Operator survey: 5G services require network automation

Heavy Reading's 2023 5G Network Analytics and Automation Operator Survey results indicate that service diversity and the 5G disaggregated cloud native infrastructure will mandate automation across the network.

The diversity of services and new 5G infrastructure demand greater operational flexibility and autonomy. Operators must engineer their networks to provide the best possible experience and performance, working agilely to deploy new, desirable services.

5G service decisions are still evolving. Globally, 5G non-standalone (NSA) networks are proliferating and many operators do not have 5G standalone (SA) yet. This means that service types such as network slicing, low latency, edge applications, etc., are still some ways in the future. When SA is available, building an efficient "operational wrap" to deliver and manage advanced services will rely on new analytics and automation technologies to differentiate 5G capabilities.

Heavy Reading's 2023 5G Network Analytics and Automation Operator Survey aims to help the industry better understand the status of network analytics and automation and provide insights into operators' strategies. (To download a copy, click here.) At the start of the survey, one question looks to understand which 5G services operators believe to be the most valuable in supporting revenue growth.

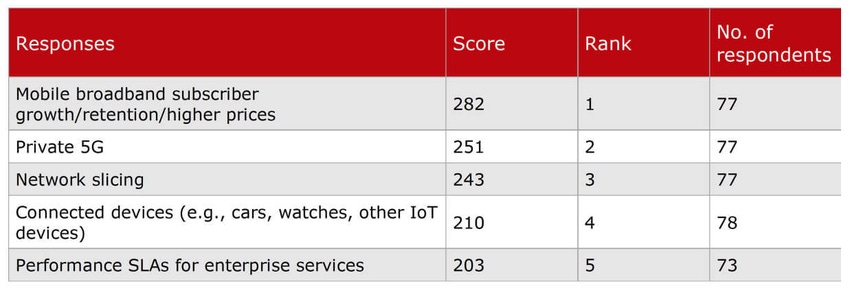

The figure below shows the weighted average scores across several 5G services, with operators ranking "mobile broadband subscriber growth/retention/high prices" first and ahead of the other options. Enhanced mobile broadband (eMBB) is the anchor service for 5G NSA and generates nearly all 5G revenue today. This scoring infers that operators are keen to grow their core businesses, which will involve greater efficiencies and new mobile packages that offer superior or premium features at an added cost.

"Private 5G" and "network slicing" rank second and third, respectively. Heavy Reading expects their importance and popularity to increase as additional operators deploy 5G SA and can support full autonomy. "Performance SLAs for enterprise services" is currently the lowest ranking (fifth) of all service choices but is likely to be a valuable market, especially for network slicing and private 5G.

"Connected devices (e.g., cars, watches, other IoT devices)" ranks just above performance SLAs in fourth. Internet of Things (IoT) is a sizeable market within 4G, but the massive machine-type communications (mMTC) use case has yet to be realized in 5G, as technologies such as RedCap remain underdeveloped.

Smaller operators have a different opinion from larger operators on the revenue growth question. For mobile operators with less than 9 million subscribers, private 5G ranks first. This result perhaps indicates that smaller operators feel they are already exploiting eMBB services and see little scope for further revenue growth with SA.

Which services are the most attractive for 5G revenue growth in your organization? (Rank in order, where 1 = the most attractive)

Given the survey results above and the desire for operators to grow their revenue and retain customers, it is evident that automation will play a fundamental role in future 5G services underpinning cost efficiencies and quality of service. Service diversity and the 5G disaggregated cloud native infrastructure will mandate automation across the network (i.e., provisioning, testing, operation, fault resolution and maintenance), specifically for the following aspects:

Automated configuration: Automation tackles the scale and complexity of administration, management and lengthy configuration across large networks with multiple service solutions (e.g., private networks, network slicing, performance SLAs, etc.), offering significant time savings over manual effort.

End-to-end 5G monitoring and visibility: 5G network visibility requires a dynamic and layered approach to monitor 5G cloud infrastructure, orchestration/containerized environments and the network domains and services. Service insights and SLA monitoring will be more granular. Examples include network slicing visibility per slice, user, session, location, etc., across KPIs like latency, jitter, packet drop and data rate.

Network probes and testing: Active test agents provide near real-time visibility, making them better equipped to monitor dynamic cloud native environments and workload changes than more traditional reactive methods.

Lifecycle and test management: Automated software deployment cycles (CI/CD) will be critical due to the increased cadence of software updates across virtual machines or cloud native deployments. In addition, automating network and service testing could enable the validation of services and configuration while assessing the perceived end-user quality of service.

Artificial intelligence/machine learning (AI/ML): These technologies will contribute heavily to automated processes, optimization and efficiencies, with AIOps processes assuring the network and its services. For example, AI/ML can help forecast network resources, user mobility patterns, RAN optimization, security anomaly prevention, fault prediction, etc.

Operators are highly motivated to deliver advanced services and drive business growth and revenue to recoup the costs of their significant 5G spectrum and network investments. However, supporting a diverse and evolving portfolio of 5G network services will require automation to provide service visibility, efficiencies and network performance excellence.

For more information, check out this archived webinar.

This blog is sponsored by Spirent.

About the Author(s)

You May Also Like