Telstra snaps up OTT business in difficult Asian waters

Australian telco Telstra, the biggest bandwidth player in intra-Asia, describes the impact of US internet heavyweights as "super net positive."

OTT giants have dominated global bandwidth routes for nearly a decade now, but there's one important market where they still run second to telcos – intra-Asia.

Heavyweights like Google and Meta account for around 80% of trans-Atlantic cable investment, but just 20-30% on intra-Asia routes, according to Paul Abfalter, Telstra's head of global wholesale & North Asia.

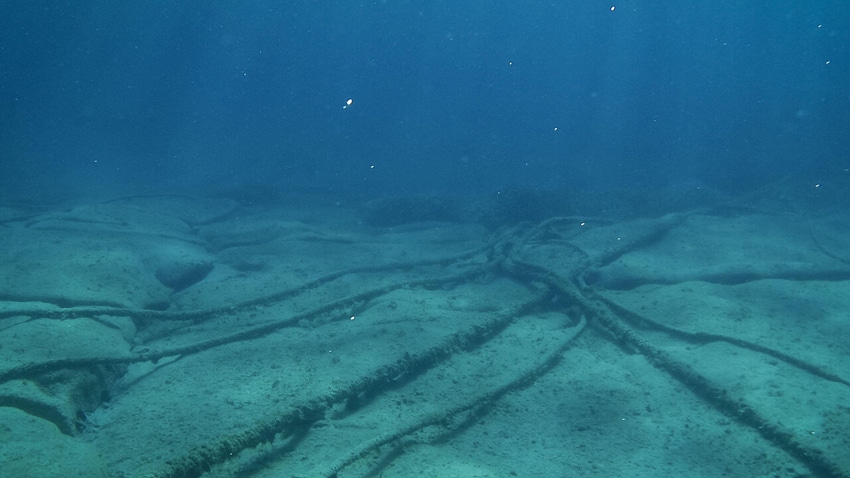

Asia's huge fishing fleets, shallow waters and population density make it "a really tough place to get cables built and maintained," Abfalter said. That’s not to forget the regulatory complexities and continuing geopolitical tensions.

The result for the subsea bandwidth business is that hyperscalers tend to focus on inter-continental routes and "for the most part are coming in behind carriers" on intra-Asia cable builds, Abfalter said.

"A lot of intra-Asia is still very much carrier-led," he told Light Reading.

But he describes the hyperscalers' impact on the segment as "super net positive" because of the scale they bring and the speed at which they work.

Google leadership

He cites Telstra's collaboration with Google on the Pacific Connect system, a series of trunk and branch cables connecting bandwidth-starved Pacific island states, which also increase capacity to Australia.

Telstra and AP Telecom had been working on connecting Guam to some South Pacific islands, but the project only came to fruition after they teamed up with Google's new trans-Pacific longhaul cable builds, significantly speeding up the buildout.

"We're grateful for Google's leadership there," Abfalter said.

He notes that even though one hyperscaler is now selling dark fiber to monetize the cost of the cable build, this is not a threat to operators.

"The one thing that none of the hyperscalers are doing or planning to do is get into the lit capacity business. None of them is doing 100-gig waves, none of them are gearing up to operate like telcos in any shape or form," he said.

Telstra's pitch to its subsea partners is that it's the biggest bandwidth player in intra-Asia, with 36 cable landing stations and the largest subsea network operations team.

It is one of the main local partners on the important new Echo cable, the first direct link between Singapore and the US west coast, due to come into service later this year.

Telstra will provide the Singapore landing station, the landing services, some marine services and the NOC.

"We'll make money across the build and operate ecosystem as well as by being a traditional carrier selling capacity," says Abfalter.

But while Telstra is well-positioned to capture a share of the current market, Abfalter admits to struggling with forecasting the impact of AI.

"The jury's out on how the AI use cases are going to change traffic flows and how they drive inter-continental and intra-region transport demand," he said.

"It's super hard to forecast five years out, incredibly hard, which is not an easy game for us, because we're in the subsea building business. It takes five years to get one built. It does make forecasting a bit of a challenge."

Read more about:

AsiaAbout the Author(s)

You May Also Like

.jpg?width=300&auto=webp&quality=80&disable=upscale)