Nokia feels US squeeze but sees wins against Samsung, Huawei

Slowdown in North America spending hurts Nokia but CEO Pekka Lundmark hails market share gains elsewhere.

The faces and logos were different, but the messages from the two big Nordic vendors of telco equipment were broadly the same. Just days after Ericsson spoke of North American sales falling off a cliff, Nokia was effectively nodding in agreement. Operators that built up inventory when supplies were tight are slashing expenditure as interest rates climb and inflation remains stubbornly high, said the Finnish vendor today. The coming months will be tough.

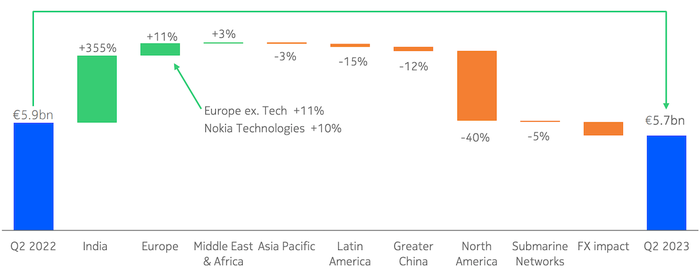

Nokia still looks in healthier shape than its Swedish competitor. Its net sales fell 3% for the recent second quarter compared with the year-earlier period, to about €5.7 billion ($6.4 billion). But they were flat on a constant-currency basis, while Ericsson's fell 9%. Unlike its rival, Nokia is still profitable, too, although its net income on a comparable basis fell 29%, to €414 million ($464 million).

The update followed cuts to Nokia's financial outlook on the same day Ericsson reported results. It has slashed its full-year net sales target by about €1.5 billion ($1.7 billion), to a midpoint of €23.9 billion ($26.8 billion), because of the spending slowdown its sees mainly in North America. Customers will eventually have to open their wallets to cope with annual traffic growth of between 20% and 30% on networks, CEO Pekka Lundmark told reporters, echoing comments made by Börje Ekholm, Ericsson's CEO, last week. But this is not expected to happen until later this year at the earliest.

Despite all this, Nokia has only tweaked its profitability targets and is now guiding for a full-year operating margin of between 11.5% and 13%, down from the previous 11.5% to 14% range. After the earlier slow progress on cost reduction, Nokia is now moving speedily ahead with plans it first announced in 2021, Lundmark told Light Reading.

"We said that the speed of that program would depend on how the overall macroeconomic develops and how our topline develops and we had really good development as you remember in 2021 and 2022, and that is why that program proceeded more slowly," he said. "So now we are accelerating against those targets we then published."

The goal announced then was to reduce annual costs by €600 million ($672 million) and shrink the workforce to between 80,000 and 85,000 employees. Nokia had an average of 86,900 on its books last year, according to its most recent annual report, and the number has already dropped from 103,100 in 2018, two years after its €15.6 billion ($17.5 billion) takeover of Alcatel-Lucent. The worse the economic outlook, the smaller it is likely to be.

Indian summer

Most of the recent revenue pain was felt at the network infrastructure unit, responsible for producing fixed-line equipment along with IP and optical network products. Sales there dropped 8%, to just less than €2 billion ($2.2 billion), as telcos reined in their spending. Yet the operating margin at this unit was up 1.6 percentage points, to 13.1%, thanks to a more profitable mix of products sold to customers.

The opposite was true of Nokia's mobile unit, currently accounting for about 46% of total sales. Its closely watched gross margin shrank by 6.8 percentage points, to 33.4%, and its operating margin by 3.3 percentage points, to 7.9%. This was despite sales growth of 1%, to around €2.6 billion ($2.9 billion), and a constant-currency improvement of 5%. Much like Ericsson, Nokia has seen activity shift to the huge Indian market, where a major 5G rollout is underway, and contracts tend to be less profitable in these early stages than when operators are adding capacity to existing networks.

Nokia sales development by region (Source: Nokia)

(Source: Nokia)

On the plus side, Nokia's mobile product range looks far more competitive than it did before Lundmark joined the company, putting it in a stronger position to capture market share from rivals such as China's Huawei and South Korea's Samsung. "When you look at where we have taken most market share, obviously it is from Chinese vendors," said Lundmark.

"When it comes to our fastest-growing market at the moment, India – there, of course, the big difference with the past is that we are now a significant vendor to Reliance Jio, whose 4G network was 100% Samsung, and the only major deals that we've seen them announce for 5G are with us and our Swedish competitor," he continued. "We believe we have taken market share clearly from Samsung and also from the Chinese competitors."

The good, the bad and the ugly

A concern for investors is the rather bleak long-term outlook for the radio access network market, with market-research firm Dell'Oro now guiding for a drop in revenues. Nokia's own expectation is that the addressable market will shrink 2% this year, but Lundmark reckons the 5G part of this will continue to grow. Only 25% of potential sites outside China have upgraded to 5G "mid-band," the frequency range supporting higher-speed network services, he said in his introduction to Nokia's latest earnings report.

Bright spots for Nokia included sales to enterprise customers – which rose 27% year-on-year, to about €510 million ($571 million) – along with Nokia Technologies, the small but profitable unit responsible for brand and patent licensing. After signing a deal with Apple in the quarter, it boasted revenues of €334 million ($374 million), an increase of 10% on the year-earlier figure, and an operating profit of €236 million ($264 million).

The real worry for both Nokia and Ericsson is the financial wellbeing of their telco clients. So far, 5G has not brought any kind of meaningful sales growth for most operators, and debt levels were high at many companies before interest rates began to rise, as Lundmark recognized on today's call. Both he and Ekholm may be right to say that traffic growth will eventually force operators to invest in network products. But as sales pitches go, it is not the most positive.

Related posts:

— Iain Morris, International Editor, Light Reading

About the Author(s)

You May Also Like