AT&T nears 100K 'Internet Air' subs

'Internet Air,' AT&T's new FWA service, added 67,000 subs in Q4, ending with 93,000. It will remain a targeted, 'catch' product that won't drive the sub volumes that AT&T's mobile rivals are seeing, CEO John Stankey said.

AT&T's new fixed wireless access (FWA) product gathered some steam in the fourth quarter of 2023, but the offering will remain a limited and targeted product in the operator's home broadband arsenal, CEO John Stankey said.

Launched commercially last August and now available in parts of 35 markets, AT&T Internet Air added 67,000 subscribers in Q4, extending its total to 93,000. Those quarterly FWA adds were a "surprise," New Street Research analyst Jonathan Chaplin said in a research note issued after AT&T posted earnings.

AT&T's cap-free and no-contract FWA service typically starts at $55 per month, a price that includes Internet Air's customer premises equipment (CPE). AT&T is currently offering it for $35 per month when paired with the company's mobile service.

AT&T will continue to use Internet Air on a selective basis, relying on it as an alternative for customers transitioning off of the telco's aging copper plant, in pockets of some markets where AT&T offers fiber service, as well as markets where AT&T has no existing wireline business. Don't expect AT&T to lean on FWA as heavily as rivals such as T-Mobile and Verizon, which added 375,000 FWA subs in the fourth quarter of 2023.

"I don't expect that we are going to be pushing the [Internet Air] product the same way that some others in the market are pushing it today," AT&T CEO John Stankey said on today's earnings call. "We made a conscious choice as a company that we want to dedicate capital to invest in fiber, which we believe is a more sustainable long-term means to deal with stationary and fixed broadband needs."

But, based on the Q4 results, FWA is becoming a contributor to AT&T's overall broadband business.

Fiber sub pace solid, but slows slightly

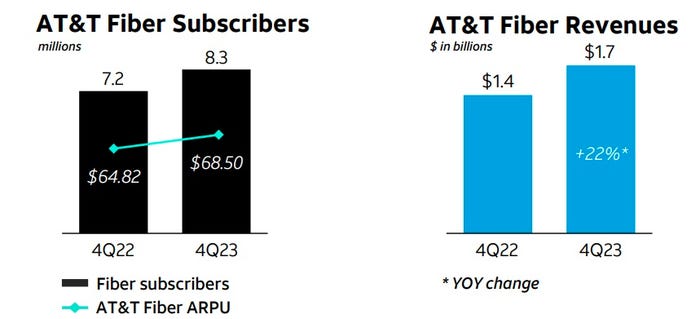

Turning to wireline, AT&T's fiber business continues to lead the way. The company added 273,000 residential fiber subs in Q4, down slightly from year-ago adds of +280,000 and a gain of +296,000 in the prior quarter. AT&T ended 2023 with 8.3 million fiber subs.

AT&T added about 400,000 fiber locations in Q4, extending that reach to 21.1 million. AT&T remains committed to expanding its fiber-to-the-premises (FTTP) footprint to 30 million locations by 2025, Stankey said.

Fiber-related revenues hit $1.67 billion, up from $1.37 billion in the year-ago quarter. Fiber average revenue per user (ARPU) reached $68.50, up from $64.82 a year earlier.

(Source: AT&T Q4 2023 earnings presentation)

Aided by FWA gains, AT&T shed 254,000 non-fiber residential customers, dropping that category down to 5.42 million. AT&T lost another 21,000 DSL subs in Q4, lowering that total to just 210,000.

Turning to the financials, AT&T's consumer wireline business posted revenues of $3.35 billion, up from $3.23 billion a year earlier.

Fiber revenues jumped to $1.67 billion versus $1.37 billion a year earlier. Non-fiber revenues were $1.02 billion, down from $1.11 billion.

Legacy voice and data revenues dipped to $361 million from $414 million in the year-ago quarter.

Updates on Gigapower, ACP and BEAD

Stankey said 2024 will be the "proving year" for the Gigapower joint venture with BlackRock that will initially bring open access fiber networks to about 1.5 million locations outside of AT&T's legacy wireline footprint. Initial Gigapower markets include Las Vegas, three cities in Arizona (Mesa, Chandler and Gilbert), parts of northeastern Pennsylvania (including Wilkes-Barre and Scranton) and segments of Alabama and Florida.

Stankey is not overly concerned about any exposure AT&T will have if the government fails to fund the FCC's Affordable Connectivity Program (ACP). ACP is having a "triage moment," but AT&T will have options and remedies if the program is shut down, he said.

Stankey said he'd rather have regulators put more energy into creating a "coherent approach" that aims to unify the nation's disparate broadband/connectivity subsidy programs.

AT&T, meanwhile, will participate in the Broadband Equity Access and Deployment (BEAD) program, but will be "measured and targeted on where we go in," Stankey said.

And AT&T's interest will vary by state and focus where the rules are best set up for investment. As one example, Texas, BEAD's largest recipient, has a "sound approach" to the program," Stankey said.

About the Author(s)

You May Also Like

_International_Software_Products.jpeg?width=300&auto=webp&quality=80&disable=upscale)