EU approves Spanish Orange, Másmóvil merger with Digi to become MNO

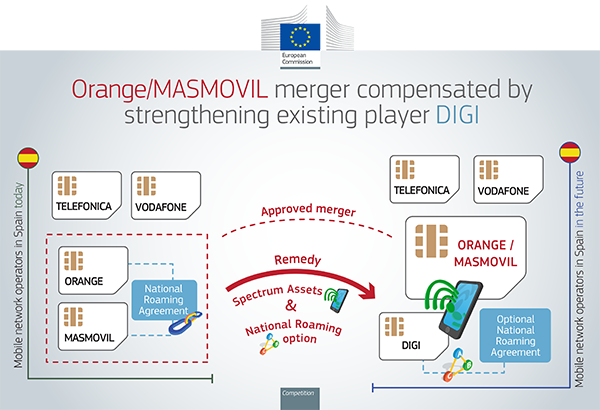

The European Commission approved a merger between Orange and Másmóvil in Spain but agreed remedies mean the country will remain a four-operator market as Digi will pick up Másmóvil's spectrum to build its own network.

The European Commission (EC) has approved the proposed joint venture between Orange and Másmóvil in Spain – a deal valued at €18.6 billion (US$20.1 billion) – with remedies. Spain's largest MVNO will become a network operator, keeping Spain a four-player market.

The merged Orange/Másmóvil entity will become the largest operator in Spain in terms of customer numbers, with Orange saying they will jointly serve over 30 million mobile customers and more than 7.3 million fixed clients. Orange, which has hailed the deal as creating a stronger operator with the scale needed to invest in 5G and fiber, expects the deal to close by the end of Q1 2024.

The EC has, nevertheless, been worried about potential negative effects on competition and conducted an in-depth investigation to assess possible negative outcomes of the merger.

It found that a merger between the two operators would eliminate a "close and important competitor" in the market. This is because Másmóvil had made "very competitive" offers to consumers and succeeded in luring many of them away from Orange. Moreover, the probe found the transaction would have caused significant price increases for end consumers, possibly well above 10%.

In all, the EC ruled that efficiencies like cost savings and incremental 5G and fiber rollout were not enough to offset the anticompetitive effects of the transaction. It has therefore negotiated two remedies which will introduce a fourth MNO to the market – as has been previously speculated in the media.

Four become four

The first of the two remedies prescribed by the EC will see Másmóvil divest its spectrum across three spectrum bands to Digi. The Romania-headquartered company has already agreed to buy Másmóvil's spectrum for €120 million ($129.8 million). This includes two medium frequency bands (1,800MHz and 2,100MHz), as well as the 3.5GHz high-frequency band. Másmóvil does not hold any low-band spectrum.

The second will allow Digi to enter a national roaming agreement to complement its own nascent network. In the EC's words, this is "critical given that, like Másmóvil's network today, Digi's future mobile network would likely not cover the entirety of Spain." Digi has already concluded a contract on the option of national roaming with Orange. The implications of the deal are also explained in the graphic below.

(Source: European Commission)

The EC notes that Digi is a suitable "remedy taker" because it is Spain's largest and fastest growing MVNO, with experience as a network operator in other EU markets. Digi, which operates in Spain as an MVNO, says it currently has over 6.1 million clients in the country.

However, no remedies are prescribed for fixed networks. The EC's reasoning here is that Digi is already a strong player in this market. John Robinson, senior analyst at Assembly Research, said in emailed remarks to the media that this "represents a positive result from Orange's perspective, which had to divest significant fibre assets to acquire Jazztel back in 2015."

All eyes on Spain

The Orange/Másmóvil merger has been closely watched across Europe, as operators in other countries have argued in favor of market consolidation.

Robinson notes that "it seems the EC is not ready to abandon its long-held view about the likely harm stemming from four-to-three mobile mergers and the important role of challengers, setting out early on its concerns that the deal could reduce competition and lead to significant price increases."

"In line with its decision in Wind/Tre in Italy, the EC required a 'fix-it-first' remedy to facilitate creation of a new mobile network operator, Digi. However, in Italy, intense competition and low-to-zero service revenue growth has prompted attempts at reconsolidation of the market, which could call into question whether the EC's high bar for merger approval was appropriate," Robinson adds.

The decision will also be closely watched in the UK, where a proposed Vodafone and Three merger is pending approval by the Competition and Markets Authority (CMA). Finding inspiration in Spain may, however, prove tricky.

Kester Mann, director of consumer and connectivity at CCS Insight, told Light Reading via email that "if Vodafone and Three are required to do similar, they would be reliant on finding a willing third-party to complete the deal. That may not be easy."

Read more about:

EuropeAbout the Author(s)

You May Also Like

.jpg?width=300&auto=webp&quality=80&disable=upscale)