Ericsson turns loss-making as 5G spending plummets

Customers will soon have to make investments to cope with surging capacity, says Ericsson, but analysts sound unconvinced.

Ericsson is impatiently waiting for the moment when the pileup of gigabytes on telco networks forces its customers to open their wallets and spend once again. "What we see is network quality around the world in many markets starting to deteriorate and that provides the basis for investment," said Börje Ekholm, the CEO of the Swedish equipment maker, on a call with analysts today, after reporting one of the worst sets of results in years.

The depletion of telco inventories built up in North America and capex cuts by major customers badly wounded the West's biggest 5G equipment maker. After registering a net profit of 4.7 billion Swedish kronor (US$460 millon) for the second quarter last year, it slumped to a SEK600 million ($58 million) loss for the same period of 2023. While headline sales were up 3% year-on-year, to SEK64.4 billion ($6.3 billion), they fell 9% on a like-for-like, constant-currency basis.

That loss stemmed partly from restructuring efforts as Ericsson began to hack into its workforce, with staff numbers dropping by nearly 1,000 in the quarter, to 103,980. The goal is to cut 8,500 jobs in total and slash SEK11 billion ($1.1 billion) from annual expenses by the end of next year. Strip out the upfront costs of laying off staff, the expense of integrating Vonage – a software company Ericsson bought for about $6.2 billion last year – and the US Department of Justice's $200 million fine for Ericsson's previous bad behavior in Iraq and the bottom line would have looked better.

But not brilliant. Ericsson's huge networks business, responsible for about two thirds of total revenues, suffered a painful quarter of declining sales and shrinking margins as commercial activity shifted to the less profitable Indian market, where a major 5G rollout is underway. Revenues at the unit fell 8%, to SEK42.4 billion ($4.1 billion), while operating profits tumbled 70%, to just SEK2.6 billion ($250 million). Unfortunately, all of Ericsson's smaller units are still registering losses.

Outside our control

Ekholm's message is that business will soon return as cost-cutting clients are compelled to add capacity to overburdened networks. "The exact timing is in the hands of customers, but we are encouraged by discussions with customers where we see a recognition of the need to strengthen capacity in the network," he said. A gradual recovery starting later this year is expected.

But markets reacted badly to the update, despite management's insistence that results were in line with former guidance. Ericsson's share price was trading down about 8% in Stockholm this morning, and it has more than halved since the start of last year. Analysts sound unconvinced that customer spending will recover fast and that Ericsson can hit its 2024 target for an earnings margin (before interest, tax and amortization) of 15%.

Ericsson's share price (SEK) (Source: Google Finance)

(Source: Google Finance)

The consensus, noted Alexander Peterc of Societe Generale, is currently at 11.5%. According to his analysis, Ericsson's outlook implies a jump of almost SEK20 billion ($1.95 billion) – nearly double what Ericsson aims to cut in annual costs. "Where are we all getting it so badly wrong?" said Peterc.

Revenue growth from licensing of intellectual property should help, answered Ekholm, after Ericsson landed a new 5G licensing deal with an unidentified device maker. He is also banking on further improvements at the long-troubled cloud software and services unit, whose operating loss (excluding restructuring charges) narrowed to SEK300 million ($29 million), from SEK700 million ($68 million) the year before. Ericsson is confident this unit will break even by the end of the year.

Enterprise lag

The big hopes rest with the newish enterprise business and Vonage. Ericsson's rationale for the takeover was that it could position the so-called communications platform-as-a-service (CPaaS) company as a kind of broker between developers and telcos. Using standardized network application programming interfaces (APIs), built into the Vonage platform, a developer could tap into advanced network features and write once for a global audience. Revenues would accrue from the developers using the platform and be shared with telcos, under the Vonage plan revealed to Light Reading earlier this year.

Ekholm had a service example to share on today's call. "When you are going to call up and put on your XR devices and say now I need super low latency and I can do that through a network API," he said. "Then you start to drive an upgrade of the network and monetization and a new way for us also to create revenues."

The idea of this mutually beneficial arrangement is that operators then spend more on network products, including the standalone version of 5G that comes with new features. Around 75% of basestations outside China do not even support midband, a frequency range associated with higher-speed services, noted Ekholm. A 5G network will also require more sites than a 4G one, he said.

"You have a higher-capacity offering when you build midband," explained Fredrik Jejdling, the head of Ericsson's networks unit, on a call with Light Reading, estimating that a site upgrade from 4G to 5G midband brings a tenfold increase. "When you get that type of capacity boost it allows two things – the ability to increase ARPU [average revenue per user] and also your production cost goes down significantly because cost per bit goes down."

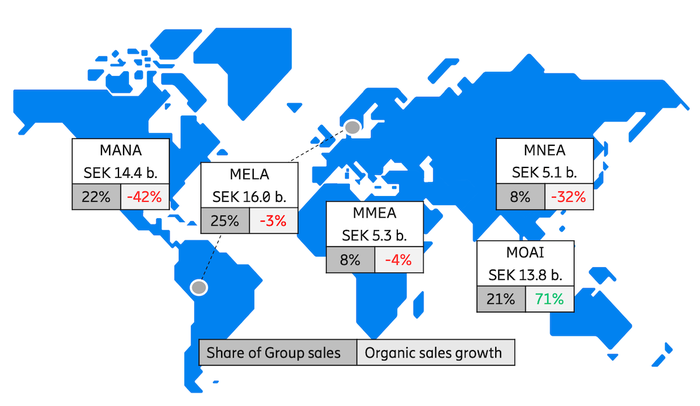

Ericsson's sales by region and growth (Source: Ericsson)

(Source: Ericsson)

But monetizing network features will not happen overnight. Ericsson does not expect Vonage to commercialize its first network API until the end of this year at the earliest, saying there is still a lot of "groundwork" to be done beforehand. In the meantime, sales of Vonage's current API offerings were up 19% in the quarter, a slower rate of growth than it managed in previous years before the takeover. At just SEK4.2 billion ($410 million), they are relatively small.

The other enterprise opportunity is the private wireless business, or what Ekholm calls "dedicated" networks. While about 6,000 of these currently exist in China, there are only 1,000 to 1,500 of them in the Western world, he estimates. Ericsson's challenge is to develop the sales organization that can target the relevant companies and fend off rivalry from the dozens of other players chasing the same market. Meanwhile, the Enterprise Wireless Solutions part of the enterprise unit made just SEK1 billion ($97 million) for the recent quarter, although this was a 69% improvement on the year-earlier figure.

Ericsson can possibly console itself with the knowledge that Nokia's share price also tumbled today after it issued a profit warning because of weaker mobile demand than it previously envisaged. The Swedish company has excelled in 5G since Ekholm took charge in 2017, boasting that its share of the market for radio access network products outside China has grown by six percentage points over this period, to about 39%. The downside is just how dependent Ericsson now is on the telco appetite for 5G investment. If Ekholm is wrong, it could be in for a long lean spell.

Related posts:

— Iain Morris, International Editor, Light Reading

About the Author(s)

You May Also Like