700MHz: Coming soon to Germany

Germany's second Digital Dividend auction could raise even more than its first.

Sequels rarely match up to the originals, but telecom regulators in Germany will be hoping that Digital Dividend 2 meets with an even warmer reception than the first installment when it goes on nationwide release in May.

The auction of 700MHz spectrum, announced late last week (in German) by Germany's Bundesnetzagentur (BNetzA) , could generate as much as €4.5 billion ($5.1 billion) for government coffers, according to analysts cited in a Reuters report -- a marked increase on the €3.58 billion ($4.1 billion) Germany raised from selling 800MHz licenses in 2010. It will also make Germany the first country in Europe to put 700MHz spectrum up for sale. Elsewhere in the region, regulatory authorities will be watching closely.

If the results of the AWS-3 auction in the US -- which last week raised a staggering $44.9 billion in proceeds -- imply that demand for spectrum is insatiable, conditions in Germany have hardly improved since 2010. Notwithstanding a recent merger between Telefónica Deutschland GmbH and E-Plus Service GmbH & Co. KG , previously the country's third- and fourth-biggest operators (behind Telekom Deutschland GmbH and Vodafone Germany ), the mobile market looks as moribund as most others in Western Europe. The juggernaut of the German economy has also been losing momentum. (See Hey Big Spenders! AT&T, Dish & VZ Splash Cash on Spectrum and Euronews: KPN to Sell E-Plus for €8.1B.)

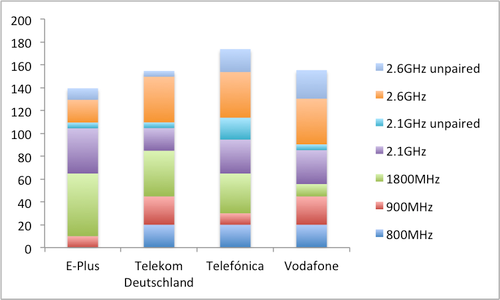

Figure 1: Current Spectrum Holdings (MHz)  Source: European Communications Office, companies

Source: European Communications Office, companies

Unsurprisingly, then, German operators have displayed little enthusiasm for an early 700MHz auction. Spending on spectrum would deplete the funds available for investment in network rollout. And the licenses themselves will come with further regulatory obligations. Winners that already operate networks will have to meet certain coverage requirements, including providing mobile broadband services along stretches of motorway and on trains, according to the Bundesnetzagentur's latest statement.

Then there is the grim prospect of fresh competition. The Bundesnetzagentur has previously hinted the auction could be a way of attracting a new entrant to the market, and in last week's announcement it promised to exempt the "newcomers" that existing operators dread from some of the obligations tied to spectrum licenses. Clearly, the arrival of a new player would nullify some of the benefits of recent consolidation, even if a new entrant would be starting from scratch.

Want to know more about 4G LTE? Check out our dedicated 4G LTE content channel here on Light Reading.

Yet 700MHz spectrum will certainly carry a premium. Like the 800MHz airwaves that starred in the Digital Dividend auction, it allows signals to penetrate buildings and cover wide areas more effectively than above-1GHz spectrum. Perhaps more importantly, it is already used by 4G service providers in other parts of the world and could, therefore, support interoperability and roaming. That, in turn, could help drive down 4G device and service costs.

With all that in mind, companies will not want to miss out on frequencies that could become increasingly important to their mobile broadband strategies in the years ahead. Even now, operators are combining airwaves from different frequency bands -- a process known as "carrier aggregation" -- to provide even higher-speed services to customers. As economic challenges grow, they may attach even more value to spectrum that will let them slash their network-equipment requirements. Moreover, if 700MHz does become the preferred 4G band globally, some of the most appealing gadgets are likely to be engineered for it.

How quickly other countries follow Germany's lead, however, will depend on more than such considerations. While France is apparently keen on holding its own 700MHz auction later this year, broadcasters are still using this spectrum in many parts of Europe. The European Commission is keen to see it freed up for telecoms by 2020, but the European Broadcasting Union has complained this timeframe is too aggressive and will lead to service disruptions for TV customers. No doubt, this is one sequel broadcasters are not looking forward to.

— Iain Morris,

, News Editor, Light Reading

, News Editor, Light Reading

Read more about:

EuropeAbout the Author(s)

You May Also Like