Broadband operator spending to pick back up in 2024... or later

Calix warned that broadband operator spending might not pick up until 2025, when BEAD subsidies have been allocated. But Corning and others suggested spending might increase earlier than that.

Broadband vendors continue to speculate on when network operators will resume spending on equipment. According to the latest data points, that might happen this year but could take until 2025.

For example, Calix's newest 2024 financial outlook "was significantly weaker than expected," wrote the financial analysts at Rosenblatt Securities. Indeed, the vendor cut its outlook again this week, after initially doing so late last year.

"Calix says customers are planning and replanning their network builds based upon applying for and potentially receiving government funds," the Rosenblatt analysts explained in a note to investors this week. "Therefore, during 2024, the company now expects appliance shipments ... to slow until decisions are made and funds are awarded, likely in early 2025."

The analysts added: "We were not expecting the company to cut the outlook again after doing so last quarter. However, Calix did need another reset and to guide for a sequentially down quarter in 1Q24."

But Calix officials promised that demand for the company's broadband equipment will pick back up – eventually.

"We have seen a significant broadening in the number of customers interested in competing for BEAD [Broadband Equity Access and Deployment program] funds. Today, nearly all our customers are either assembling a BEAD strategy or actively pursuing funds," Calix CEO Michael Weening said during the company's quarterly conference call, according to Seeking Alpha.

The US government's BEAD program promises to funnel a massive $42 billion in subsidies through US states to telecom companies willing to build networks in rural areas. But allocation of those funds is taking longer than expected, forcing network operators to stall their deployment plans until they have a better sense of how much funding they might get.

"While they do this, they slow their new [network] builds as BEAD money could be used instead of consuming their own capital, and thus, we'll slow our appliance shipments until decisions are made and funds are awarded," Weening said. "At that point, the winners will move ahead and those who decided to skip the BEAD program or did not receive BEAD funding, we'll begin investing to ensure that the winner does not impinge on their market. This represents a delay but also represents a unique opportunity for Calix."

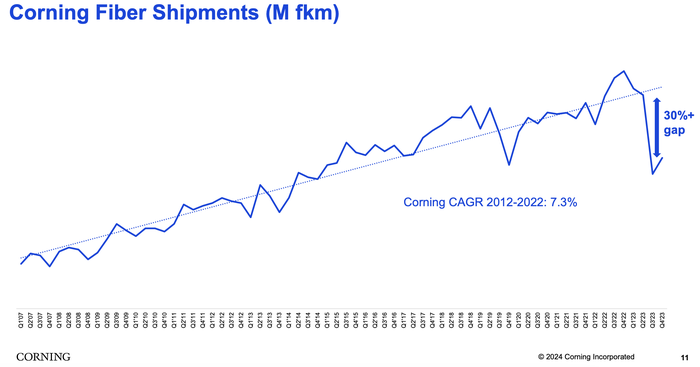

Corning said its fiber shipments, measured in kilometers, are well below normal trends. But the company expects shipments to rise in the coming months.

Corning's ambitions

Other companies are promising a similar reawakening in demand from fiber and cable broadband network operators.

"We anticipate optical communications sales will spring back because we believe and our carrier customers have confirmed that they purchased excess inventory during the pandemic and that they've been utilizing this inventory to continue deploying their networks," said Corning CEO Wendell Weeks during his company's quarterly conference call, according to Seeking Alpha. Corning manufactures much of the physical cabling used in US fiber networks.

"We believe these carriers will soon deplete their inventory and execute on the increased broadband deployment plans they've communicated to us over the last several months," Weeks said. "As a result, we expect them to return to their normal purchasing patterns to service their deployments."

He also noted that operators are waiting for BEAD funding. "We continue to expect BEAD funding really to start to translate into demand, the beginning of it, sort of late this year. They are progressing with awarding the grants and it will just take a bit for those to turn into real programs," Weeks said.

Sales in Corning's optical business unit – which houses its fiber products – continued to slide in the fourth quarter of 2023. During Corning's conference call, Weeks suggested that the company is starting to see the glimmer of an uptick in demand from its broadband operator customers, but nothing definite yet. "We'll know more in the coming months," he said.

Market vagaries

2023 was a tough year for many telecom suppliers providing equipment for cable, wireless and fiber networks. Now, each sector of the industry is trying to guess when operator demand might return.

In the mobile industry, vendors are hoping that demand for 5G equipment will resume beginning later this year. "It appears that activity levels may have stabilized and are showing some early signs of improving trends," wrote financial analysts at Morgan Stanley in a recent note to investors.

Meanwhile, some cable vendors are suggesting a similar timeline. For example, executives at vendor Harmonic said this week they expect sales in the first half of this year to be relatively soft and then accelerate in the second half of the year as operators start to ramp up network upgrades, including moves to DOCSIS 4.0 technologies.

About the Author(s)

You May Also Like