Pining for PON

A cheaper PON technology from Hitachi could be heading toward North America

March 26, 2003

ATLANTA -- OFC 2003 -- North American carriers here at the OFC Conference may not be joking when they say, "No PON intended."

PON -- passive optical network -- the transmission technology that uses splitters to fan out a fiber transmission line to as many as 64 end points, is still more expensive than some carriers would like, though they appreciate PON's simplicity.

One PON fan is Bill Smith, BellSouth Corp.'s (NYSE: BLS) chief product development and technology officer. "I love the PON architecture," he says. "Anytime you can remove active components from a solution you've done a good day's work." Smith, however, acknowledges that right now American service providers such as BellSouth are having trouble getting PON installed at costs lower than fiber to the home or fiber to the curb.

In Asia, however, manufacturing costs are lower, and PON appears to be picking up speed in at least one major service provider network.

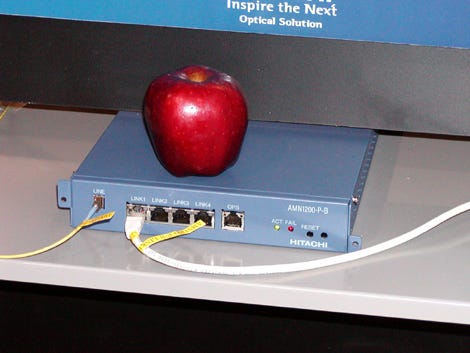

Hitachi Telecom (USA) Inc. is here at OFC, happily chatting up its success with a recent PON equipment installation inside NTT Communications Corp.'s network. Hitachi's AMN1200 systems, which are developed along with NTT, extends LAN segments up to 20 kilometers beyond a remote access office or central office.

NTT began deploying Hitachi's PON gear in September 2002, and they already have more than 60,000 PON systems deployed, serving about 100,000 residential and small business subscribers, according to David Foote, Hitachi Telecom's chief technology officer. Another 100,000 subscribers are expected by midsummer, he says.

Foote says Hitachi is not yet sure whether it will begin selling the AMN1200 in North America. Some service providers might want to add features or make adjustments to the central office unit, which takes singlemode fiber in and spits out several 100-Mbit/s broadband access lines. If Hitachi can leave the box as is, it can take advantage of the already low manufacturing costs it sees after having produced more than 100,000 units in Japan.

Like BellSouth, Hitachi's service provider customers also want as many last-mile options as they can get for as little money as possible. That helps explain why another Hitachi subsidiary, Hitachi Kokusai Electric Ltd., is expected to sign an original equipment manufacturer (OEM) agreement with Wave7 Optics Inc. sometime in the next week, according to Emmanuel Vella, Wave7's chief marketing officer.

Like BellSouth, Hitachi's service provider customers also want as many last-mile options as they can get for as little money as possible. That helps explain why another Hitachi subsidiary, Hitachi Kokusai Electric Ltd., is expected to sign an original equipment manufacturer (OEM) agreement with Wave7 Optics Inc. sometime in the next week, according to Emmanuel Vella, Wave7's chief marketing officer.

Wave7's technology is marketed as a PON alternative, employing active components to extend a fiber network's reach to cover a distance of up to 70 km between a hub and an end subscriber. Hitachi Kokusai is a distributor of the Wave7 Optics Last Mile Link products in Japan and Korea. But the new arrangement would have Hitachi manufacturing Wave7's gear under a private label, possibly giving the technology more pickup worldwide.

Meanwhile, back in the U.S., where PON faces a crisis of cost, Wave7 says it is close to signing a contract with a large utility in the Southeast to be a part of a PON network that will pass 30,000 homes. Vella says Wave7 signed the deal about a month ago and the build-out should start around the third quarter of this year. Wave7 will likely announce the deal at Supercomm 2003.

— Phil Harvey, Senior Editor, Light Reading

For up-to-date information about the OFC Conference, please visit Light Reading’s Unauthorized OFC Preview Site.

You May Also Like

.jpg?width=300&auto=webp&quality=80&disable=upscale)