Charter could retain 75% of Spectrum One promo's free mobile lines

A wave of Charter subs who received a free mobile line for a year via its 'Spectrum One' promo are rolling off this fall. ISI Evercore expects Charter to retain about 75% of those mobile lines as they convert to pay.

Charter Communications amplified its connectivity convergence strategy last October with the debut of "Spectrum One," a promo that bundles together home broadband, its advanced Wi-Fi product and a free mobile line for a year. Charter's promo also bakes in promotional pricing of $49.99 per month, rising to $69.99 per month after a year.

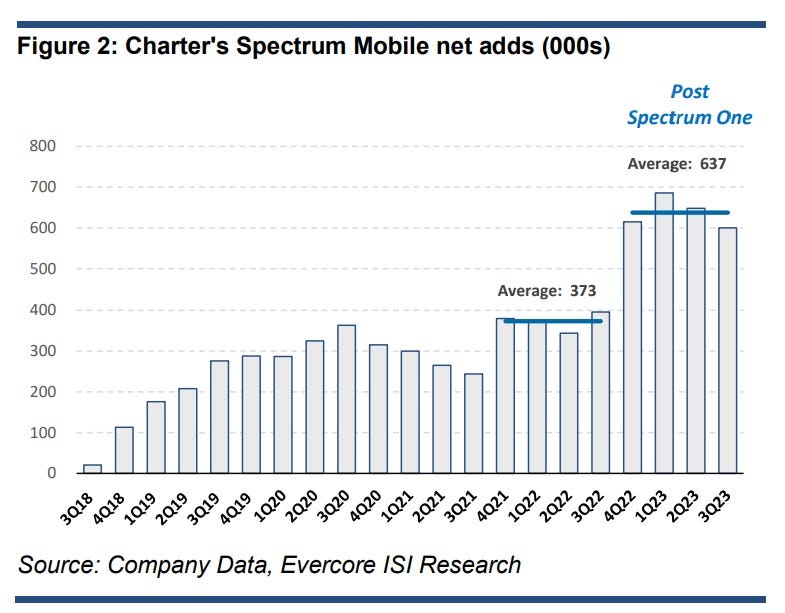

Charter hasn't pinpointed how much of its mobile line growth is attributed directly to Spectrum One, but the promo has certainly had some impact. From Q4 2022 through the first half of 2023, Charter added 1.9 million mobile lines compared to 1.09 million mobile lines in the same year-ago three-quarter stretch.

With the first big wave of Spectrum One customers reaching the end of that 12-month promotion, analysts are keeping close tabs on how many of those customers churn off or stick with the program as prices rise and those free mobile lines convert to pay.

Charter has been adamant that it expects retention levels to remain high, but it hasn't pointed to specific numbers.

"We're really confident of what that means when it [the Spectrum One roll-off] happens at scale beginning in October. It'll stick," Charter CEO Chris Winfrey said last month at a Goldman Sachs investor event.

When the question came up again at a Bank of America event, Charter CFO Jessica Fischer noted that the company's confidence is due in part to multi-market pilots launched in the third quarter of last year that shared similarities to the Spectrum One promo. She said the number of pilot customers who rolled to pay – and actually used those free mobile lines – exceeded Charter's expectations.

'Meaningful acceleration' from Spectrum One

Noting that Charter has seen a "meaningful acceleration" in mobile line growth since the launch of Spectrum One a year ago, ISI Evercore believes that Charter will retain a large portion of free mobile lines that will soon switch to pay.

"Our base case assumes a 75% retention rate," ISI Evercore analyst Vijay Jayant explained in his analysis of the Spectrum One roll-off.

As for roll-offs related to the promo itself, Jayant expects about 16,000 mobile disconnections in 2023, 238,000 disconnections in 2024 and 252,000 disconnects in 2025. That compares to retained lines that are rolling off the promos of 168,000 in 2023, 723,000 in 2024 and 594,000 in 2025.

Turning to the financial impact, Jayant estimates that the average revenue per user (ARPU) uplift from Charter's free-to-pay conversation will be roughly $33 ($30 mobile, plus a 60% take-rate on Charter's $5 per month advanced Wi-Fi product). In turn, that suggests a contribution of revenue in the range of $210 million in 2024 and $255 million in 2025, he added.

Jayant also assumes that Spectrum One has accounted for about 90% of mobile line gross adds since it was launched last October. The analyst forecasts the promo will generate about 3 million in annual gross adds between 2023 and 2025, of which about 40% will be on the free one-year promo.

"We expect that Charter will ultimately retain 75% of this cohort," Jayant predicted.

US cable operators don't report mobile churn (yet). Jayant assumes Charter's mobile churn was 1.25% prior to Spectrum One, and that it declined only modestly to 1.15% after its launch. That's still slightly higher than the monthly postpaid phone churn of AT&T, T-Mobile and Verizon of 0.7% to 0.9%.

Jayant also expects Spectrum One to evolve over time, producing a "steady stream" of 290,000 mobile lines a quarter, or 1.16 million mobile lines a year entering one-year-free promos before seeing any typical churn.

Evolution of Spectrum One

Charter has already started to branch off from the original Spectrum One promo.

In concert with last week's launch of the Xumo Stream Box from the Comcast/Charter national streaming joint venture, Charter introduced a new promotional package called Spectrum One Stream. That package includes Charter's home broadband service (300 Mbit/s downstream), the operator's Advanced Wi-Fi offering, one unlimited line of Spectrum Mobile (free for a year) and a Xumo Stream Box (free for 12 months) for $49.99 per month for 12 months.

About the Author(s)

You May Also Like