EuroProfile: Astellia

French network monitoring and analytics specialist is on a mission to help mobile operators improve their customer care and customer satisfaction ratings.

April 30, 2015

French company Astellia is one of many technology suppliers in the communications sector that can be pinned with the customer experience management (CEM) badge, but while many companies have products that can be a part of an operator's CEM strategy, Astellia can claim that helping mobile operators improve their customer care and customer satisfaction ratings is at the heart of its day-to-day operations.

The term "customer experience management" (CEM) first appeared on Light Reading ten years ago, when specialist vendor Arantech announced it had raised $10 million to fund its expansion so it benefit from the impending investments of mobile operators in dedicated CEM tools. (See Arantech Raises $10M.)

Arantech was on to something: It was acquired in 2009 by Tektronix Communications , another company that saw the potential in helping operators enhance their customer care capabilities and which is now in the process of being snapped up by service assurance giant NetScout Systems Inc. (Nasdaq: NTCT). (See OSS News: Tektronix Strikes Again!.)

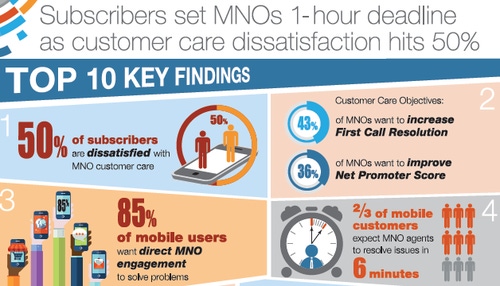

Progress, though, appears to have been slow -- despite plenty of talk, communications service providers still have a shocking reputation for customer care, as industry research commissioned by Astellia has shown. (See Astellia Highlights Customer Care Disconnect and the infographic below.)

Figure 1:

According to Astellia's chief marketing officer, Cedric Arnaud-Battandier, there is still a willingness amongst mobile operators to gain greater insight into their networks, service performance and customers and then, using analytics tools, make use of that information for network optimization, marketing, customer care and business strategies.

The company has evidence to show it's doing something right: In 2015 alone it has announced customer engagements at Orange Slovensko (Slovakia), Zain KSA (Saudi Arabia), SMART (Philippines) and Aircel (India).

Astellia is convinced enough that it too has been on the M&A trail, having acquired Spanish radio access network optimization and analysis specialist Ingenia Telecom in 2014. (See Astellia Acquires Ingenia Telecom.)

Want to know more about customer care issues? Check out our dedicated customer experience management content channel here on Light Reading.

In common with many small, specialist companies -- it had full-year revenues of €51.2 million (US$57.3 million) in 2014 -- Astellia believes it can best serve the industry as an independent company. But with service assurance and analytics becoming increasingly key, and M&A fever running high in the communications networking industry, will the Euronext-listed company remain a standalone vendor for long? Let's see if Astellia can make it to 2016 without being swallowed by one of the larger Service Provider Information Technology (SPIT) companies.

Company name | Astellia |

Location (headquarters) | Rennes, France |

Founded | 2000 |

Key executives | Christian Queffelec, CEO, chairman and co-founder; Gilles Allain, Executive Vice President Sales; Julien Lecoeuvre, co-founder, CTO and Executive Vice President Innovation & Strategic Marketing; Cedric Arnaud-Battandier, Chief Marketing Officer |

Headcount | 480 |

Company focus/strategy | 100% on mobile operators, focused on optimizing network performance and enhancing customer experience |

Funding | Public company on Euronext Paris (symbol: Alast) |

Revenues (annual) | 51.2 million euros in 2014, up by 8% year-on-year |

Profitability | Operating profit of 1 million euros, net loss of 0.3 million euros in 2014 |

Headline customers/key accounts | Orange, Zain, Smart, with more than 200 customers in total |

Main regions of sales activity/customer engagement | Europe and Middle East, increasingly Asia and expanding in North America |

Key partners | Voipfuture, MicroStrategy, DigitalRoute, local distributors |

Main competitors | Tektronix Communications (about to be part of Netscout), JDSU (soon to become Viavi Solutions) |

CMO's favorite movie | The Matrix (1999, The Wachowski Brothers) |

— Ray Le Maistre,

, Editor-in-Chief, Light Reading

, Editor-in-Chief, Light Reading

You May Also Like

_International_Software_Products.jpeg?width=300&auto=webp&quality=80&disable=upscale)