Shifting consumer demands coupled with ongoing 5G network deployments have led to a bonanza for vendors, with two equipment makers recently announcing an expansion of their units in India Nokia recently announced that it will be extending manufacturing of PON optical line terminals (OLTs) at its factory in Sriperumbudur in South India to meet the growing domestic and international demand for high-speed broadband.

"India is seeing massive demand for fiber connectivity from both fixed and mobile operators. OLT production at our Chennai plant will offer a timely boost to meeting this demand in a timely way," says Sanjay Malik, SVP and Head of India Market at Nokia, in the press note issued by the company.

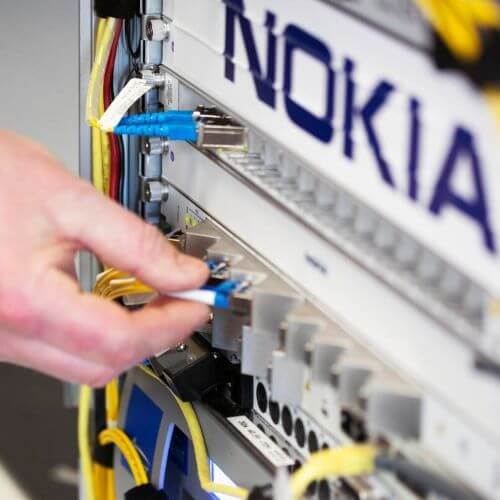

Figure 1:  More of Nokia's PON OLTs will be made in India in future.

More of Nokia's PON OLTs will be made in India in future.

(Source: Nokia)

A couple of months ago, another European vendor, Ericsson, had announced that it would be scaling up its production capacity and operations with its partner Jabil in the city of Pune in Western India to address the 5G network deployments in India.

"As 5G gets introduced in India, we are ramping up production of our 5G telecom equipment in Pune in a phased manner, to support the network deployments of Indian telecom service providers. The production in India is part of our global production footprint with a presence across continents," said Nunzio Mirtillo, head of Market Area Southeast Asia, Oceania and India at Ericsson, in a press note in December 2022.

Aside from Nokia and Ericsson, Samsung could, according to media reports, be investing around 4 billion Indian rupees (US$48.47 million) to start manufacturing 4G and 5G radios in the country. One of its largest mobile device manufacturing units is already located in India.

The 5G impact

This sudden uptake in telecom gear manufacturing in India has been prompted by the 5G boom and growing fiberization efforts of Indian telcos. Two of India's top telcos, Reliance Jio and Bharti Airtel, launched 5G in October last year. While Jio has launched 5G in around 230 cities and towns, Airtel has said it is on track to cover the entire country in March 2024. Further, Vodafone Idea is likely to hand over 5G contracts soon, with the government finally acquiring a 33.4% stake in the company.

In its recent results, Airtel reported a capital expenditure of 81.05 billion rupees (US$982.2 million) in the December 2022 quarter, up from INR56.97 billion ($690.33 million). Jio plans to spend $25.1 billion by the end of this year to build a 5G standalone (SA) network across the country. While Jio awarded 5G contracts to Nokia and Ericsson, Airtel is working with Nokia, Ericsson and Samsung to set up a 5G network.

Another factor is the departure of the Chinese vendors from India, which means that European vendors have likely got bigger 5G contracts than they might have if Huawei and ZTE were still operating in the country.

Goodbye China, hello India!

Telecom vendors are also trying to reduce their dependence on China for production. The geopolitical factor is one of the key reasons why manufacturers are looking to diversify their supply chain and not depend entirely on China. Further, the Chinese government's zero-COVID policy meant erratic and extended shutdowns, which in turn affected supply chains.

Though Nokia and Ericsson have had manufacturing units in India since 2008 and 1994, respectively, the manufacturing was largely centered in China. The Indian government has, however, now made it easier for telecom vendors to expand manufacturing with the launch of the Production Linked Incentive (PLI) scheme. All three vendors, Nokia, Ericsson and Samsung, are participating in the PLI scheme.

Related posts:

— Gagandeep Kaur, Contributing Editor, special to Light Reading

Read more about:

AsiaAbout the Author(s)

You May Also Like