AT&T 'Internet Air' sub growth to peak by late 2025 – analyst

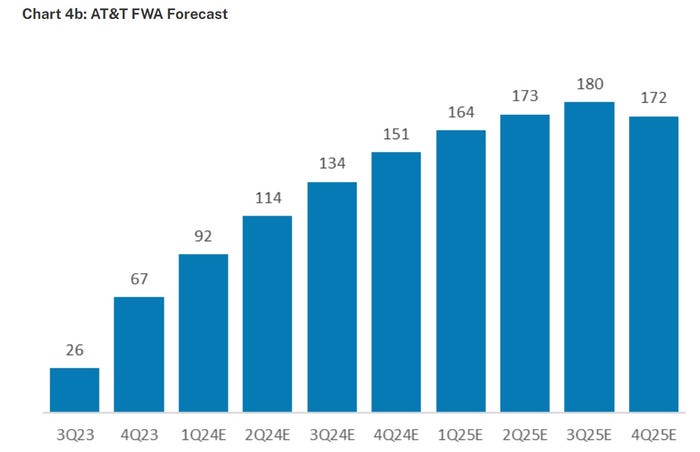

AT&T has not provided subscriber guidance for 'Internet Air,' its new fixed wireless access (FWA) product. But New Street Research assumes the offering will hit a peak of 180,000 subscriber adds per quarter by late 2025.

AT&T launched "Internet Air" commercially last August and has recently expanded the offering to nearly 60 locations. The cap-free and no-contract fixed wireless access (FWA) service typically starts at $55 per month, but is reduced to $35 per month when customers bundle it with AT&T's mobile service.

AT&T considers Internet Air as way to "catch" DSL customers and to complement its primary focus on fiber-based broadband.

AT&T added 67,000 Internet Air customers in Q4 2023, upping its total to 93,000.

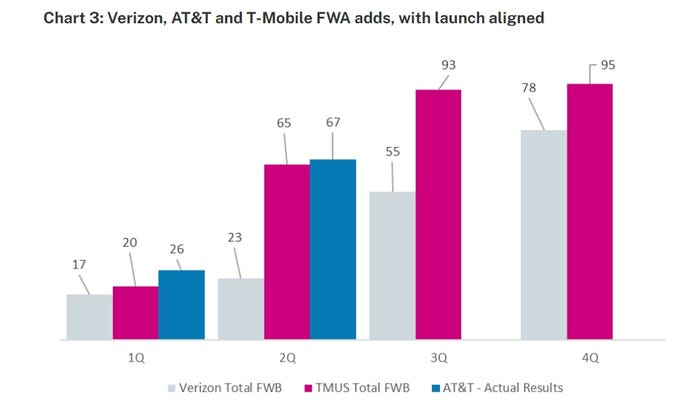

AT&T is not using Internet Air as aggressively as T-Mobile and Verizon are for their respective FWA products – T-Mobile added about 541,000 of them in Q4 while Verizon tacked on 375,000.

"I don't expect that we are going to be pushing the [Internet Air] product the same way that some others in the market are pushing it today," AT&T CEO John Stankey said on the company's recent Q4 2023 earnings call.

AT&T likewise has not provided any subscriber guidance for Internet Air.

AT&T's FWA high mark: About 180,000 subs per quarter

But New Street Research has published a preliminary forecast that assumes Internet Air sub growth peaks at about 180,000 adds per quarter by late 2025. That peak is expected to run for between six and eight quarters, if AT&T follows the same path as T-Mobile and Verizon, the research firm added.

Sub numbers are in thousands. (Source: New Street Research)

But that forecast comes with a big caveat: "The Company has given us very little to go on, and so we have limited conviction in the forecast, at this stage," New Street Research analyst Jonathan Chaplin explained. "All they have said is that they expect to accelerate from the current pace, but they don't expect to add subscribers at the pace of Verizon or T-Mobile. That leaves a wide range."

But he does see AT&T taking a similar trajectory that T-Mobile and Verizon took during the early phases of their respective FWA launches.

Subscriber numbers in thousands. (Source: New Street Research)

"With business [FWA customers] included, we suspect that AT&T would be tracking a little ahead of T-Mobile in the first couple of quarters," he wrote.

About the Author(s)

You May Also Like