ViacomCBS preps launch of 'broad pay' streaming service

Expanded version of CBS All Access to 'soft launch' later this year, feature content from a wider range of ViacomCBS content properties, and complement the company's free Pluto TV and premium Showtime streaming services.

ViacomCBS shed more light on its streaming strategy Thursday, announcing it is developing a "broad pay" OTT service that will vastly expand the amount and type of on-demand and live TV content that's available today on its CBS All Access subscription offering."Broad pay," in this sense, refers to a new paid streaming service that will feature a broader array of content than the current CBS All Access offering.

This broader version of CBS All Access will "soft launch" later this year and will feature a "house of brands" from ViacomCBS' content stable, tacking on content from Nick, MTV, BET, Comedy Central, Smithsonian and Paramount, president and CEO Bob Bakish said on Thursday's Q4 earnings call.

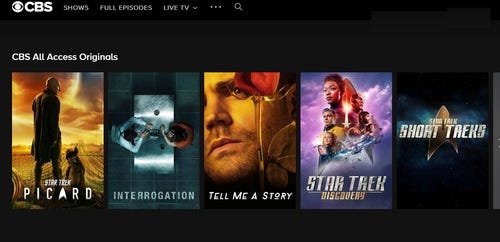

Figure 1:  The current form of CBS All Access starts at $5.99 per month with ads. The ad-free version costs $9.99 per month.

The current form of CBS All Access starts at $5.99 per month with ads. The ad-free version costs $9.99 per month.

ViacomCBS did not reveal pricing on the expanded streaming service, which will feature 30,000 TV shows and up to 1,000 movies from its Paramount division. The current form of CBS All Access sells for $5.99 per month with ads and $9.99 per month without ads, and features more than 12,000 TV episodes, including exclusive original series such as Star Trek: Picard, and access to live TV services, including CBS local stations, CBSN and ET Live.

It's expected that the new, bigger version of CBS All Access will be sold direct to consumers and distributed by various digital and pay-TV partners. Of recent note, ViacomCBS struck a deal to distribute and sell CBS All Access via Comcast's X1 pay-TV platform and its Xfinity Flex platform for broadband-only customers.

But without a full set of details on pricing and distribution strategy, some industry-watchers were left scratching their heads about the company's forthcoming streaming service:

I consider myself pretty savvy when it comes to streaming video service, but I literally have NO idea what the new ViacomCBS streaming product will be, that they are calling "House of Brands" and is designed to work with legacy and new distributors pic.twitter.com/JEoXLTrWMP

— Rich Greenfield, LightShed (@RichLightShed) February 20, 2020

The company said the new broad pay offering will fit into a set of streaming categories from ViacomCBS that also includes free (via the ad-based Pluto TV service) and premium (Showtime).

"We think a combination of broad pay, free and premium is where the market will go," Bakish said.

Streaming strategy forms following merger

That plan enters play as ViacomCBS attempts to accelerate a streaming strategy following the recent merger of Viacom and CBS.

As traditional pay-TV struggles against cord-cutting and reduced viewership of live TV, streaming is becoming a critical growth engine for ViacomCBS just as it is for other media giants, including Disney (Disney+), WarnerMedia (HBO Max) and NBCUniversal (Peacock).

For Q4, ViacomCBS' domestic streaming and digital video business brought in $1.6 billion, up 60% versus the year-ago period, with expectations that this piece of the business will grow 35% to 40% for all of 2020. Its Pluto TV service saw monthly active users (MAUs) climb 75%, to 22 million, with expectations that total will reach 30 million by year-end. ViacomCBS' domestic streaming sub base (which includes CBS All Access and the standalone, OTT-delivered version of Showtime) has climbed past 11 million, with expectations it will reach 16 million by the end of 2020.

Bakish said ViacomCBS is in the early stages of expanding its streaming offerings globally, noting that Pluto TV is available today in the UK, Germany, Austria and Switzerland, and will be available next month in parts of Latin America. CBS All Access is also up today in Canada and Australia. "Streaming is clearly a global priority," he said.

Investors still not buying in

On the financial front, ViacomCBS Q4 revenues declined 3%, to $6.87 billion, along with a net loss of $273 million (44 cents a share), in what Bakish referred to as a "transitional" period following the merger. Affiliate revenues rose 1% thanks to strong retransmission and subscription revenue that offset declines from the traditional pay-TV market.

It's clear that ViacomCBS has more convincing to do regarding its position that the merger and the scale it brings will be a long-term positive for the business. So far, that message has not resonated with investors:

When CBS announced its merger with Viacom in August, the combined market value of the companies was $30b. Viacom was valued then at $12b. Today, ViacomCBS has a market cap of $18b. So the market has erased the entire value of Viacom from the day of the deal's announcement.

— Alex Sherman (@sherman4949) February 20, 2020

The stock has been in decline since the merger was consummated in early December. Continuing that trend, ViacomCBS shares were down $5.47 (15.34%) to $30.20 in morning trading Thursday.

Related posts:

— Jeff Baumgartner, Senior Editor, Light Reading

About the Author(s)

You May Also Like

_International_Software_Products.jpeg?width=300&auto=webp&quality=80&disable=upscale)