Cable snared nearly half of US mobile line adds in Q3 – analyst

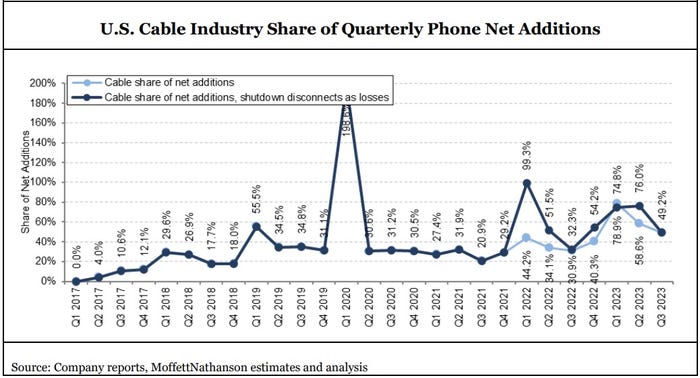

US cable represented 49.2% of all mobile net additions in Q3, by far the highest level ever for the period, according to MoffettNathanson. And there's still room to grow.

US cable operators are struggling to accelerate home broadband subscriber growth, but their mobile strategies continued to drive upward through the third quarter of 2023.

US cable represented nearly half (49.2%) of all mobile phone net additions in the third quarter, up from 32.3% in the year-ago quarter, according to MoffettNathanson's latest report (registration required) sizing up the US mobile sector.

The bulk of that take came way of Charter Communications and Comcast. Charter added another 594,000 mobile lines in Q3, up from 396,000 in the year-ago quarter, for a total of 7.22 million, putting it on a path to pass Dish Network as the nation's largest MVNO. Comcast tacked on 294,000 mobile lines in Q3, down from a year-ago gain of 333,000 lines, for a grand total of 6.27 million. Altice USA added 24,100 mobile lines in Q3, accelerated from +4,100 a year ago, extending its total to 288,200 mobile lines.

Based on those figures (WideOpenWest and privately held Cox Communications have yet to disclose their respective mobile subscriber figures), US cable ended Q3 with 13.77 million mobile lines in service. US cable's take in Q3 2023 was "by far the highest level ever for a third quarter," MoffettNathanson analyst Craig Moffett noted.

Moffett estimates that US cable's mobile take has reached about 14 million mobile lines, representing just 4.3% of the post-paid market and 5.4% of the total market, and "pointing to significant room to grow market share."

Mobile growth at Comcast and Charter are also showing up in Verizon's financials. Q3 service revenue growth of +0.6% at Verizon, which has MVNO deals with Comcast, Charter and Cox, "would have been flat were it not for the rapid growth in wholesale revenues that comes from their Cable MVNO," Moffett pointed out.

But the analyst also notes that the mobile strategies of Comcast and Charter have "diverged sharply." Charter's mobile line growth has been accelerated with a more aggressive pricing and growth strategy, aided in part by a Spectrum One promotion that offers a free line of mobile service for a year. Comcast, by comparison, is moving up-market with premium plans and pricing that's more comparable to the mid-tier plans from the incumbent mobile operator.

"Charter's more aggressive approach has yielded much faster subscriber growth… at presumably much lower ARPU [average revenue per user]. It is unambiguously the more disruptive approach for the incumbents," Moffett wrote.

Charter's wireless ARPU for Q3 closed in at $28.91, down from $33.53 in the year-ago period. Moffett expects that number to stabilize in Q4 as the first batch of customers on Charter's Spectrum One promotion start to roll off and a subset of them convert those free lines to pay.

Data offload improving cable's wireless economics

Cable's mobile economics are also being aided by data offload. The bulk of that offload is occurring over their in-home and metro Wi-Fi hotspots, with Charter estimating that about 87% of its mobile customer traffic rides on the operator's Wi-Fi network. Comcast and Charter should see even more offloading benefits as they start to deploy CBRS spectrum selectively in high-usage areas.

Moffett estimates that the amount of traffic that Comcast and Charter put over Verizon's mobile network is as much as 50% lower than it would be without the effectiveness of their respective offload capabilities.

As Comcast and Charter turn up more CBRS spectrum, "[c]able's hybrid MNO/MVNO economic model will improve still further. And so will their ability to disrupt the status quo of the Big Three," Moffett predicted.

Cable's recent success in mobile is outpacing overall mobile industry growth.

"After Cable's outsized take – even after adding back Dish Network's dismal Third Quarter performance with Boost, which donated subscribers back to the net add pool – the Big Three's subscriber growth rate slowed much more sharply, to just 1.3% in Q3, down by roughly half from the post-COVID peak set in late 2021," Moffett said.

About the Author(s)

You May Also Like

.jpg?width=300&auto=webp&quality=80&disable=upscale)