A spectrum hoard after a Vodafone-Three merger would be awkward

UK competition authorities considering remedies should first look at the spectrum imbalance a tie-up would create.

Auctions, when they concern the radio spectrum that supports mobile-phone services, have long been a charade. In a proper auction of the kind that happens at Sotheby's, the auctioneer's tasks are to extract as high a price as possible and shift all the artwork. He or she cares not if the mysterious lady with the diamond earrings bags all the Turners, leaving better-known spenders empty-handed. But such hoarding at any cost by unknown players would be a disaster for the overseers of a spectrum auction.

The optimum outcome is for spectrum to be apportioned in neat and equal slices, like cake at a children's party. Anything else distorts the market, to the ultimate detriment of consumers. Typically, the "winners" are established before the auction even starts, with total strangers rarely bothering to show up. Ever since the 3G auctions around the turn of the century, when companies nearly bankrupted themselves to secure spectrum, governments have been slammed for overcharging licensees. The whole process is a farce and about as free and competitive as a general election in Russia.

Further illustration of that comes with the prospect of a UK merger between Vodafone and Three. The planned tie-up, announced by the operators last week, would create a beefier telco generating about £8.4 billion (US$10.8 billion) in revenues and serving around 28.1 million customers, according to S&P Global Market Intelligence. This would give it a 29.4% share of the market. But after previous "auctions," it would also control about half the radio spectrum used by the telecom sector. And while BT and Virgin Media O2 – the UK's two other telcos – could try appealing to its customers and chipping away at its market share, its treasure trove of frequencies would be sealed off.

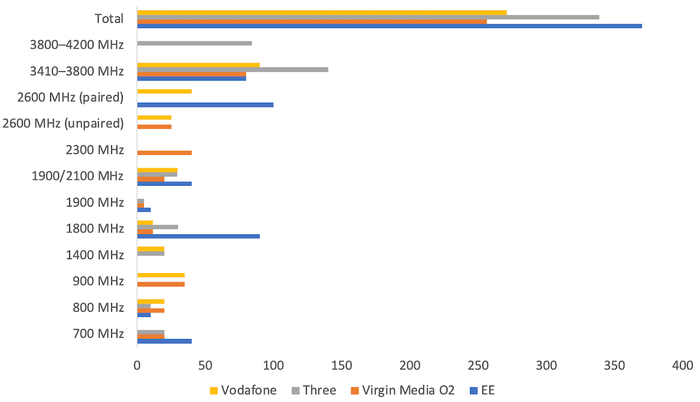

Data maintained by Ofcom, the UK telecom regulator, shows that Vodafone and Three combined would have a grand total of 609.6MHz across various spectrum bands, giving them exactly 49% of the 1,236MHz circulating in the market. Their dominance would stretch across several critical bands, including the 3.5GHz range in which operators are deploying their 5G services. Importantly, they would also hold about 40% of the most valuable sub-1GHz spectrum, crucial for providing decent indoor coverage.

Spectrum holdings in UK telecom market (Source: Ofcom)

(Source: Ofcom)

Lowband gaps carry a high cost

Access to these airwaves gives their operators an insurmountable advantage. In Japan, new entrant Rakuten Mobile has struggled to lure customers because its shortage of lowband airwaves hurts service quality on subway trains and inside buildings. 1&1, a German mobile virtual network operator turning infrastructure player, "needs low-band spectrum to be able to decisively migrate its traffic from Telefónica Deutschland's network to its own network," said Barclays in a recent research note obtained by Light Reading.

Regardless of the band in question, an operator with 40MHz of spectrum has an undeniable edge over a competitor with just half that amount. The only way to address this is to deploy more equipment, which means tolerating higher investments and thinner margins. Outside participation in government-run "auctions," Vodafone and Three would have done nothing to earn this cost advantage, discounting Three's takeover of spectrum-rich UK Broadband in 2017.

That £250 million ($320 million) deal largely explains Three's frequency hoard. And assuming the entire amount was for UK Broadband's midband holdings as they are currently assessed by Ofcom, the fee works out at just $0.02 per MHz per head of population (a common way of valuing spectrum), about 13% of what operators had to pay for midband spectrum during a government "auction" a year later.

The huge spectrum imbalance a merger would create is precisely why the UK's Competition and Markets Authority should ignore Ericsson CEO Börje Ekholm. "We encourage the UK authorities to approve this deal quickly and without imposing any major remedies," he said in a LinkedIn post last week. Ekholm's support is unsurprising. As a major supplier to both Vodafone and Three, Ericsson could initially lose out as the two operators pool resources and reduce capital expenditure from about £1.5 billion ($1.9 billion) to £1.1 billion ($1.4 billion) a year. If "remedies" include stripping them of spectrum assets, they might be less willing to invest.

Give it up

But allowing one operator to retain half the country's spectrum, while serving less than a third of its customers, would clearly deal a blow to competition. The arrangement is already controversial because it would reduce the number of mobile networks from four to three. Opponents worry this consolidation will result in higher prices for customers during a cost-of-living crisis. Supporters counter by arguing that neither Vodafone nor Three covers its cost of capital – a point on which government authorities seem to agree.

A useful compromise would allow the merger to go ahead provided the operators relinquish some of their spectrum assets. Rather than giving these to a new entrant and preserving a four-player set-up (as previously happened in Italy), authorities could look to share them between BT and Virgin Media O2, while ensuring Vodafone and Three are compensated.

The mechanics may be tricky, and they could mean abandoning any future pretense that government spectrum awards are fully competitive auctions. Yet the alternative would be as unfair as taxing one company but not others. Either that, or blocking the merger altogether.

Related posts:

— Iain Morris, International Editor, Light Reading

Read more about:

EuropeAbout the Author(s)

You May Also Like