US fiber rollouts reach tipping point but are still far behind HFC

Fiber now passes about 51.1% of US households, and fixed wireless access continues to make inroads. But cable is still the top tech for delivering broadband.

DENVER – CABLE NEXT-GEN TECHNOLOGIES AND STRATEGIES – Fiber network deployments have reached a milestone as they now pass more than 50% of US households, according to recent data from the Fiber Broadband Association and RVA Market Research and Consulting.

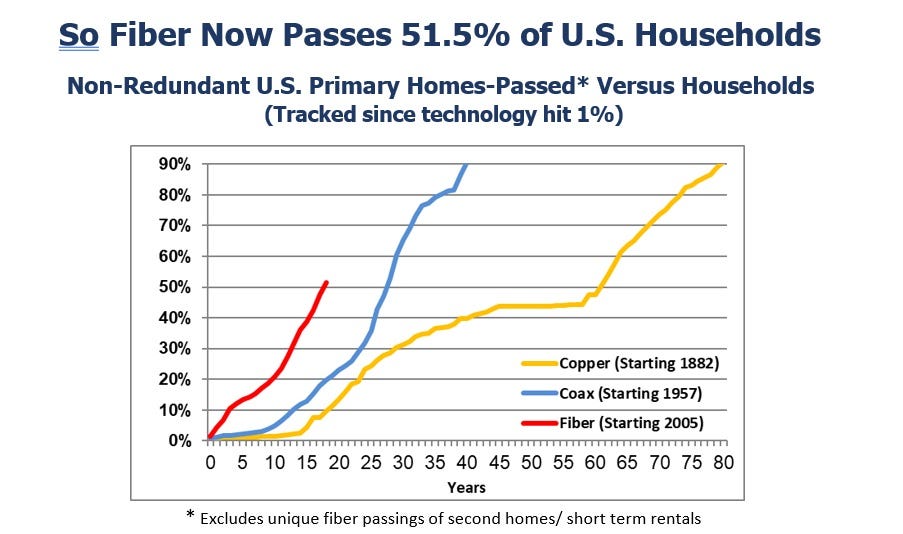

Here's how the growth of fiber has risen in recent years compared to coax cable (or hybrid fiber/coax, HFC) and the long history of copper.

(Source: Fiber Broadband Association and RVA Market Research and Consulting)

"Thanks to this latest surge, fiber lines now pass nearly 78 million U.S. homes, up 13% from a year ago," Alan Breznick, Heavy Reading analyst and the cable/video practice leader at Light Reading, explained in recorded opening remarks here at Light Reading's 17th's annual Cable Next-Gen event.

Almost 69 million of those locations are "unique" fiber homes, meaning that about 9 million are passed by more than one fiber provider, Breznick said.

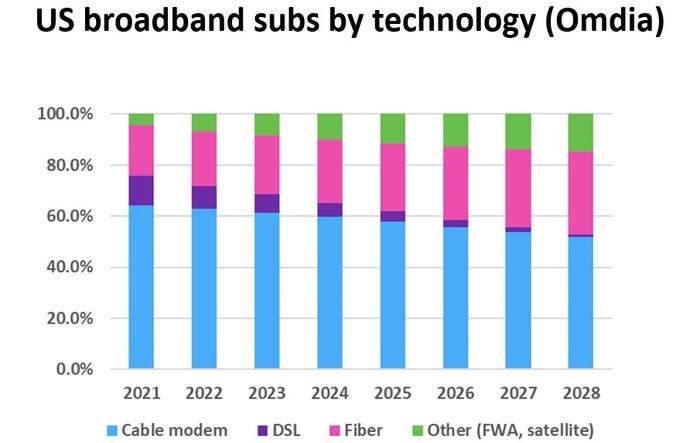

The share of broadband technology is also evolving. While HFC remains the primary way of delivering broadband, fiber-to-the-premises (FTTP) and fixed wireless access (FWA) will continue to make their presence felt in the coming years.

(Source: Omdia)

Omdia, a research company that shares the same owner as Light Reading, expects cable's share of that mix to drop over the next four years, hitting about 55% by 2028, while fiber's share is expected to rise to 30% by that time, Breznick explained.

Cable also embracing FTTP

For the cable industry, fiber and FWA are not solely about competition. Many operators are also using FTTP extensively in greenfields and subsidized rural buildouts. They are deploying it on a targeted basis via a new generation of nodes that can support multiple access technologies, including HFC and wireless.

Additionally, CableLabs has put fiber-to-the-premises on the front burner via a pair of new working groups. A recent survey from Omdia shows that more than one-third of cable operators have already deployed passive optical networking (PON) in some form.

That number will "undoubtedly keep rising" thanks to initiatives such as the Broadband Equity Access and Deployment (BEAD) program, Breznick said.

Meanwhile, operators such as Mediacom Communications have tapped into FWA to extend the reach of broadband in rural areas.

Combined, they demonstrate some of the reasons why the industry has been shedding the "cable" label via rebranding efforts and name changes in recent years.

Cable's broadband challenge

But, against that backdrop, the cable industry is struggling to grow broadband subscribers as it faces more broadband competition paired with historically low churn and a slow housing move market.

"If it feels like an uphill battle for cable, maybe that's because it is. But that doesn't mean it has to be a losing battle," Breznick said. "That's because the cable industry still has plenty of tricks left up its sleeve."

Those tricks include the use of next-generation DOCSIS 3.1 (sometimes called DOCSIS 3.1+ or extended DOCSIS 3.1) that can bump up speeds as high as 8 Gbit/s by opening up new orthogonal frequency division multiplexing (OFDM) channels. Some operators, including Comcast, Charter Communications, Rogers Communications, Cox Communications and Cable One, have begun to deploy DOCSIS 4.0 or have put it squarely on their network upgrade roadmaps.

And though cable operators' network spending is expected to be down in the first half of 2024, vendors are optimistic that the spigots will start to open up again in the second half of the year as operators pick up the pace.

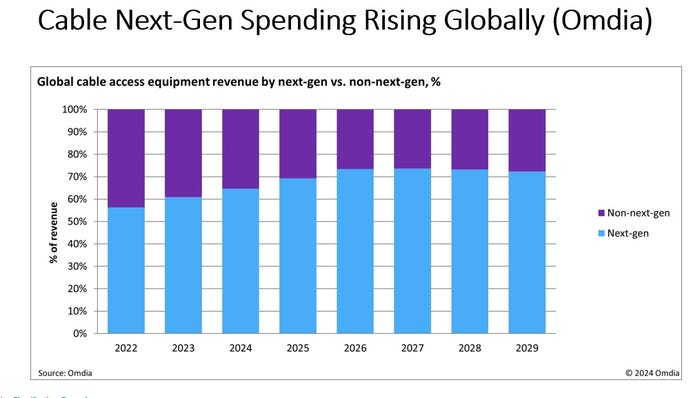

Breznick notes that Omdia expects spending on next-gen cable technologies to tick up in 2024 and 2025 and then reach a relatively steady annual state through 2029.

(Source: Omdia)

Light Reading will have much more coverage of the event throughout the week.

About the Author(s)

You May Also Like

_International_Software_Products.jpeg?width=300&auto=webp&quality=80&disable=upscale)