Cable One transfers CBRS spectrum licenses to Wisper

Cable One sold its stake in Wisper and also transferred its 3.5GHz CBRS spectrum licenses to the company. Now, Wisper plans to use Tarana equipment in that spectrum for fixed wireless.

Cable company Cable One sold its stake in wireless Internet service provider Wisper and, as a result, also transferred its 3.5GHz CBRS spectrum licenses to the company.

A Cable One representative explained to Light Reading that the cable company's spectrum licenses were initially purchased through a partnership with Wisper. "With the recent monetization/conclusion of our partnership with Wisper, Cable One has applied to have the licenses assigned to Wisper per FCC regulation and authorization," the representative wrote in response to questions from Light Reading.

In an FCC filing outlining the spectrum transaction, Wisper said it intends to use the CBRS licenses "to bolster its fixed wireless operations and deployment of broadband services in rural areas."

In its latest SEC filing, Cable One said it sold its 40% stake in Wisper on July 13, 2023, for $35.9 million. Cable One's original stake in Wisper stems from an investment made in 2020.

Cable One "wanted to exit and Wisper bought them back out," Wisper CEO Nathan Stooke told Light Reading. Cable One "decided to go in a different direction."

Stooke noted that Element8 recently replaced Cable One as an investor into Wisper. Element8 is an Internet service provider that is backed by a $200 million strategic investment from Digital Alpha, which is a $1.5 billion investment firm with a strategic collaboration agreement with Cisco Systems. Element8 announced it invested into Wisper on July 26, 2023, though the terms of the investment were not disclosed.

Wisper moves forward

As Light Reading previously reported, Stooke founded Wisper in 2003, in the very early days of fixed wireless. Over the years, Wisper has used fixed wireless access (FWA) equipment from a number of vendors including Motorola, Ubiquiti and Cambium Networks.

However, Wisper plotted a broad expansion starting in 2018 via the FCC's CAF II program. Wisper was a big winner in the CAF II program, scoring $220 million in government subsidies to build Internet connections across rural areas of six US states. (Interestingly, Cable One provided Wisper with a letter of credit to help bolster the company's CAF II bidding.)

Wisper and Cable One also jointly won roughly $5 million in the FCC's Rural Digital Opportunity Fund (RDOF) program in 2020, though Stooke said Wisper has retained a small portion of those winnings.

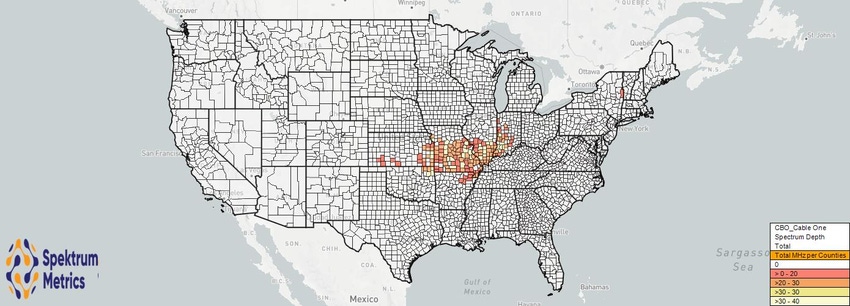

Also in 2020, Cable One purchased roughly 500 CBRS licenses in the FCC's CBRS spectrum auction. But the company purchased those licenses via a partnership with Wisper. That partnership allowed the two companies to work together in the auction.

To meet its CAF II and RDOF coverage goals, Stooke said the company turned to FWA equipment supplier Tarana Wireless.

"We've been doing very, very well with Tarana," he said. Stooke said Wisper has installed Tarana equipment atop roughly 260 cell sites and is using the equipment to provide FWA download speeds of around 400 Mbit/s and upload speeds of around 30 Mbit/s. He said the company is on track to cover more than 60% of its CAF II requirements by the end of this year, putting the company well ahead of its FCC network buildout deadlines.

"The buildout has been going well," Stooke said.

Wisper initially offered FWA services via Tarana equipment operating in the unlicensed, GAA portion of the CBRS band. Now, following Cable One's transaction, Wisper intends to use the licensed, PAL portion of the CBRS band for its Tarana-powered fixed wireless services.

However, Stooke noted that Wisper's FWA customer gains have been "a little bit slower than expected." Wisper counted around 20,000 FWA customers in 2021 and today counts around 22,000. Stooke attributed the situation to the COVID-19 pandemic, where customers scrambled to sign up for Internet services. Now, he said, they're not necessarily interested in switching to a new provider like Wisper.

Cable One's evolving strategy

Cable One is among the many smaller cable Internet providers in the US. Like other cable operators, Cable One has seen broadband subscriber growth slow.

In recent comments, Cable One executives said the operator is not yet ready to follow the likes of Comcast and Charter Communications into the mobile industry. Comcast, Charter and others have been inking MVNO deals with big wireless network operators in order to offer smartphone connections alongside their broadband Internet offerings.

Further, some cable companies are planning to expand their mobile efforts via their CBRS spectrum holdings. For example, Comcast purchased more than 800 CBRS spectrum licenses for around $459 million in 2021. Now, that company has begun running tests of a CBRS mobile network in its hometown of Philadelphia built with equipment from Samsung. The move will allow Comcast to reduce its MVNO payments to its mobile network partner, Verizon.

"If this works, we're going to continue to be able to look at more markets," said Comcast CEO Brian Roberts of its CBRS network in Philadelphia.

Comcast reported the addition of 316,000 mobile lines in its second quarter results, bringing its mobile customer base to a total to 5.98 million.

About the Author(s)

You May Also Like