"Millimeter wave is essential," Amit Jain, Verana Networks' founder and chief commercial officer, told Light Reading in a recent interview.

However, he acknowledged that the market for millimeter wave (mmWave) 5G equipment has hit a bit of a lull, mainly due to US operators' current interest in midband spectrum for 5G. He said that he believes the mmWave market will begin to pick back up next year.

Jain isn't alone. All of Verana's existing investors, as well as a few new ones, have participated in a new funding round to support the company, Verana said Tuesday. The investment represents a bet that big 5G network operators will again start investing in equipment for 5G in the mmWave spectrum after their current network buildouts in the midband spectrum wrap up.

Verana announced a $28 million Series B venture capital funding round. DC Investment Partners (DCIP) led the round, and all of Verana's Series A investors also participated, alongside new investors Taiwania Capital and TDK Ventures. In addition, Verana said that it scored $4.5 million in convertible debt financing from strategic investors including Lockheed Martin Ventures.

Verana has raised $43 million since it was founded in 2020. The company is working to develop a hardware and software platform primarily for outdoor mmWave 5G small cells, initially targeting fixed wireless access (FWA) services. Jain said that the company's technology will make such deployments much cheaper by addressing issues ranging from cell site permitting to backhaul, but he declined to provide details. Verana said that it has over 70 employees in the US and India.

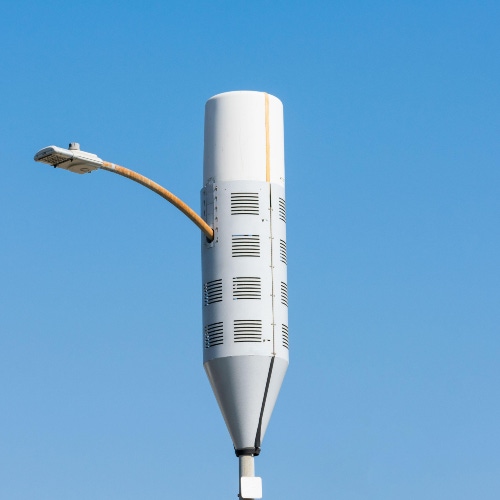

Figure 1:  Small cells atop light poles often broadcast mmWave 5G signals.

Small cells atop light poles often broadcast mmWave 5G signals.

(Source: Michael Vi/Alamy Stock Photo.)

Despite the venture capital vote of confidence in Verana, the company has taken a slight step back. When Light Reading reported on Verana in 2020, the company had intended to make commercial mmWave products available to operators sometime in 2022. Now, Jain said, the company is targeting 2023 for that release.

Nonetheless, Jain and Verana's investors believe that the company remains mostly on track. "We do think that our timing ... would be the right timing," said Mark Bulkeley, managing director of DCIP. Bulkeley will be joining Verana's board of directors under the new round of funding.

Others agree. "With the limited number of capex [capital expense] dollars, there is too much near-term return on the [midband] C-band deployments to ignore. The investments will come back to mmWave, but it will take another 12-18 months in the US," said analyst Dan McNamara, of research and consulting firm Mobile Experts, in a release. "The positive takeaway is that the increasing demand for data is not going away and mmWave systems work and are needed – it will just take a bit longer to see a wider deployment."

Mobile Experts predict that "Act 2" for 5G in mmWave spectrum will begin in the 2023-2024 timeframe.

That outlook is noteworthy considering that operators like AT&T and Verizon, starting in 2018, put most of their initial 5G emphasis on transmissions running in the mmWave spectrum. The result was tiny coverage areas – mostly in downtown areas or large venues like sports stadiums and airports – due to the relatively diminutive propagation characteristics of signals in such spectrum bands.

T-Mobile, though, mostly eschewed mmWave after acquiring substantial midband spectrum holdings from Sprint in 2020. AT&T and Verizon have since followed suit after buying their own midband spectrum holdings in FCC auctions. Indeed, the FCC's big C-band auction of midband spectrum in 2021 raised a total of $81 billion in winning bids – a record.

Verizon so far is the only US operator to maintain a significant focus on 5G in the mmWave spectrum. The operator recently boasted of 35,000 mmWave transmission sites across the country. Light Reading reported earlier this year that Verana filed an application to test mmWave systems in spectrum owned by Verizon, though the two companies have not announced an official partnership.

Related posts:

— Mike Dano, Editorial Director, 5G & Mobile Strategies, Light Reading | @mikeddano

About the Author(s)

You May Also Like