AT&T, Charter have biggest BEAD opportunity – studies

AT&T and Charter 'over-index to states that received the lion's share of BEAD allocation,' ISI Evercore finds.

AT&T and Charter Communications are best positioned to benefit from the multi-billion-dollar Broadband Equity Access and Deployment (BEAD) program based on state-by-state allocations and the presence of each operator in those states, reckon analysts that have broken down the numbers.

"The larger the presence an operator has in a state with a sizable allocation of BEAD funding, the greater the opportunity there is for it to see benefits from a build-out near its existing footprint and fill-in additional pockets across its DMAs [designated market areas] with edge-outs," the analysts at ISI Evercore surmised in a research note. "In that context, we highlight that AT&T and Charter over-index to states that received the lion's share of BEAD allocation."

Broken down further, AT&T and Charter have 33% and 27%, respectively, of their residential broadband subs, come from the two top BEAD states – Texas and California – ISI Evercore pointed out.

Comcast, they added, will also have a "meaningful opportunity for subsidized edge-outs," and could look to aggressively bid in parts of Texas, Michigan, Washington, Florida and Illinois, where it already has a foothold, ISI Evercore added.

AT&T, Charter and Comcast have all signaled interest in participating in BEAD in some shape or form.

ISI Evercore's review arrives a few days after the White House announced how more than $40 billion in funding for broadband will be distributed via the $42.5 billion BEAD program. Texas, with $3.3 billion, led the way, followed by California ($1.8 billion), Missouri ($1.7 billion), Michigan ($1.56 billion) and North Carolina ($1.53 billion).

The top five states accounted for 24% of total funding allocation, while the top ten made up 40%. "We note, however, that the sheer magnitude of the +$40bn broader subsidy program suggests there is scope for all operators to benefit," ISI Evercore explained.

New Street Research also ran an analysis of the state-by-state BEAD allocations.

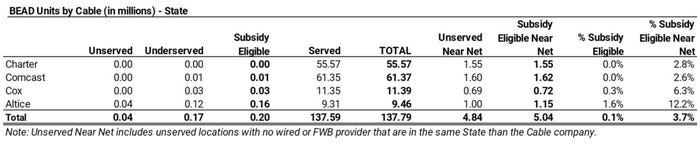

On the cable side, New Street also found, based on BEAD units, that Charter has the biggest opportunity, followed by Comcast, Cox Communications and Altice USA.

Click here for a larger version of this image.

(Source: New Street Research)

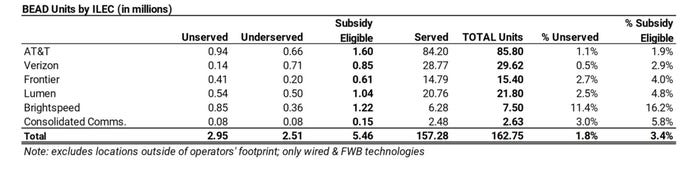

On the telco side, New Street agreed that AT&T has an edge, followed by Verizon, Frontier Communications and Lumen.

Click here for a larger version of this image.

(Source: New Street Research)

"ILECs should be well-positioned to secure subsidies for locations within their footprint because they should have a lower cost to deploy fiber thanks to preexisting infrastructure and an easier path to returns thanks to an existing customer base," New Street said.

Based on current timelines, New Street expects operators to start bidding on BEAD funds in the first quarter of 2024 through mid-to-late 2024. Funds, the analysts added, should be appropriated in 2024 with spending "starting to flow through in earnest starting in 2025."

Related posts:

NTIA issues final guidance for BEAD challenge process (press release)

— Jeff Baumgartner, Senior Editor, Light Reading

About the Author(s)

You May Also Like