Big telcos cut another 85K jobs in 2022 as gen AI loomed

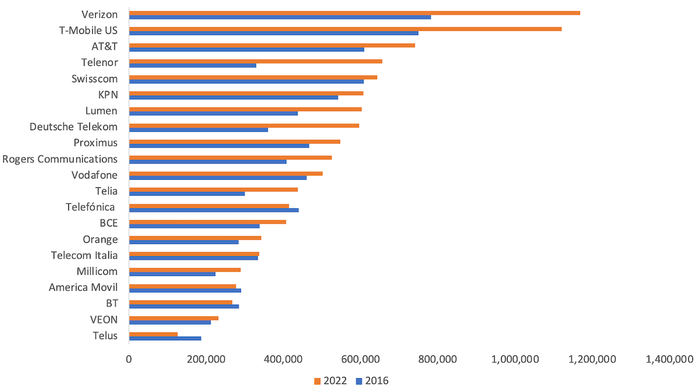

The 20 Tier 1 operators regularly tracked by Light Reading have cut 20% of their combined workforce in the last seven years.

Generative AI's founding fathers have gone all J. Robert Oppenheimer. The man widely credited with developing the atom bomb worked furiously on the science and then panicked that he had given mankind the tools of its own destruction. Having unleashed destructive forces of a different nature, today's software masters are suddenly calling for a moratorium on AI. Allowed to evolve, it will ultimately kill us, they say.

Long before that happens, just about everybody agrees it will trigger upheaval in the workplace. In the telecom sector, BT boss Philip Jansen reckons AI will claim about 10,000 jobs at his company by the end of the decade, around a tenth of the current total. Numerous telcos are experimenting with the latest AI advances to reduce manual effort and further shrink the workforce. Chatbots have already claimed thousands of customer-service jobs. Highly automated networks can run with minimal intervention by humans. Network operating centers that previously hummed with human activity are turning eerily quiet.

Just as the handloom weavers of the eighteenth century were replaced by the machine operators of the nineteenth, these telco jobs may eventually be succeeded by new and unforeseeable roles. But it is hard to imagine they will be in the telecom sector. Since 2015, the industry's biggest telcos in North America and Western Europe have been cutting jobs without replacing them. The trend was maintained last year, when the 20 Tier 1 telcos regularly tracked by Light Reading slashed their combined headcount by nearly 85,000 jobs, according to publicly available data.

Those latest reductions mean the workforce across these 20 companies has shrunk by around 384,000 jobs since 2015, more than a fifth of the total back then. Cuts have been driven by efforts to protect margins, pay off debts and offload underperforming or non-core assets as telcos struggle to increase their sales. Across these various companies, reported revenues have fallen from about $761 billion in 2015 to less than $725 billion last year, when converted into US dollars at today's exchange rate.

Divestments mean not all these jobs have been scrapped. In some instances, people have merely found they are working for a different employer (initially, at least). This would have been the case following the merger between Vodafone's huge Indian subsidiary and Idea Cellular, for example. The sale of towers by companies such as Spain's Telefónica will have entailed the transfer of employees as well as concrete and steel. AT&T's decision to spin off its WarnerMedia business, now combined in a joint venture with Discovery, explains much of the net reduction in headcount last year.

Table 1: Headcount at major service providers

2018 | 2019 | 2020 | 2021 | 2022 | |

America Movil | 189,448 | 191,523 | 183,180 | 177,713 | 176,014 |

AT&T | 268,220 | 247,800 | 230,760 | 202,600 | 162,900 |

BCE | 52,790 | 52,100 | 50,704 | 49,781 | 44,610 |

BT | 106,742 | 105,344 | 99,546 | 98,175 | 97,148 |

Deutsche Telekom | 215,675 | 210,533 | 226,291 | 216,528 | 206,759 |

T-Mobile US | 52,000 | 53,000 | 75,000 | 75,000 | 71,000 |

KPN | 12,431 | 11,248 | 10,102 | 9,699 | 9,452 |

Lumen | 45,000 | 42,500 | 39,000 | 36,000 | 29,000 |

Millicom | 21,403 | 22,375 | 21,419 | 20,687 | 19,446 |

Orange | 150,711 | 146,768 | 142,150 | 139,698 | 136,430 |

Proximus | 13,385 | 12,931 | 11,423 | 11,532 | 11,634 |

Rogers Communications | 26,100 | 25,300 | 23,500 | 23,000 | 22,000 |

Sprint | 28,500 | 27,000 | 0 | 0 | 0 |

Swisscom | 19,845 | 19,317 | 19,062 | 18,905 | 19,157 |

Telecom Italia | 57,901 | 55,198 | 52,347 | 51,929 | 50,392 |

Telefonica | 120,138 | 113,819 | 112,797 | 104,150 | 103,651 |

Telenor | 20,832 | 20,044 | 18,000 | 16,000 | 14,000 |

Telia | 20,836 | 21,232 | 20,741 | 19,566 | 19,237 |

Telus | 58,000 | 65,600 | 78,100 | 90,800 | 108,500 |

VEON | 46,132 | 46,492 | 43,639 | 44,585 | 16,207 |

Verizon | 144,500 | 135,000 | 132,200 | 118,400 | 117,100 |

Vodafone | 98,996 | 95,219 | 96,506 | 96,941 | 98,103 |

Total | 1,717,585 | 1,667,343 | 1,611,467 | 1,546,689 | 1,461,740 |

Toward the self-driving network

But the impact of technology, including the Internet and machine learning, is increasingly noted by executives who speak to Light Reading. Online shopping became the norm during the pandemic, and some of the stores that were temporarily closed have not subsequently reopened. Chatbots introduced long before ChatGPT was conceived have been replacing customer-service assistants during basic interactions with subscribers.

On the IT and networks side, some operators have been able to cut technical jobs by moving resources into the public cloud, relying on AWS, Google Cloud or Microsoft Azure to operate and maintain workloads. While very few operators have entrusted their network functions to public cloud providers, many are investing in software that can anticipate and address looming faults before technicians are needed. With intent-based networking, someone can specify a single and simple objective and leave automated software systems to handle all the complicated underlying work previously done by human programmers. A self-driving network may be easier to build than a self-driving car.

Indeed, companies building "greenfield" networks from scratch claim to operate them with a fraction of the people employed by established telcos. Marc Rouanne, Dish's chief networks officer, compares his systems integration team of just 50 people with an operations unit of at least 2,000 inside a traditional telco. Rakuten operates a telecom network in Japan with an operations team of about 200 people, according to Rabih Dabboussi, the chief revenue officer of Rakuten Symphony (a subsidiary selling telco products). An equivalent "legacy" operator would have between 6,000 and 7,000, he said at a recent UK press briefing.

Relentless pruning

BT's Jansen anticipates up to 55,000 job reductions by the end of the decade. Most will occur as the UK operator switches off older networks and systems and finishes rolling out its nationwide full-fiber network, a replacement for the copper lines that have lasted a century. If his forecast is accurate, then telcos in other countries upgrading to fiber while ditching legacy platforms will presumably be able to cut thousands of jobs as well.

Revenues per employee ($)  (Source: companies)

(Source: companies)

So far, this relentless pruning has not always brought much, if any, improvement in basic productivity measures. Sales per employee at BT fell from about $285,000 in 2016 to roughly $268,000 last year as headline annual revenues sank by $4.3 billion over this period. Telefónica's per-employee revenues dropped from more than $408,000 in 2016 to less than $386,000 in 2022. Only in the less competitive US market have all operators enjoyed substantial gains. Each one also generates considerably more in per-employee revenues than any of its European peers. Verizon, the leader for this metric, made $1.17 million last year.

Whether the average telco of 2030 will be more profitable is doubtful, but it seems bound to employ even fewer people, judging by the trend of recent years. AI may speed up the arrival of the zero-touch, fully automated network, one that responds dynamically to changing traffic patterns and circumstances. For customers of the future, interacting with those companies will be more like dealing with an Amazon or Netflix today, where the tapping of a screen or clickety-click of a mouse replaces the voice of the customer agent. Unless, of course, you are talking to a robot.

Related posts:

— Iain Morris, International Editor, Light Reading

Read more about:

EuropeAbout the Author(s)

You May Also Like