that research has fallen from 43% in 2008 to 39% today, with most of the decline occurring in the last three years. "The fundamental question now at the heart of the African business model is whether the data boom will ultimately translate into higher overall revenue and margin growth for mobile operators," said Zibi in the report. (See Vodacom Revenues up on Smartphone Sales.)

Disagreements over the value of assets could explain why talks between Bharti Airtel and Orange have yet to bear fruit. But the French incumbent is likely to be interested in further opportunities to expand its African footprint at a knockdown price. Although it has recently sold businesses in Uganda (to Airtel) and Kenya (to Helios, a private-equity firm), it has also emphasized the importance of Africa to its overall strategy. During a press briefing in London earlier this year, Orange unveiled a target of increasing revenues across its African and Middle Eastern markets by 20% between now and 2018. (See Orange Aims for 20% Sales Growth in Africa.)

For all the latest news from the wireless networking and services sector, check out our dedicated mobile content channel here on Light Reading.

Doubling down on French-speaking countries in West and Central Africa seems to be a primary objective. The Airtel businesses in Burkina Faso, Chad, Congo Brazzaville and Sierra Leone (English-speaking but a good geographical fit) would "naturally complement" Orange's footprint in the region, an Orange spokesperson previously told Light Reading. By sharing resources across neighboring countries, and monitoring networks across West and Central Africa from facilities in Abidjan (Cote d'Ivoire) and Dakar (Senegal), the French service provider reckons it will be able to grow EBITDA by even more than 20% over the next few years. (See Orange Lauds Attractions of Airtel Africa Deal.)

All of this would make Airtel's local unit in Gabon an obvious target for Orange. "[It's] a bit surprising that Orange isn't there already," says Zibi. Besides being the mobile market leader in Gabon, Airtel has been making investments in both 4G networks and fiber-optic submarine links, switching on a connection between the capital city of Libreville and the seaport of Port-Gentil earlier this year. The country is also bordered to its north by Cameroon, where Orange is already active.

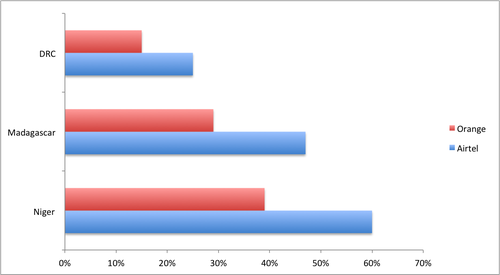

But Zibi thinks Airtel's units in the Democratic Republic of Congo (DRC) and Niger -- as well as its business in Madagascar -- could also pique Orange's interest. The French incumbent already operates networks in all three of those countries but could see takeovers as a means of boosting its market share and reducing competition. The difficulty here may be overcoming regulatory resistance to consolidation: Merger activity involving giants such as Airtel and Orange seems bound to be a concern for competition authorities. Indeed, in Niger, Zibi estimates Airtel's share of subscribers at 60% and Orange's at 39%, which could obviously be a showstopper for any deal.

Figure 1: Market Share of Subscribers  Source: Xalam Analytics.

Source: Xalam Analytics.

Nevertheless, Tracy Kivunyu, a research analyst with African Alliance Kenya Investment Bank, agrees that Orange would probably give serious consideration to buying Airtel's operations in the DRC, Gabon and Madagascar if they came up for sale. She also thinks Airtel's unit in the Seychelles, where Orange does not currently have a presence, could be a target. "The rest of the countries are not very attractive from an Orange current operations standpoint," she says.

That does not necessarily mean Bharti Airtel has no interest in exiting some of those markets, too. But Kivunyu thinks it unlikely that Airtel will look to sell all of its African operations, even describing the East Africa business as "relatively airtight."

"I find it highly unlikely that Airtel will exit Kenya," she says. "They are investing quite a lot in their value-added services platform as we speak and are in pole position to move into positive EBITDA territory." And as she points out, it has only been a year since Airtel bought Orange's business in Uganda.

Bharti Airtel recently agreed to a $1.7 billion sale of about 60% of its African towers and believes it could raise around $1.5 billion from selling networks in Burkina Faso, Chad, Congo Brazzaville and Sierra Leone, according to Kivunyu. In the July-to-September quarter, its net debts were 2.11 times EBITDA over the last year, which looks respectable in comparison with some of its European counterparts. Yet much of that debt is denominated in US dollars, making Bharti Airtel vulnerable to currency movements, and Fitch Ratings now expects the credit profiles of India's biggest operators to come under pressure from "larger capex requirements and debt-funded M&A," besides growing competition. Project Leap could force Bharti Airtel into some hard decisions about its African venture.

— Iain Morris,

, News Editor, Light Reading

, News Editor, Light Reading

Read more about:

EuropeAbout the Author(s)

You May Also Like

_International_Software_Products.jpeg?width=300&auto=webp&quality=80&disable=upscale)